Causes of a bear market

The usual cause of a bear market is investor fear or uncertainty, but there are a multitude of possible causes. While the global COVID-19 pandemic caused the 2020 bear market, other historical causes have included widespread investor speculation, irresponsible lending, oil price movements, over-leveraged investing, and more.

Bear vs. bull

A bull market is essentially the opposite of a bear market. Bull markets occur when there is a sustained rise in stock prices, and they are typically accompanied by elevated consumer confidence, low unemployment, and strong economic growth.

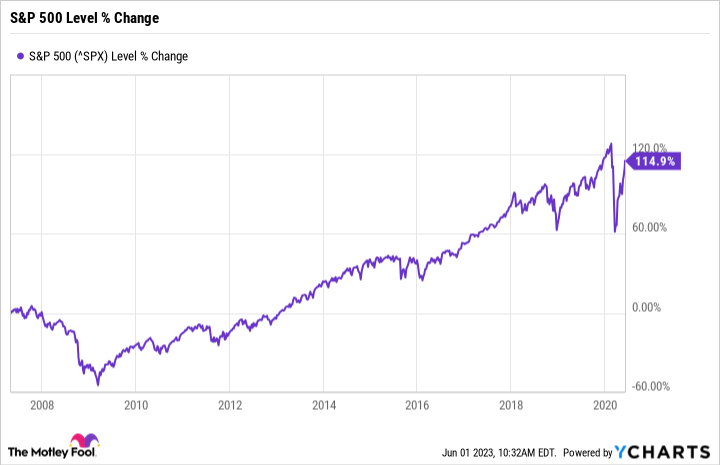

Generally speaking, a bull market is defined as a 20% rise from the lows reached in a bear market, but the definition isn't as strict as that of a bear market. Investors typically mark the start of a bull market at the market bottom of a bear market, and as a result, you generally won't know we're in a bull market until it's already well underway. For example, the S&P 500 reached the lows of the financial crisis in March 2009, so that is considered the start of the bull market that lasted until early 2020.