15 Ways to Invest in Supply Chain Logistics

15 Ways to Invest in Supply Chain Logistics

These stocks can deliver solid returns for years to come

It can be easy to take the flow of goods and services from source to consumer for granted. Or at least it was easy to do so until the pandemic occurred. Labor shortages fed shipping and manufacturing snarls, and "supply chain" and "logistics" became household terms perhaps like never before.

Companies involved in the supply chain -- that complicated network of people, places, products, and resources -- can be excellent investments. Here are some to consider.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. FedEx

FedEx (NYSE: FDX) is an international brand name in transportation, business, and e-commerce services, with a fleet of about 480 airplanes and 30,000 land vehicles and a network of 400 service centers -- plus those drop-off boxes that you see everywhere.

This Memphis-based company's stock is down about 40% this year, but it's yielding about 2.9%, so you can enjoy some dividend income while you wait for the price to recover.

Previous

Next

2. CSX

The CSX (NASDAQ: CSX) name is practically synonymous with "railroad" and for good reason.

This Jacksonville, Florida-based corporation operates nearly 20,000 miles of rail lines east of the Mississippi, with a fleet of about 3,500 locomotives as one of the fundamental pieces of American supply chain infrastructure.

CSX stock also is currently yielding about 1.4%, and over the past 10 years, it has even outperformed the S&P 500 in total return.

Previous

Next

3. A.P. Moller-Maersk

A.P. Moller-Maersk (OTC: AMKBY) is the formal name of the Danish company behind the Maersk name seen on freighters and shipping containers around the world. It lays claim to being the planet's largest such operator, serving about 375 ports in more than 115 countries. Currently, Maersk stock is down about 45% year to date and yields a whopping 14%.

Previous

Next

4. Manhattan Associates

Manhattan Associates (NASDAQ: MANH) is not in the business of shipping stuff itself. This Atlanta-based technology company develops, sells, and supports software for supply chain and inventory operations installed at a wide range of companies and industries around the world.

Its stock is currently selling for about $140 a share, but analysts give it a consensus target price of $178.75, a substantial upside for what should be considered a growth stock that doesn't pay a dividend.

Previous

Next

5. Old Dominion

Old Dominion Freight Line (NASDAQ: ODFL) is one of America's largest trucking companies. It operates as a less-than-truckload (LTL) motor carrier and has a fleet of about 10,400 tractors and 28,000 trailers along with more than 250 fleet maintenance and service centers. The company is headquartered in Thomasville, North Carolina, and its stock price is off about 23% so far this year.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. SPDR S&P Transportation ETF

SPDR S&P Transportation ETF (NYSEMKT: XTN) is an exchange-traded fund (ETF) that seeks to track the performance of the S&P Transportation Select Industry Index. An investment here buys you a stake in about 50 different transportation-related stocks, and you'll get a current yield of about 1% from a stock that's down about 28% year to date.

Previous

Next

7. XPO Logistics

XPO Logistics (NYSE: XPO) is another of our nation's largest LTL carriers, offering that service along with brokerage services and a nationwide network of docking facilities and driver training schools. The company even manufactures its own trailers at a facility in Searcy, Arkansas.

XPO stock is currently trading for about $50 a share and carries an analyst-bestowed target price of $90.11, which would deliver quite a bit of capital gains if and when it reaches that mark.

Previous

Next

8. GXO Logistics

GXO Logistics (NYSE: GXO) is a 2021 spinoff from Greenwich, Connecticut-based XPO Logistics. This company specializes in warehousing and distribution, including e-commerce delivery and returns.

GXO Logistics already has about 900 facilities from which it provides its outsourced logistics services to a wide variety of industries and companies around the world.

A badly trounced stock price that's down about 60% so far this year could make this an attractive buy and hold.

Previous

Next

9. Oracle

One of the largest software services enterprises in the world might not pop to mind as a growth play in logistics. But supply chain management is big business for Oracle (NYSE: ORCL).

One of the original Silicon Valley powerhouses, Oracle not long ago moved its headquarters to Austin, Texas, and its stock may now be a bargain, down 24% year to date and yielding nearly 2%.

Previous

Next

10. UPS

United Parcel Service (NYSE: UPS) may be the largest shipping courier of all, providing delivery and other supply chain solutions in about 200 countries and territories with its ubiquitous fleet of about 120,000 cars, vans, tractor-trailers, and even motorcycles.

