For one thing, claiming Social Security at 62 means more years of benefits. This is why it remains one of the most popular ages to apply. Seniors who wish to retire in their early 60s but cannot afford to do so on their own can supplement their personal savings with Social Security to help them cover their expenses.

Signing up early can also be advantageous if you don't expect to live longer than the average American, for one reason or another. You'll likely get a larger lifetime benefit this way. If you try to delay benefits, there's a chance you could wait too long and miss out on Social Security altogether.

Benefits of working past 62

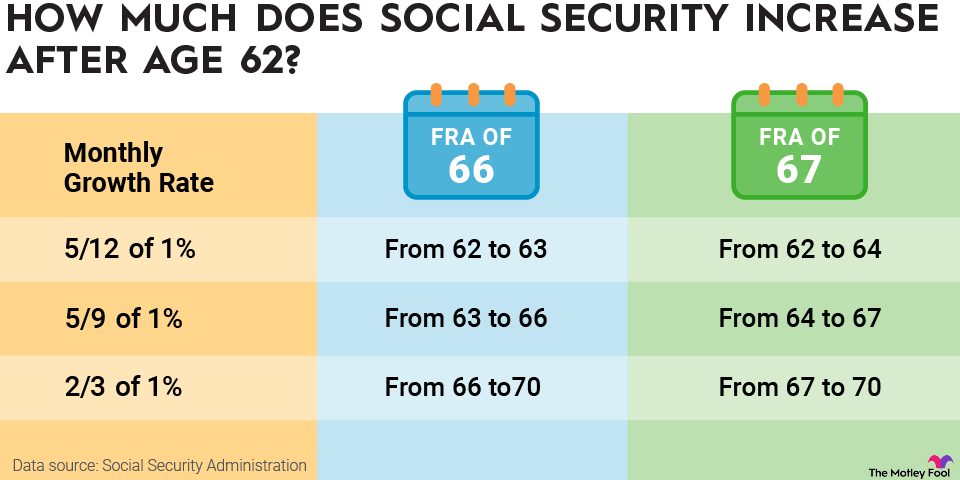

Delaying Social Security allows you to increase your monthly checks as discussed above. This could lead to a larger lifetime benefit for those who live into their mid-80s or beyond.

