10 Trends Investors Should Be Paying Attention To

10 Trends Investors Should Be Paying Attention To

Know what affects your holdings

As an investor, it’s easy to be overwhelmed with information. The financial news cycle is 24/7, and there’s no shortage of tips on the internet or TV for finding winning stocks. While the best investors generally practice a long-term, buy-and-hold strategy, it’s also a good idea to be aware of the kind of trends that can affect your holdings such as disruptive technologies, geopolitical risks, and overall market sentiment.

With that in mind, keep reading to see 10 trends investors should be watching right now.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Cryptocurrency

In less than a year, cryptocurrencies like Bitcoin and Ethereum went from a fringe investment idea to one embraced by traditional financial institutions like banks.

The “market cap” of Bitcoin is now around $1 trillion, rivaling some of the biggest companies in the world, and the crypto boom has spawned new markets like non-fungible tokens as well.

It’s impossible to know what the future of cryptocurrency is, whether it will become a true alternative to fiat currency or if crypto prices will continue to rise, but it’s clear investors can no longer ignore crypto. At the very least, it’s become a viable alternative asset class, and that could siphon away investor funds that would otherwise go to stocks. Considering the success of cryptocurrency thus far, it may also be worth putting at least some of your investments into a currency like Bitcoin or Ethereum.

Previous

Next

2. Interest rates

Arguably no financial data point is more determinative for equity prices than interest rates. As borrowing rates increase, investors tend to move from stocks to bonds, where a return on their investments is guaranteed. Therefore, as interest rates rise, investors should expect stock prices to fall, all other things being equal.

Federal Reserve Chair Jerome Powell has promised not to raise the benchmark federal funds rate until 2023, and 10-year Treasury yields remain low at just 1.2%, meaning expectations of a rate hike or an “overheating” economy are also low.

Still, there is talk of the Fed tapering its bond-buying program, which was set up to stimulate the economy, and the recovery from the pandemic could also lead rates to rise.

Previous

Next

3. Inflation

Inflation rates go hand in hand with interest rates, and they often move in tandem. Recently, however, consumer prices have been rising faster than the Federal Reserve’s goal of 2% annual inflation. Year-over-year prices on all items rose 5.4% in the consumer price index in July. But Fed Chair Powell believes that inflation is currently “transitory,” meaning prices are only rising temporarily because of a snapback effect from the economic reopening from the pandemic and because of supply constraints in specific industries like auto manufacturing. Once those are corrected, inflation should normalize.

Still, investors should keep their eye on inflation rates as rising inflation will impact a number of industries, like restaurants and retailers, and could be a drag on the overall economy if it gets too high. Sustained high inflation could also lead the Federal Reserve to raise interest rates faster than expected, leading to a rotation into bonds.

Previous

Next

4. The China crackdown

Chinese stocks tumbled broadly in July after Beijing issued a sweeping set of restrictions on for-profit education that included banning tutoring companies like New Oriental Education & Technology and TAL Education Group from making a profit in the sector. Those two stocks have fallen nearly 90% from their peaks earlier this year, and investors are fearful of a crackdown spreading to other sectors as the government has also punished tech giants like Alibaba and DiDi Global over monopoly and data-sharing concerns.

At the same time, U.S. regulators are threatening to delist Chinese stocks from U.S. exchanges if they don’t show their books to U.S. auditors.

Those incidents have all added up to an atmosphere of fear around Chinese stocks and have caused some investors, like Cathie Wood, to sell Chinese stocks, arguing that the geopolitical risk will weigh on valuations for the foreseeable future.

ALSO READ: 3 Reasons to Sell Your Chinese Stocks, and 3 Reasons to Hold Them

Previous

Next

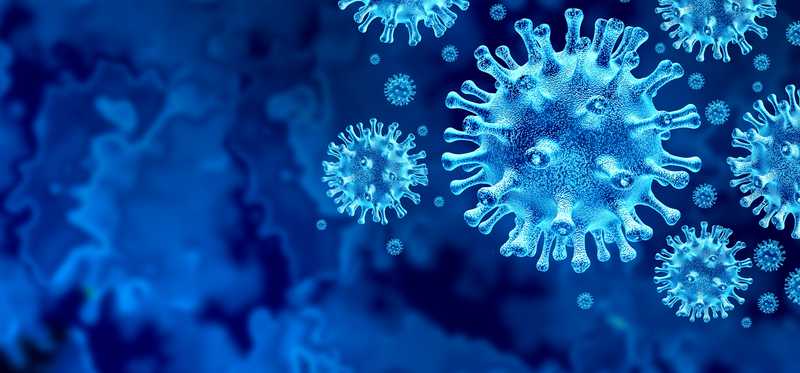

5. The delta variant

Back in June, it seemed that the coronavirus crisis was fading into the rearview mirror. All American adults were able to access vaccines, and infection rates had plunged from their peaks earlier in the year. The economy was normalizing.

