Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Some of you may have heard the phrase "buy the dips" at some point in your personal or working life, or somewhere in your investment education.

Here you'll learn what "buying the dip" means, how the strategy works, and how to manage risks associated with the technique.

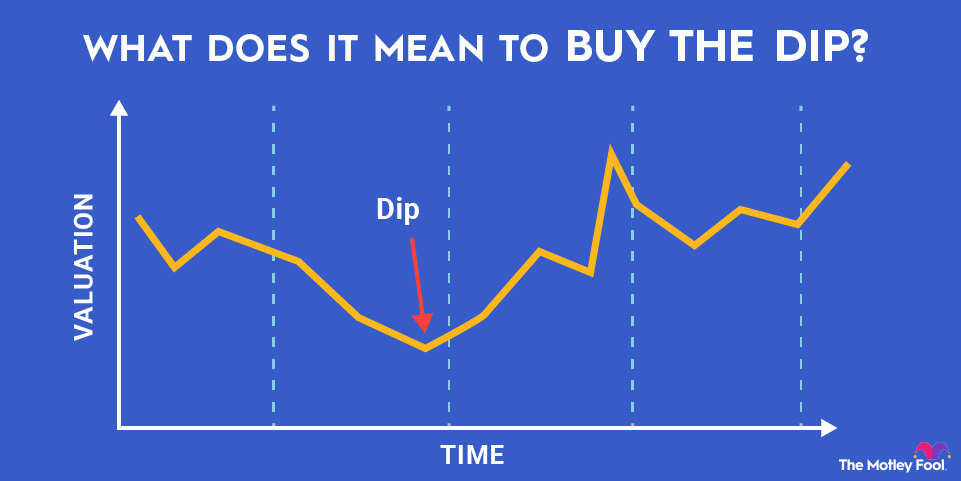

"Buying the dip" is another way to say purchasing a stock or an index after it's fallen in value. As the stock's price "dips," it may present an opportunity to pick up shares at a discount and enhance your future gains if and when the stock rebounds to its previous high (or more).

Buying the dip is usually done in reaction to short-term price movements, and isn't usually a strategy associated with long-term investing. If you've decided to buy shares solely based on a recent decrease in stock price, you're engaging in a form of market timing.

Does the size of "the dip" matter? Unless you've specifically laid out in advance the price drop that would cause you to purchase more stock, it's difficult to define a "dip size" that's universally applicable. This is another reason why trying to buy the dip is a questionable investing strategy for long-term investors.

Generally, the larger the dip, the more you stand to gain if the stock returns to its previous levels. However, a stock that's experienced an unusually large drop in price may have experienced a shift in its underlying fundamentals. It may never return to its high.

Buying the dips, in practice, involves holding a portion of cash or lower-risk liquid assets out of the market and waiting for market prices to fall. "Prices" in this context means the market values of stocks, bonds, index funds, or even cryptocurrencies.

Once prices have fallen -- for whatever asset you're tracking -- you take all or some of the cash you've been holding and purchase more of the asset. This lowers your overall average cost and can enhance your returns, assuming you hold the asset long enough and higher valuations prevail over time.

For example, if you had kept sufficient cash on the sidelines for the months or years leading up to a major dip, you could have deployed your money to purchase ultra-cheap shares of a massive ETF when the crash finally came.

No doubt you would have lowered your average cost basis for the ETF and would have enjoyed supercharged returns up to and through future current market highs. But this isn't as easy in practice as it seems in hindsight.

Remember that when you look at a stock chart, you're looking at previous performance. Once it's already happened, it all seems obvious. The difficult part is predicting dips before they happen, knowing how far the dip will ultimately go, and then having enough confidence in the asset to believe it will return to its previous highs. Some good fortune doesn't hurt either!

With cryptocurrency, the game is a bit different. Some people are hesitant to deploy large amounts of capital into digital assets, and for good reason. These are emerging technologies with no underlying fundamentals, cash flow, or valuation metrics, so it's truly difficult to know the difference between a dip or a semi-permanent crash in these markets.

Let's use Bitcoin's historic boom and bust cycles as an example. From 2015 to 2017, Bitcoin went from its dip to its peak in just over 1000 days. However, in 2022, Bitcoin halved in value and took almost three full years to return to its previous price.

Because we don't have a standardized methodology to assess Bitcoin's underlying fundamentals (if there are any!), and cryptocurrency tends to trade in a whipsaw-like manner, buying the dips could be more suitable in this arena. This is likely because Bitcoin and other cryptocurrencies are speculative in nature. In other words, Bitcoin is traded as a high-risk, high-reward asset that can "dip" at a moment's notice.

If you have a certain amount of money earmarked for cryptocurrency, investing sooner or holding it for a longer period of time doesn't necessarily give you a better chance of making money. Further, because Bitcoin has no cash flow or associated earnings, you won't miss out on dividend payments by waiting for the next crash to add some to your portfolio.

The decision to buy Bitcoin or any other digital currency should be considered at length in advance, so be sure to understand the associated risks of doing so. If you do decide to buy, make sure it's as part of a globally diversified portfolio comprised of different asset classes.

Buying the dips comes with some advantages, but there are many disadvantages:

Say you had purchased 1,000 shares of imaginary company Super Big Corporation in January when it was trading for $40 per share, totaling a $40,000 investment.

At the same time, say you wanted to keep a portion of your money on the sidelines to wait for the stock's next pullback. Imagine that amount was $10,000.

As it turned out, the stock's next pullback happened in March of the next year, when the stock fell from $80 to around $60 -- $20 higher than your original purchase price!

Had you invested all the money from the beginning, $50,000, you'd have nearly doubled your money to $100,000 within the course of a year.

Instead, you'd be left with $80,000 a year later and $10,000 on the sidelines -- with no way to know when to invest it.

Finally, money you kept out of the market won't qualify for favorable long-term tax treatment until you invest it and hold it for a year, and it will also miss out on any accrued dividends over the time it remains idle.

Simply put, once you've decided to invest in a stock, invest the portion that makes sense for your total financial picture and invest all of it.

If you do decide that you want to try to buy the dip in a particular index or stock, there are some things to keep in mind:

There are many psychological reasons that would lead one to believe that buying the dips is a sound investing strategy. Part of becoming a successful long-term investor, however, is learning to overcome these emotional and psychological biases to give yourself the best chance of doing well over time.

Buying the dips, if you do choose to try it, should be done in moderation and with a full understanding of the risks involved. Alternatively, it makes sense to develop a risk-adjusted asset allocation that considers your short- and long-term goals and to fully invest your money in accordance with it. There's a good chance that the "future you" won't be disappointed.

A final note on buying the dip can be summed up with the old investing adage, "Time in the market is better than timing the market."