Say you had purchased 1,000 shares of imaginary company Super Big Corporation in January when it was trading for $40 per share, totaling a $40,000 investment.

At the same time, say you wanted to keep a portion of your money on the sidelines to wait for the stock's next pullback. Imagine that amount was $10,000.

As it turned out, the stock's next pullback happened in March of the next year, when the stock fell from $80 to around $60 -- $20 higher than your original purchase price!

Had you invested all the money from the beginning, $50,000, you'd have nearly doubled your money to $100,000 within the course of a year.

Instead, you'd be left with $80,000 a year later and $10,000 on the sidelines -- with no way to know when to invest it.

Finally, money you kept out of the market won't qualify for favorable long-term tax treatment until you invest it and hold it for a year, and it will also miss out on any accrued dividends over the time it remains idle.

Simply put, once you've decided to invest in a stock, invest the portion that makes sense for your total financial picture and invest all of it.

How to manage risks when buying the dip

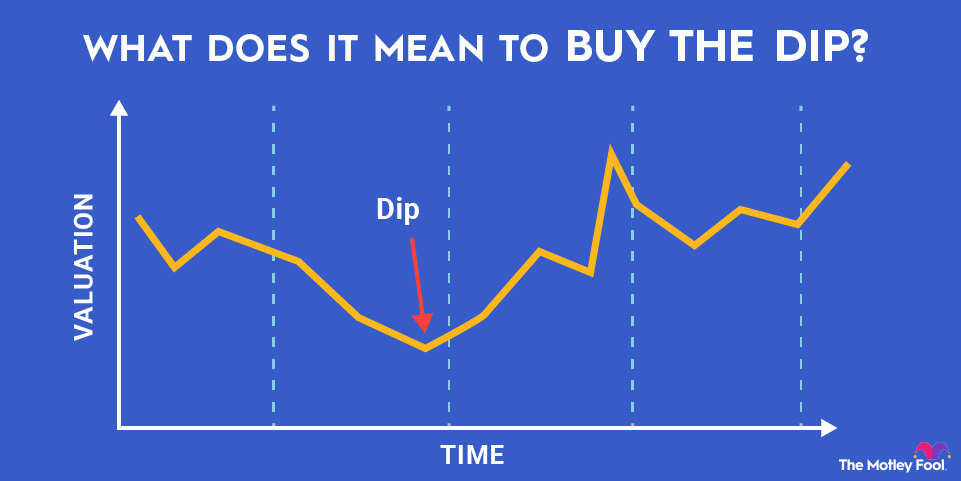

If you do decide that you want to try to buy the dip in a particular index or stock, there are some things to keep in mind:

- Limit the amount that you decide to keep out of the market to a small percentage. If you have $50,000 to invest, keep only a modest amount uninvested as "dry powder" -- somewhere in the neighborhood of $5,000 to $10,000.

- Determine a specific price decline at which you're willing to deploy money. If you determine in advance that you'll buy more shares if a stock declines 10%, be ready to do it and execute your plan. Don't continuously wait for further drops -- you may be waiting a very long time!

- Understand the possible consequences of having money uninvested. You'll miss out on favorable tax treatment and the potential for qualified dividends, so be sure you know what you're giving up and why.

- Know that this is an unorthodox strategy when it comes to generating reliable after-tax returns. It might feel like buying the dips is advisable, but, in the lion's share of cases, it's best to be fully invested at all times. If your asset allocation calls for a portion of your portfolio to be held in cash, that's a different story.

Related investing topics