However, the delta variant has rendered that conclusion moot. Daily average cases in the U.S. are now above 100,000, the second-highest wave by case count after the one this winter, and hospitals in some parts of the country are strained once again.

The outbreak is a reminder that the pandemic isn’t over, and that has direct repercussions for business like airlines that were counting on a travel recovery. It’s also a warning that future variants could disrupt the economy as well.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Meme stocks

In investing, the value of a stock typically reflects the value of the underlying business, and investors buy and sell companies based on their impression of how the stock price compares with the value of the business. However, 2021 has seen an explosion in meme stocks, or stocks like GameStop and AMC Entertainment that have skyrocketed with the help of viral memes on social media. These stocks have experienced a wave of interest from retail investors on platforms like Robinhood that have propelled their prices up by more than 1,000%. Short squeezes and gamma squeezes have also helped send these stocks higher.

It’s unclear if the influence of meme investing will expand in the market. While it’s only affected a small percentage of stocks so far, it could spread, especially since the investors behind it have been so successful thus far, and that could render more traditional investing techniques useless.

Previous

Next

7. Automation

Automation is a broad technological concept with far-reaching consequences. As more tasks become automated, millions of people could lose their jobs, though there will also a slew of benefits for consumers and appealing opportunities for investors.

Autonomous vehicles may be the most important innovation on the horizon for this technology. While AVs are proving to be more difficult to develop than many had anticipated just a few years ago, autonomous vehicles, if they go mainstream, would have a significant impact on a number of industries including transportation, auto manufacturing, travel and others.

Just as the internet spawned its own wave of dot-com stocks, automation and AVs could do the same, as we’ve already seen with stocks like Tesla soaring.

ALSO READ: Thinking of Buying Tesla Stock? Here's What You Need to Know

Previous

Next

8. Virtual and augmented reality

Another emerging technology worth keeping your eye on is virtual and augmented reality. Facebook CEO Mark Zuckerberg recently observed that the dominant computing platform tends to shift every 15 years, going from mainframes to personal computers to internet and then mobile. Zuckerberg believes the next major computing platform will be virtual reality, and Facebook is investing heavily into its Oculus division and Facebook Reality Labs, which is developing VR and AR technologies.

Zuckerberg referred to the “metaverse” on the company’s most recent earnings call, meaning a digital space where people can interact as they do in the real world.

As more technology moves in this direction, more investing opportunities will open in the space, and the technology will have a greater impact on our day-to-day lives.

Previous

Next

9. Renewable energy

Another technology that could have far-reaching impacts over the next generation is renewable energy, which encompasses technology including wind, solar, and geothermal energy.

Renewables will help drive a transition away from fossil fuels, impacting oil and gas stocks, and also help accelerate the growth of sectors like electric vehicles.

On a larger scale, investors should also be paying attention to the impact of climate change as that could speed up the transition to renewable energy and have environmental impacts that could affect a wide range of stocks.

Previous

Next

10. Antitrust regulations

While antitrust regulations may not be a trend exactly, calls to regulate tech giants like Amazon, Apple, and Facebook have been getting louder and could pick up steam in the coming years. What increased regulation and oversight would look like remain to be seen, but Sen. Elizabeth Warren has called for Facebook to unwind its acquisitions of Instagram and WhatsApp and for Amazon to not compete with its marketplace sellers.

Meanwhile, companies like Google are facing greater scrutiny in places like Europe over privacy concerns.

As big tech companies get more powerful, they’re likely to face stricter regulations, and that could have a direct impact on investors in those stocks, as well as their smaller competitors.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Trend investing vs. long-term investing

While following trends is important for investors, for the best stocks, trends often don’t matter. For these stocks, the best way to invest is to find companies with sustainable competitive advantages that will allow them to outperform the market over a long period of time, even in good times and bad.

Trends can help guide you to these stocks, however. For instance, paying attention to e-commerce or mobile technology early on could have led you to Amazon or Apple, respectively. But these companies have also succeeded because of their sustainable competitive advantages, including their brands.

When following trends, keep in mind that some trends, like disruptive technologies, have a longer time frame of relevancy than others, like interest rates. Still, this list is a good place to start for investors looking for trends that will impact the market in one way or another over the coming years.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Jeremy Bowman owns shares of Alibaba Group Holding Ltd., Amazon, Ethereum, and Facebook. The Motley Fool owns shares of and recommends Alibaba Group Holding Ltd., Amazon, Apple, Bitcoin, Ethereum, Facebook, and Tesla. The Motley Fool recommends New Oriental Education & Technology Group and TAL Education Group and recommends the following options: long January 2022 $1,920 calls on Amazon, long March 2023 $120 calls on Apple, short January 2022 $1,940 calls on Amazon, and short March 2023 $130 calls on Apple. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.