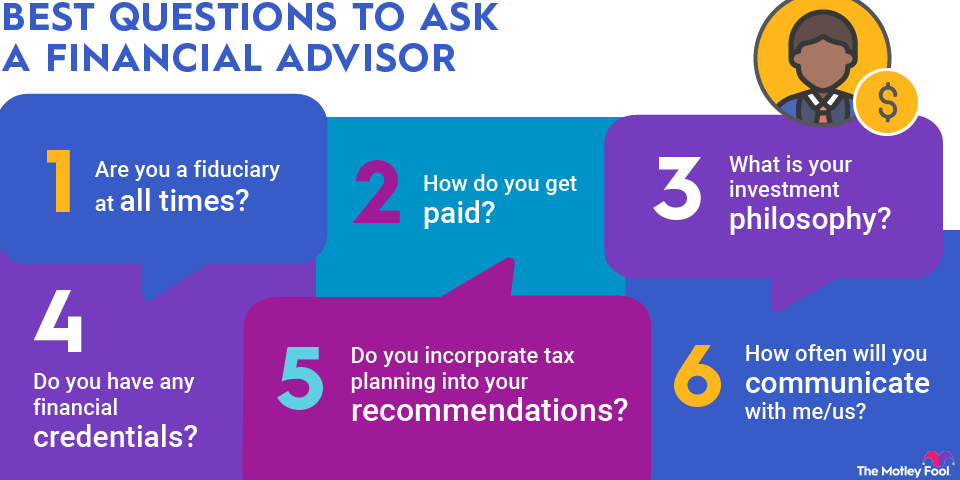

If you're considering hiring a financial advisor, it's a good idea to have a list of questions ready during your interview process.

Financial advice can be helpful when you're unsure about any financial decisions. However, you'll want to have confidence that you're working with a qualified professional before you hire one.

Asking these key questions can help you find the right financial advisor to help manage your money.

1. Are you a fiduciary at all times?

This is the most critical question: Is the advisor always a fiduciary?

Advisors with a fiduciary obligation must put your best interests above their own at all times. Some advisors wear a few hats, acting as both advisors and product salespersons. An advisor will guide you to make sound financial decisions, while a salesperson may be at least as concerned with fulfilling their own quotas or sales requirements.

The stark reality is that many advisors, especially those working for large brokerage institutions, are both advisors and salespeople at the same time. They may only choose to work with select clients who can afford to pay high advisory fees or purchase expensive investments.

Confirming that your advisor is always acting as a fiduciary is essential before beginning any sort of advisory relationship. Eliminating conflicts of interest will result in a more fruitful interaction on both ends.

2. How do you get paid?

This question is essential so you can understand how you're paying for any services you receive

Many advisors charge an AUM fee, or a fee corresponding to the assets under management (AUM). For example, 1% of assets managed is a common fee structure.

This may not sound like much. But the reality is a bit surprising: A 1% fee applied to a $1 million balance is $10,000 per year, and the fee will increase proportionally as the account balance increases. Over time, and due to the nature of compound interest, fees add up quickly.

Other advisors have different fee structures, which vary depending on whether they actually manage money for you. For example, some advisors charge trading commissions on any orders they place on your behalf.

Fee-only financial planners, on the other hand, typically charge you on an hourly basis or charge a fixed-fee retainer for ongoing access to advice. Some might also be willing to work on a project basis, depending on the depth and complexity of your needs.

The only way to know is to ask -- but be sure you understand the dollar amount you're paying for any service. Don't be satisfied with just a percentage amount!

3. What is your investment philosophy?

Asking about an advisor's investment philosophy is an important way to learn how they think about risk, and it's also an opportunity to have them showcase their knowledge about investing and financial planning.

You may not necessarily agree with the advisor's philosophy right off the bat. But it's important to see that they actually have a philosophy to offer.

You'll know quickly if the advisor displays fluency in the topic. They should be able to give you opinions about stocks, bonds, exchange-traded funds (ETFs), mutual funds, and insurance products in addition to explaining their personal philosophy around investing.

4. Do you have any financial credentials?

Credentials are not necessarily the be-all and end-all for an advisor. But they do signal a commitment to the study of financial topics and to their professional craft.

Most financial credentials, like the chartered financial analyst (CFA) designation or the certified financial planner (CFP) mark, are voluntary. This means the advisor put in the effort to earn the credential, even when it may not have been required.

Many credentials take hundreds of hours of dedicated study to complete, and some exams, like the vaunted CFA exam, are given infrequently. It's not uncommon for a candidate to take several years to complete the CFA program.

In general, take the advisor's credentials in the context of their entire picture as an individual. Alone, a few letters after someone's name may not mean much to you. But paired with a track record of fiduciary guidance and varied experience, credentials can carry quite a bit of weight.

5. Do you incorporate tax planning into your recommendations?

Like it or not, taxes are an ongoing expense for all investors. A tax-aware advisor will recommend products (and accounts) that help you minimize your lifetime tax liability.

Simple changes to your investment plan can make things simpler and reduce costs. For example, holding dividend-paying stocks in a taxable brokerage account will lead to taxable income every time a dividend is paid. Holding growth stocks in a taxable account, on the other hand, won't generate as much taxable income unless you begin to realize gains.

Your advisor's knowledge about these tax issues can add a ton of value over the long haul, so be sure that your advisor has some knowledge of tax planning before you hire them.

6. How often will you communicate with me/us?

Try to get a sense of how frequently you'll communicate with your advisor and make sure that schedule fits your needs.

For some people, one or two discussions per year might be enough. Others who need more of a high-touch advisory relationship should find an advisor willing and able to provide one.

Also, be sure you understand the advisor's preferred mode of communication aligns with your expectations. In other words, get a sense of whether you'll meet with your advisor virtually or if they typically do in-person meetups. Having someone you can connect with in a way that works for both of you will create the foundation for a productive relationship.

Related investing topics

Why picking an advisor is so important

Spending time researching cost structures and advisor services can be exhausting, but it's well worth the effort.

Knowing the key questions to ask an advisor will help you find the right person to turn to for advice so you can reach your financial goals. Working with a trusted partner makes sense as long as you can identify the value they provide and you see results over the long term.

Asking the right questions can also help you avoid entering into a relationship where an advisor puts their needs first or charges you far more than you're comfortable paying.

Take your time, do your due diligence, and hire someone who gives you confidence around your financial decisions.