Earnings per share, or EPS, is a common financial metric used to gauge a company's profitability. It measures the company's net earnings against its current share count. Diluted EPS goes a step further, factoring in shares that a company may be obligated to issue in the future.

Usually you can find both earnings per share and diluted earnings per share listed on a company's income statement.

How to calculate diluted EPS

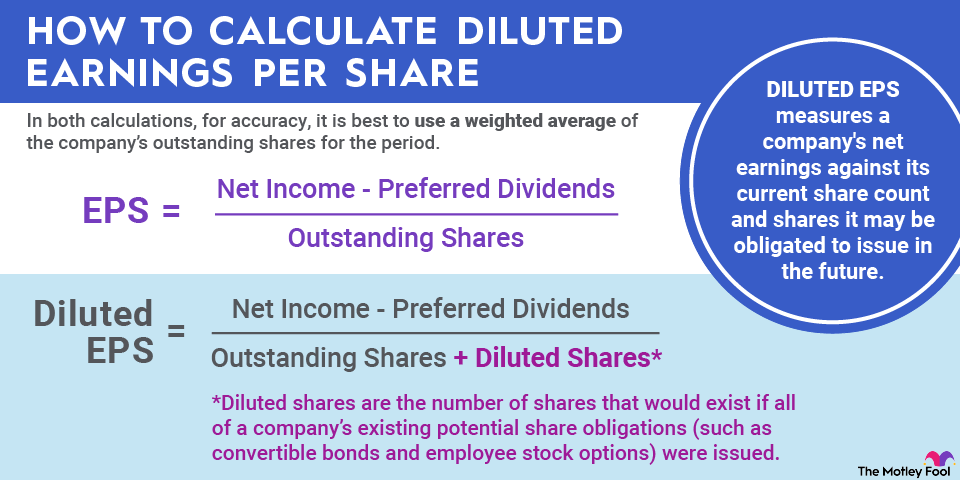

You calculate basic EPS by taking the company's net income (minus any preferred dividends) and dividing by the number of outstanding shares.

Then, to calculate diluted EPS, simply add the number of "diluted shares" -- the number of shares that would exist if all of a company's existing potential share obligations were issued.

The formula for diluted earnings per share is a company's net income (excluding preferred dividends) divided by its total share count -- including both outstanding and diluted shares.

The most common types of diluted shares are employee stock options and investor stock warrants, both of which confer the right to purchase shares of stock at a later date for a specific price. Other types of diluted shares are convertible securities, like convertible bonds or convertible debt, which transition into shares of stock under certain conditions.

Example of diluted EPS calculation

Here's how to calculate diluted EPS. Let's say Company X has the following statistics:

Metric | Amount |

|---|---|

Net income | $110 million |

Preferred dividends | $10 million |

Outstanding shares | $200 million |

To determine Company X's basic EPS, we first subtract $10 million from $110 million to get $100 million. Then we divide by 200 million shares to get an EPS of $0.50 per share.

However, let's say Company X also has the following obligations:

Obligation | Potential Share Issuance at Current Price |

|---|---|

Employee stock options | 50 million shares |

Convertible bonds | 150 million shares |

To calculate diluted EPS, we start by adding those diluted shares (50 million + 150 million = 200 million) to the 200 million outstanding shares to get a denominator of 400 million shares. We use the same numerator as before ($100 million) to get a diluted EPS of $0.25/share.

In real life, diluted EPS will seldom deviate so drastically from ordinary EPS. Plus, this is a simplified view of stock options. Stock options can execute at varying strike prices, potentially altering the number of stocks issued and therefore the total number of diluted shares.

The finer points of calculating diluted EPS

To truly determine the full effect of stock options on diluted shares, follow these additional steps. Stock options are the most common obligation to issue shares that companies face. Basically, when a company issues stock options at a certain exercise (strike) price, you need to account for the intrinsic value of the options and how much stock could be purchased with that amount of money.

First, multiply the number of issued stock options by the exercise price. This tells you how much would be paid to exercise the options.

Amount paid = Options issued * Exercise price per share

Next, divide that result by the current market price of the stock to determine how many shares could be purchased for the exercise price of the options.

Value of options in current shares = Amount paid to exercise options / Current share price

Finally, subtract this figure from the number of options outstanding to determine the excess shares that would need to be issued to meet these obligations.

Diluted shares = Options issued-Value of options in current shares

This is the number you add to the outstanding share count to determine the number of shares that could exist if the options were exercised.

Related investing topics

Why to use diluted EPS

Diluted EPS can give a more accurate picture of a company's financial condition than ordinary EPS.

Many companies have obligations that could result in additional shares being issued. For example, if a company issues stock options to its employees or has any outstanding bonds that could be converted into common stock, that could result in the issuance of more shares. When the overall number of a company's shares increases, each individual share is worth less, a phenomenon known as "dilution."

That's why it can be best to express financial metrics such as EPS using the "fully diluted" share count: the number of shares that would exist if all these obligations were met.