15 Ways to Invest in Recession-Resistant Healthcare Companies

15 Ways to Invest in Recession-Resistant Healthcare Companies

A diverse lineup of investments to help cure economic ills

Healthcare is about as essential an industry as we have in this country, and by its very nature -- like food and shelter -- it should be fairly recession resistant.

Note we say "resistant" and not "proof." While there are no guarantees, each of the investment options listed here has the record and prospects of standing up to whatever economic ills lie ahead.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. Medical Properties Trust

Medical Properties Trust (NYSE: MPW) is one of the largest private hospital owners in the world, with a portfolio of more than 440 properties in 10 countries. This is a real estate investment trust (REIT) that leases the properties to operators. About 70% are always essential acute care hospitals. The company also is growing its investment in behavioral health facilities.

ALSO READ: This Dirt Cheap Dividend Stock Shines a Light on Its Hidden Upside Potential

Previous

Next

2. Walgreens Boots Alliance

Walgreens Boots Alliance (NASDAQ: WBA) has about 9,000 retail stores in the United States alone and is a great example of businesses that simply didn't close during the pandemic because of the essential nature of the drugstore trade. That also should help this massive operator weather a recession as well.

Previous

Next

3. Teladoc Health

Teladoc Health (NYSE: TDOC) works with medical professionals around the world to provide telemedicine and other virtual healthcare services. The company was founded just 20 years ago and now operates in 130 countries. Affordability and accessibility should help this essential services provider keep going strong through whatever the economy serves up next.

Previous

Next

4. Vanguard Health Care ETF

Investing in Vanguard Health Care ETF (NYSEMKT: VHT) gives you a stake in more than 400 different companies. This is an exchange-traded fund (ETF) that seeks to match the performance of an index called the MSCI US IMI Health Care 25/50. It's an easy way to invest in the healthcare industry as a whole without choosing individual stocks.

Previous

Next

5. Pfizer

Pfizer (NYSE: PFE) is a pharmaceutical and biotechnology giant with a history dating back to 1849 and its creation in New York by two German immigrants, one of them named Charles Pfizer. The company is still based in the Big Apple and now employs more than 79,000 people engaged in the development, manufacture, and distribution of thousands of critical medications and vaccines, including one of the first to beat back COVID-19.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Alexandria Real Estate Equities

This one might look like a stretch as a healthcare stock, but it's really not. Alexandria Real Estate Equities (NYSE: ARE) is an office REIT that specializes in lab and office space in collaborative clusters in key research and development communities around Boston, San Francisco, North Carolina's Research Triangle, and more. It's the landlord to Pfizer and thousands of other developers and producers of life-improving and life-saving medicines and therapies.

ALSO READ: 2 Great Stocks That Are Still Ridiculously Cheap Right Now

Previous

Next

7. UnitedHealth Group

UnitedHealth Group (NYSE: UNH) employs more than 125,000 people and works with about 6,500 hospitals and 1.3 million physicians and other healthcare professionals to provide coverage to more than 25 million Americans, primarily through employer plans. This is a big business that's not getting any smaller or any less essential anytime soon.

Previous

Next

8. Sabra Health Care REIT

Sabra Health Care REIT (NASDAQ: SBRA) is a provider of skilled nursing and senior housing around the United States and Canada. Skilled nursing facilities, or nursing homes as they're often called, provide an essential service in any economy, and a growing senior population also promises to keep senior housing communities thriving now and in the years ahead, including at the more than 400 properties that Sabra leases to operators across the United States and Canada.

Previous

Next

9. Baxter International

Baxter International (NYSE: BAX) produces a vast array of advanced medical products, from dialysis and other infusion therapies to surgical tables and lights. Its products are used in hospitals, clinics, nursing homes, and at home under physician supervision, and it does business in more than 100 countries.

