5 Best and Worst Real Estate Markets Right Now

5 Best and Worst Real Estate Markets Right Now

The housing market is changing quickly

The housing market is moving quickly in response to inflation, rising interest rates, and a shaky economy. Both buyers and sellers are thinking twice as sellers scramble to catch the top, and buyers are starting to call the bluff.

Some markets are already experiencing strong declines in demand, while other metropolitan areas are holding strong due to solid demand and reasonable pricing. Keep reading to learn five places where you can safely buy and five you should avoid at all costs right now.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

Best #1: Chicago, Illinois

When a small town sees decreased demand -- for example, a major business in the area leaves -- it is feasible for that area to stay down for the long term or take a significant amount of time to recover. It's another thing altogether when major metropolitan areas see a dip.

Big cities will almost always recover as the allure of all they offer piques the interests of opportunists. At 55 days without significant price increases, Chicago's days on market are more than double the national average. Temporarily decreased demand can allow buyers to get choosy.

ALSO READ: Here's Why a Near-Term Recession Shouldn't Crush the Housing Market

Previous

Next

Best #2: Elgin, Illinois

If suburbs are more your thing, Elgin, Illinois, is mirroring Chicago's moves while still offering close enough access to big city living.

The median sales price is lower, too, at $279,500 compared to Chicago's $355,000. At 45 days, the days on market are slightly lower than Chicago's, likely due to relatively more affordable living as interest rates continue to increase.

Previous

Next

Best #3: McAllen, Texas

The days on market are significantly fewer than the year prior, going from 38 days last year to just 19 days. Housing supply has remained consistent, and median sales prices have only increased by 17.7%, which seems to be at a reasonable pace relative to much of the country.

Steady growth and increasing demand are positive indicators that McAllen could present a good buying opportunity.

ALSO READ: Home Prices Are Up More Than the S&P 500: How Real Estate Investors Can Take Advantage

Previous

Next

Best #4: Fresno, California

Fresno has fallen into the hot-market category, with homes selling within an average of 10 days on the market. Many homes are getting multiple offers and seeing waived contingencies. And nearly 70% of those sold are selling above the asking price. While many other cities are seeing the market weaken, Fresno is clearly still holding strong.

Previous

Next

Best #5: Springfield, Massachusetts

Not quite as hot as Fresno but still a standout for the eastern seaboard, Springfield is experiencing increased demand and a balance of supply. This has resulted in a 17.4% increase in price, which is nothing astronomical in today's wild housing markets.

As the third-largest city in Massachusetts, it offers affordable city living without the sky-high housing prices of Boston or other major metros in the northeast.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

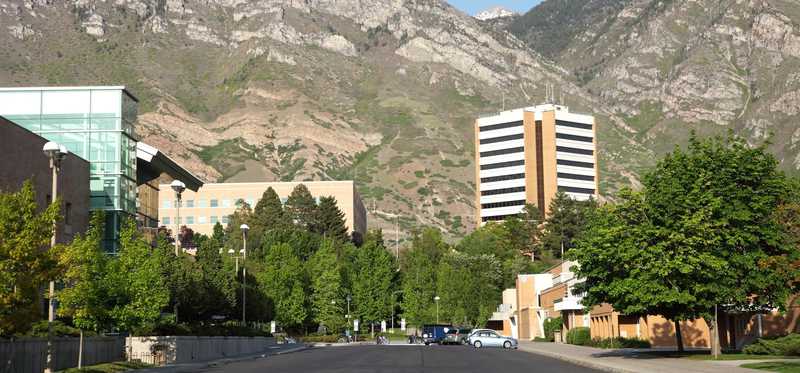

Worst #1: Provo, Utah

Provo is just outside Salt Lake City and saw a major influx of residents during the pandemic, but things have quickly slowed down. During the two years of the coronavirus pandemic, home prices rose 65.7%. And now, they have the highest number of price drops in the country. May 2022 had 47.8% of sellers taking less than they originally hoped for.

Previous

Next

Worst #2. Tacoma, Washington

Just a hair behind Provo is Tacoma, Washington. Of the homes listed, 47.7% had to reduce their asking prices. Nearly half the seller's market is having to adjust expectations in what likely is just the beginning of a rebalancing in supply and demand.

Previous

Next

Worst #3: Denver, Colorado

When nearly half the homes listed must drop their list prices by 46.9%, it's clear times are changing. Denver has long been known as one of the country's most expensive real estate markets, but it seems even the wealthy have limits. As prices and interest rates rise, homeowners realize they can only afford so much, and demand is faltering.

Previous

Next

Worst #4: Sacramento, California

A full 44.3% of homes listed in Sacramento, California, had to cut prices before selling. With a median sale price of $610,000 in May 2022, the income needed to support a mortgage payment is considerable. As interest rates continue to climb, buyers are moving to more affordable cities, decreasing demand in these high-dollar markets.

Previous

Next

Worst #5: Boise, Idaho

Not quite as high as Provo, 44.2% of homes needing price drops in order to sell is still nothing to sniff at. This is expected as Boise was in the top 10 metropolitan areas where prices increased most during the pandemic, seeing a whopping 66.7%. It was also considered one of the most overvalued markets going into 2022.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

Housing is changing, but good markets are still out there

Markets change all the time. While we're seeing big shifts on a macro level, local factors will ultimately lead the way. There are definitely markets to stay clear of right now, but there are also several markets that could lead to good buying opportunities for the long term.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.