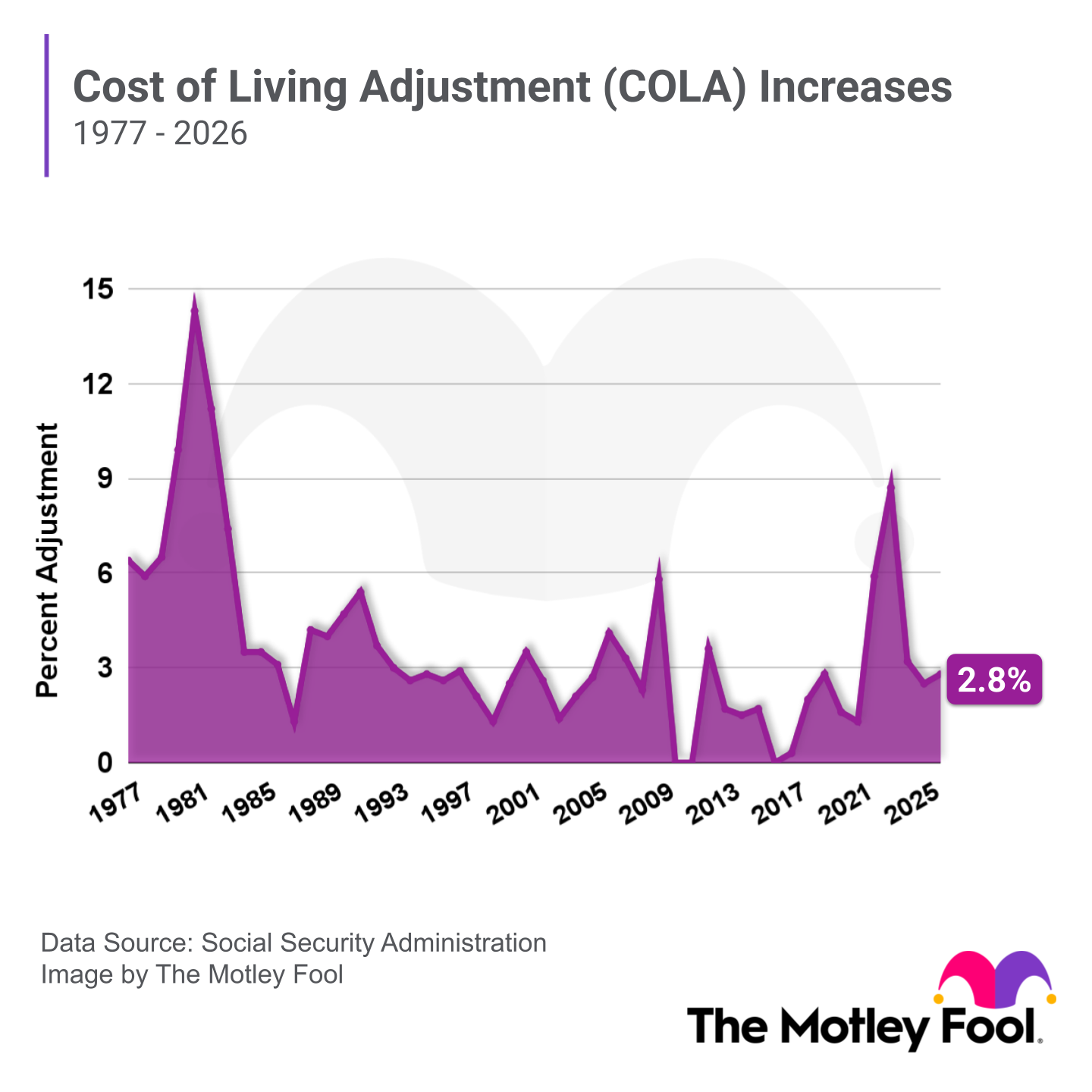

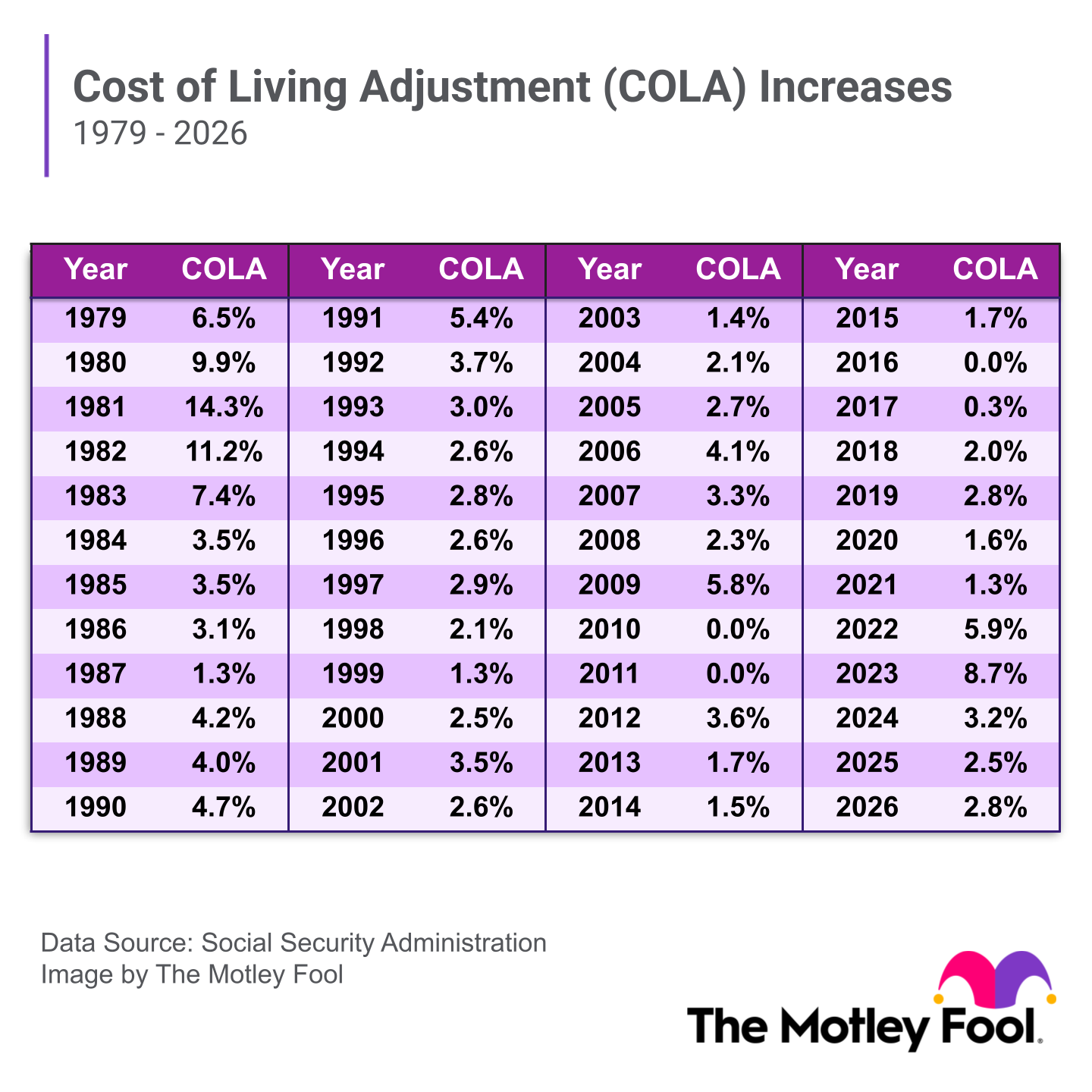

Larger monthly checks also mean larger cost-of-living adjustments (COLAs). These are annual Social Security increases that all beneficiaries receive to help their checks keep pace with inflation.

When you delay Social Security until your FRA or beyond, you also don't have to worry about the earnings test. Those who work while claiming Social Security under their FRA could see a portion of their benefits withheld if their annual income is too high. But the money isn't gone forever.