15 Steps to Take if You're Worried You'll End Up Retiring Late

15 Steps to Take if You're Worried You'll End Up Retiring Late

A late retirement isn't your only option

Some people work hard, save well, and manage to retire early. But if you're worried that you're in for the opposite fate -- retiring late -- you may be wondering if there's anything you can do about it. The good news? You can. These moves could help you catch up on retirement savings and avoid having to plug away longer than you'd like to.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

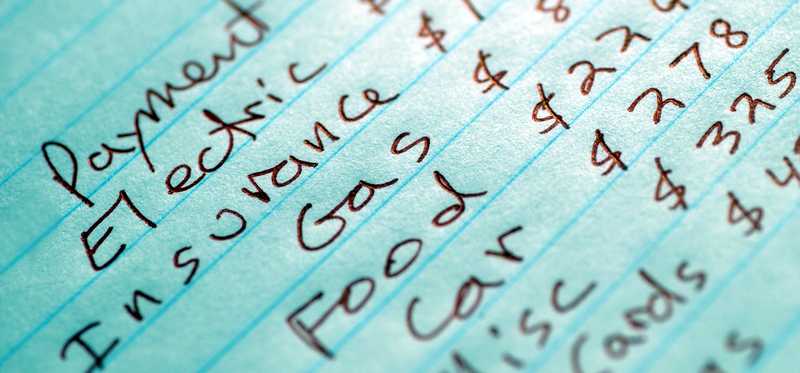

1. Get yourself on a budget

Following a budget is a key step in managing your money. And once you have a better handle on your money, you can find ways to save more of it. There are different apps you can use to make budgeting easier, so it pays to play around with those that are free and see which works best for you.

Previous

Next

2. Consider moving to a less expensive home

Your home is probably your single largest monthly expense. Reducing what you spend on housing could help you free up more money for your nest egg. To that end, you may want to consider moving to a less expensive neighborhood, or staying in your current ZIP code but downsizing.

Previous

Next

3. Get a less expensive car

Cars usually don't gain value over time. Quite the contrary -- they tend to lose value consistently, so there's little sense in overspending on one, especially if your IRA or 401(k) could use a boost. If your car payments eat up a large chunk of your income, it may be time to swap your current vehicle for one that's less expensive.

ALSO READ: Average New Car Payment Reaches $656. Here's How to Pay Less

Previous

Next

4. Cook more meals at home

Restaurant meals are fun and tasty -- but they come at a cost. If you're behind on IRA or 401(k) contributions to the point where you're worried about a late retirement, pledge to do the bulk of your cooking at home. The money you save can then go right into your nest egg.

Previous

Next

5. Cut the cord with cable

Many people who pay for cable don't end up watching the bulk of the channels they get. If your long-term savings need work, consider cutting the cord and replacing cable with a lower-cost streaming service or two. You can then bank the difference.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Cancel services you don't get a lot of use from

Can't remember the last time you entered the gym? Get a newspaper delivered daily you only read once a week? If you can say yes to questions like these, you're throwing money away that could help you build up your nest egg instead. Take a look at what you're spending on and cancel items of little value.

Previous

Next

7. Don't overspend on your kids

You may want to give your kids the best of everything -- the newest electronics, cool clothes, and the opportunity to pursue different interests. But if your nest egg is seriously lacking in funds, it may be time to cut back on splurges for your children. In fact, if they're old enough, you should encourage your kids to get jobs so they don't need to come to you for spending money all the time.

ALSO READ: How to Get Your Kids Interested in Personal Finance

Previous

Next

8. Stop funding your kids' college accounts

It's noble to want to pay for as much of your kids' education as you can. But if you're behind on retirement savings, it's time to stop those 529 plan contributions and put more money into your IRA or 401(k). There are different options your children can explore for financing an education, and you shouldn't have to retire at a later age than desired to fund a series of costly college degrees.

Previous

Next

9. Get a second job

You may only have so many opportunities to cut back on spending and ramp up your nest egg contributions. But if you're willing to get a second job or side hustle, you can use your earnings to fund your IRA or 401(k). And to be clear, your side gig doesn’t have to be something you can’t stand. You can turn a hobby like baking or crafting into an income source.

ALSO READ: 5 Summer Jobs You Can Turn Into Year-Round Side Hustles

Previous

Next

10. Grow your job skills

The more valuable an employee you are, the more likely you'll be to snag a promotion. And that could be your ticket to higher earnings. Once your paycheck increases, you're likely to find that it's easier to increase your retirement plan contributions, so it pays to spend some time boosting your skills and learning new things.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. Rethink the way you're investing

Investing heavily in bonds makes sense when you're in retirement -- not when you're trying to save for it. If you're worried you're not making good progress in the savings department, take a look at your investments. You may need to stop playing it safe and start loading up on stocks, which tend to be riskier but more financially rewarding.

Previous

Next

12. Invest in dividend stocks

Dividend stocks are a great investment to hold in your retirement plan, because you can take the payments you get and reinvest them for added growth. That said, you shouldn't buy stocks based on a large dividend payment alone. Rather, make sure you're investing in companies whose share prices are likely to rise over time.

ALSO READ: Is Loading Up on Dividend Stocks the Secret to Meeting Your Financial Goals?

Previous

Next

13. Make sure you're claiming your full 401(k) match

If you have a 401(k) plan through your employer, you may be entitled to free money in the form of a company match. Make certain to contribute enough out of your paychecks to claim that match in full. It could help you catch up on savings and avoid having to extend your career.

Previous

Next

14. Rethink your retirement plans

You may not have enough savings to retire on time and spend your days traveling all over. But that doesn't mean you're doomed to a late retirement. If you're willing to make compromises, you may be able to retire on time but spend your time differently.

ALSO READ: Worried Inflation Will Wreck Your Retirement? Make These 3 Moves

Previous

Next

15. Consider long-term part-time work

You might not be in a position to retire on time and still manage your bills. But continuing to work full-time well into your 70s doesn't have to be your sole solution. You could instead plan to retire on time but work part-time for the first half of your retirement if that's what it takes to make the numbers work.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

Don't assume you'll retire late

If you're behind in the retirement savings department, you might assume that ending your career at a later age is your only option. But it isn't. There are different steps you can take to catch up on building your nest egg. You can also change your vision of retirement so you're able to wrap up your career at a more desirable age.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.