To calculate diluted EPS, we start by adding those diluted shares (50 million + 150 million = 200 million) to the 200 million outstanding shares to get a denominator of 400 million shares. We use the same numerator as before ($100 million) to get a diluted EPS of $0.25/share.

In real life, diluted EPS will seldom deviate so drastically from ordinary EPS. Plus, this is a simplified view of stock options. Stock options can execute at varying strike prices, potentially altering the number of stocks issued and therefore the total number of diluted shares.

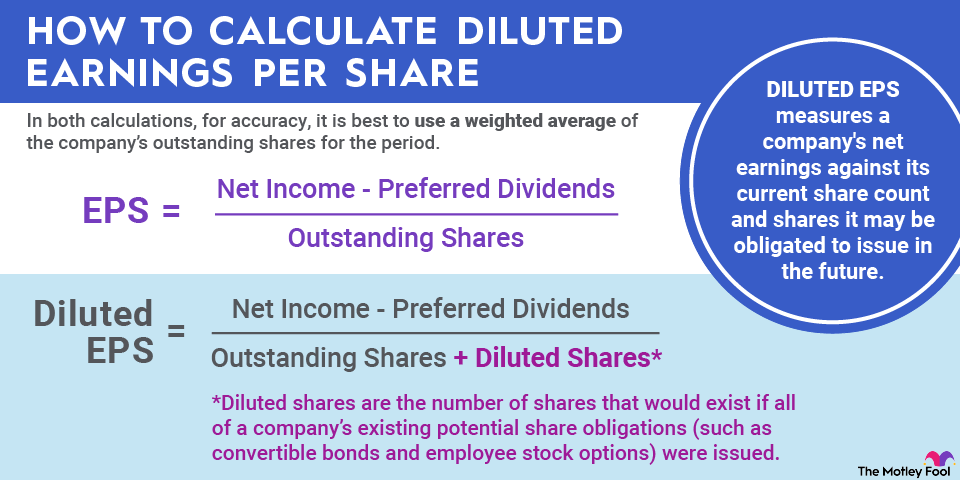

The finer points of calculating diluted EPS

To truly determine the full effect of stock options on diluted shares, follow these additional steps. Stock options are the most common obligation to issue shares that companies face. Basically, when a company issues stock options at a certain exercise (strike) price, you need to account for the intrinsic value of the options and how much stock could be purchased with that amount of money.

First, multiply the number of issued stock options by the exercise price. This tells you how much would be paid to exercise the options.