Previous

Next

10. Medtronic

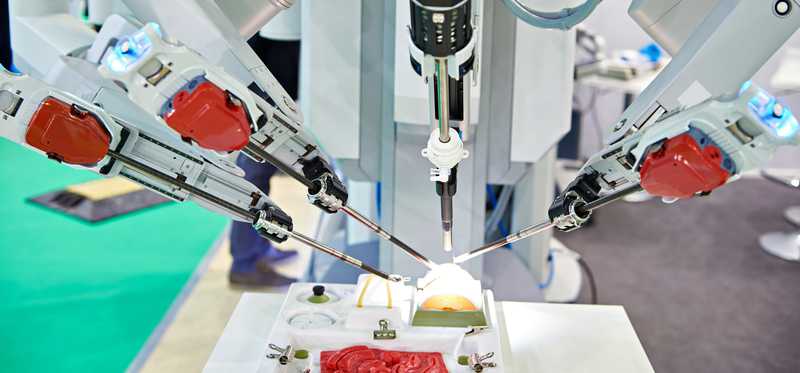

Medtronic (NYSE: MDT) is one of the largest medical device manufacturers on the planet. The company's specialties include pacemakers, defibrillators, stents, angioplasty balloons, insulin pumps and other diabetic care essentials, and much more. Advanced robotics and imaging software also are a growing business for this multinational.

Previous

Next

11. SPDR S&P Health Care Equipment ETF

SPDR S&P Health Care Equipment ETF (NYSEMKT: XHE) is an easy way to invest in this recession-resistant industry without having to study and track individual stocks. This exchange-traded fund holds about 80 stocks chosen to generally correspond to the performance of the S&P Health Care Equipment Select Industry Index. State Street Global Advisors owns and operates the fund.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

12. Healthcare Realty Trust

Healthcare Realty Trust (NYSE: HR) has a portfolio of more than 700 medical office buildings around the country, making it the largest such REIT of its kind. Doctors' offices would seem to be about as recession resistant a business as any, and Healthcare Realty Trust adds geographic diversity with a presence in 14 major markets around the country.

Previous

Next

13. Johnson & Johnson

Johnson & Johnson (NYSE: JNJ) has size, breadth, time, and track record on its side when it comes to choosing a healthcare stock for recessionary times, or any other. Not only does J&J produce an army of brand-name consumer products (from Listerine to Nicorette to Neosporin), it's a leading developer and marketer of medicines and vaccines, including one for COVID-19. This is a 130-year-old company with a market cap of about $430 billion. It's a Dividend King to boot, with a record of 60 straight years of annual payout bumps.

Previous

Next

14. Merck & Co.

Merck & Co. (NYSE: MRK) is another old-timer, founded in 1891 and now a global developer, manufacturer, and distributor of pharmaceuticals for the human and veterinary medical industries alike. On the people side, specialties include products for oncology, immunology, neuroscience, and acute hospital care. For animals, Merck offers medicines, vaccines, and even digitally connected identification and monitoring products.

Previous

Next

15. Stryker

Stryker (NYSE:SYK) has a market of about 75 countries for its medical technology products. Stryker operates in two segments: MedSurg and Neurotechnology, and Orthopaedics and Spine. The need for hip and knee joint replacement implants and surgical equipment for emergency and intensive care units will be there regardless of the economy, and Stryker has built a long record of reliably producing shareholder returns, too, including 29 years of dividend increases.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

These healthcare options could help ease your economic pains

Technically by some key measures, we're already in a recession. Everyone's situation is different, of course, and each recession plays out differently as well. But a balanced portfolio of investments in sound companies is always a good way to ride them out, and healthcare companies belong on the list. The options we covered here are a good place to start.

Marc Rapport has positions in Alexandria Real Estate Equities and Medical Properties Trust. The Motley Fool has positions in and recommends Alexandria Real Estate Equities, Merck & Co., and Teladoc Health. The Motley Fool recommends Johnson & Johnson and UnitedHealth Group. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.