10 Ways to Get Started Investing in Real Estate With $10,000

10 Ways to Get Started Investing in Real Estate With $10,000

Here are some great ways to commit 10 grand to real estate investing

Real estate investing is a traditional way to grow wealth, and there are multiple ways to get involved, from Main Street to Wall Street. Here are some to consider.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. Use online direct investing platforms

Direct investing platforms let you put money directly into properties of multiple types -- especially commercial -- across the country. Some also offer non-traded real estate investment trust (REIT) options.

This kind of crowdfunding is less liquid than buying publicly traded stocks and comes with minimums ranging from less than $100 to $50,000 or more. Examples include Groundfloor, CrowdStreet, Fundrise, and RealtyMogul.

ALSO READ: Real Estate Investment Trusts: What They Are and How to Invest in Them

Previous

Next

2. Try house hacking

Buying a townhouse and living in half of it, a two-floor house and living on the ground floor, or a condo and renting out a room … this is nothing new. It's a good way to use $10,000 for a down payment and help pay the mortgage while building equity. And now it has a 21st-century name: house hacking.

Previous

Next

3. Buy and flip homes

Flipping refers to the practice of buying a property -- typically a house -- and doing what it takes to get it ready for market and then selling it, hopefully quickly and for a nice profit.

Keep in mind the 70% rule as you consider putting $10,000 down on such a project: It's recommended that you don't invest more than 70% of the property's ultimate value, less the renovation costs.

Previous

Next

4. Buy and rent a house

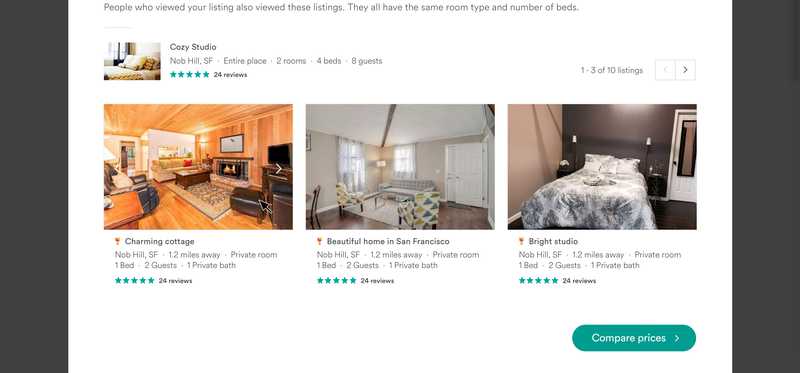

Buying and renting homes has been a tried-and-true practice in this country since this was a country. Short-term rentals through Airbnb and the like have added to the possibilities. A $10,000 investment can be enough to swing a mortgage on a place in many places, but do your due diligence on the physical condition and market prospects of the place you're considering.

Previous

Next

5. Invest in short-term rental arbitrage and management

If you've got the chops and the chips, you can invest your $10,000 in ramping up a short-term rental arbitrage business. That means subleasing and then renting out other people's properties on platforms like Airbnb and VRBO.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Buy a commercial property

"Commercial property" can mean office building, retail space, warehouse, or multifamily property of five units or more. Through a mortgage lender or an arrangement with a broker or property owner, your $10,000 can get you started on a little bit bigger business here than simply buying a house.

ALSO READ: 6 Things to Know About Investing in Commercial Real Estate

Previous

Next

7. Invest in a qualified opportunity fund

Qualified opportunity funds were created a few years ago to fund investments in opportunity zones: designated areas across the country that provide tax breaks to buyers of residential and commercial properties to encourage redevelopment.

Previous

Next

8. Buy into an equity REIT

REITs own portfolios of income-producing properties and are available both in publicly traded and non-traded shares. Their holdings run the gamut from shopping centers to office buildings (including the Empire State Building), rental homes, warehouses, hotels and casinos, and even data centers and mobile towers.

They're all required to pay shareholders at least 90% of their taxable income as dividends. Exchange-traded REITs typically offer more transparency and liquidity and a lower cost of entry than their non-traded counterparts. Examples include mall owner Simon Property Group, self-storage giant Public Storage, and medical marijuana specialist Innovative Industrial Properties.

ALSO READ: 3 High-Yield REITs That Have Made Me a Ton of Money

Previous

Next

9. Buy into a mortgage REIT

Mortgage REITs (mREITs) manage portfolios of mortgages and mortgage-backed securities. Some mREITs originate mortgages, especially in the commercial space, while most buy pools of government-backed residential mortgages.

mREITs tend to pay higher dividends than equity REITs, but their share prices tend not to rise as much, and they're considered riskier. These are primarily income stocks. Examples include Broadmark Realty Capital and AGNC Investment Corp.

Previous

Next

10. Buy other real estate-related stocks

The market is replete with real options here. That includes home builders like D.R. Horton, commercial real estate brokers and managers like CBRE and RE/MAX Holdings, short-term stay specialists like Airbnb, and index funds like the Vanguard Real Estate Index Fund.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

A well-placed $10,000 now can pay off later with income and capital growth

The suggestions here vary in volatility and potential, liquidity, and whether you directly own all or part of the real estate. Matching the right mix to your own goals and needs can make that $10,000 investment now pay off well into the future in the form of passive income and capital growth.

Marc Rapport owns Innovative Industrial Properties and Vanguard Real Estate ETF. The Motley Fool owns and recommends Airbnb, Inc., Innovative Industrial Properties, and Vanguard Real Estate ETF. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.