15 Painless Strategies for Growing Your Nest Egg

15 Painless Strategies for Growing Your Nest Egg

How much savings can you accumulate?

It's important to save a decent chunk of money for retirement to ensure that you're able to pay your bills. And the good news is that building a nest egg won't necessarily involve a ton of sacrifice. Here are some easy ways to boost your savings.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

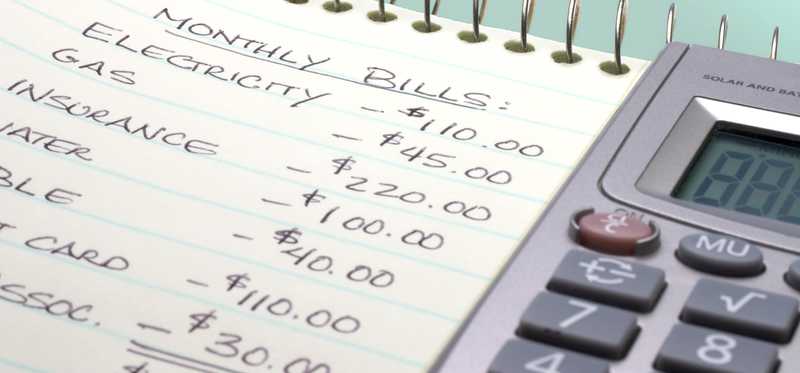

1. Start following a budget

Mapping out your monthly expenses will help you prioritize your savings. If you don't have a budget already, set one up using a spreadsheet or app. It's an easy way to stay organized and take control of your spending.

Previous

Next

2. Cut back on spending

You may need to slash a few bills to make more room for IRA or 401(k) contributions. But you don't necessarily need to go to the extreme of downsizing or getting rid of a car. Cutting back on smaller expenses like cable or the gym might go a long way.

Previous

Next

3. Refinance your mortgage

Mortgage rates are up right now, but that doesn't mean you can't lower your home loan's interest rate. And if you're able to snag a lower borrowing rate, it could free up money to contribute to your IRA or 401(k).

Previous

Next

4. Stop wasting money on high-interest debt

Carrying a balance on your credit cards? The sooner you pay it off, the more money you'll stop spending on interest. That's money that can fund your retirement plan.

Previous

Next

5. Get a side hustle

Today's labor market is loaded with opportunities to pick up a side gig and boost your income. And since your earnings from a side hustle won't be earmarked for existing bills, you should be able to contribute that money to your retirement account should you so choose.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Bank your annual tax refund

Most tax filers get a refund every year. If that's money you don't need for essential bills, put it directly into your IRA or use it to boost your 401(k) plan contributions.

Previous

Next

7. Save your entire raise -- or as much as you can part with

Many people get raises year after year. Save all of yours, and you'll seamlessly grow your long-term savings. Of course, this year, many people have to use their raise to cover rising living costs in light of inflation. But if you're able to bank your raise even some years, it'll go a long way.

Previous

Next

8. Claim your full 401(k) match

Most companies that offer 401(k) plans match worker contributions to some degree. Snagging your full match could leave you with a lot of extra money for retirement.

Previous

Next

9. Take advantage of catch-up contributions

Once you turn 50, you're eligible to boost your IRA or 401(k) plan contribution rate. Right now, catch-ups can be made for up to $1,000 a year for the former and $6,500 for the latter.

Previous

Next

10. Give yourself a lengthy savings window

The more years you give your IRA or 401(k) to grow, the more money you stand to retire with. The simple act of starting to save for retirement when you get your first job could put you in a strong position to end your career with a lot of wealth.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. Go heavy on stocks

Investing in stocks is a great way to grow your nest egg. Bonds may be less volatile, but they don't tend to deliver returns that are as high. If you're uneasy about buying individual stocks, you can always choose index funds, which let you invest in bunches of companies instead.

Previous

Next

12. Fund more than one account

Putting money into different retirement plans could leave you with a large sum down the line. If you max out your IRA, see if you're eligible for a health savings account, or HSA, which can double as a retirement savings plan once you get older. You may even be able to contribute to both an IRA and 401(k) at the same time.

Previous

Next

13. Diversify your portfolio

Holding a diverse mix of investments could lead to stronger returns in your IRA or 401(k). Index funds are a great diversification tool, but you can also diversify by owning stocks across a wide range of market segments.

Previous

Next

14. Invest in companies that pay dividends

The great thing about getting paid dividends is that you can reinvest that money automatically to grow your savings. There are numerous stocks with a strong history of paying dividends, and you can also look at real estate investment trusts, or REITs, which commonly pay dividends that are higher than average.

Previous

Next

15. Extend your career a bit

Working a couple of extra years will give your savings more time to grow -- even if you don't add to your nest egg during that time. If you don't want to keep working full-time, see if it's possible to scale down to part-time. Either way, working could make it so you don't have to tap your nest egg right away, thereby letting it gain a bit more value.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

What can a generous nest egg do for you?

You may have lofty goals for retirement, like traveling or moving to a buzzing city. Or, you may want to enjoy a simpler lifestyle without financial concerns. The more money you sock away for your senior years, the more likely you'll be to enjoy that time to the fullest, and these steps could be your ticket to doing just that.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.