Like FedEx, UPS stock has been hit by e-commerce volume concerns. It's now down about 22% for the year, pushing its generous dividend yield up to about 3.6%.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. Postal Realty Trust

Postal Realty Trust (NYSE: PSTL) offers a way to invest in perhaps the largest delivery operation of all: the United States Postal Service. Postal Realty is a real estate investment trust (REIT) that owns and/or operates a growing collection of post offices that now numbers about 1,500 in all 50 states. That's a very reliable tenant providing the cash flow to fund a dividend yield that's currently about 6%.

Previous

Next

12. Prologis

Prologis (NYSE: PLD) owns and operates a network of logistics warehouses serving more than 5,800 customers in 19 countries from its home base of San Francisco. Prologis is one of the largest REITs in the business and also perhaps the largest owner of industrial properties, with more than a billion square feet under its roof.

Prologis is also growing, organically and through acquisitions such as the recent deal to buy rival Duke Realty. Given the consistent demand for the kind of space it offers, and its breadth and resources, analysts consider Prologis stock a buy. It currently trades for about $103 a share and yields about 3%.

Previous

Next

13. Terreno Realty

Terreno Realty (NYSE: TRNO) is based in San Francisco and was founded more than a decade ago by former Prologis executives. Terreno specializes in small warehouses located in prime, hard-to-duplicate infill spaces in six U.S. coastal markets. Its portfolio of 250 or so buildings, and 42 leasable improved land parcels, provides the revenue for 11 straight years of dividend increases that now has its yield at about 3%.

Previous

Next

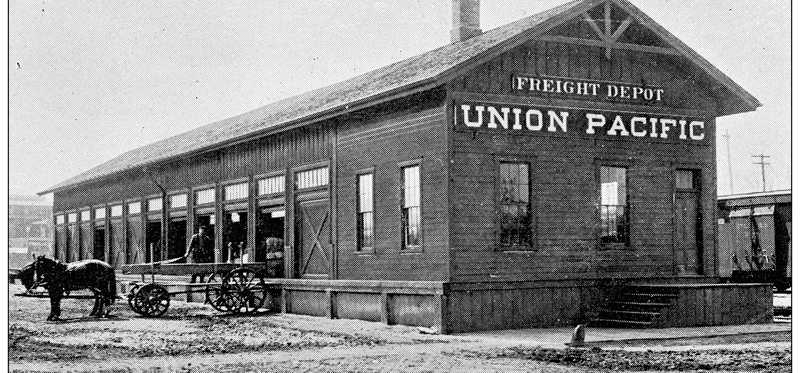

14. Union Pacific

Union Pacific (NYSE: UNP) is the western United States' answer to CSX and is among our most historic providers of such infrastructure, dating to its 1862 founding during the Civil War. Union Pacific is based in Omaha, Nebraska, and now has a rail network of about 32,000 miles that ultimately connects Pacific and Gulf Coast ports with the rest of the country. You can climb aboard for about $200 a share and enjoy a dividend yield of about 2.5%.

Previous

Next

15. Brookfield Infrastructure Partners

Let's wrap up this list with a major provider of infrastructure for moving everything from natural gas and water to traditional freight to toll roads and even data. Brookfield Infrastructure Partners (NYSE: BIP) is part of the vast, Toronto-based Brookfield Asset Management (NYSE: BAM) empire. Brookfield Infrastructure Partners stock is down only about 12% year to date and is yielding a nice 3.9% after 14 consecutive years of dividend increases.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

Necessity-based services and investor potential

The beaten-down stock market provides a lot of opportunity for investors to take a stake now in companies that should be among those who will benefit most when the upswing inevitably resumes. As providers of essential services in good economies and bad, supply chain logistics companies like the ones highlighted here can be a great place to start that search.

Marc Rapport has positions in Postal Realty Trust, Inc., Prologis, and Terreno Realty. The Motley Fool has positions in and recommends Brookfield Asset Management, FedEx, Old Dominion Freight Line, Prologis, and Terreno Realty. The Motley Fool recommends Brookfield Asset Management Inc. CL.A LV, Brookfield Infra Partners LP Units, Brookfield Infrastructure Partners, GXO Logistics, Inc., Union Pacific, and XPO Logistics. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.