What does this mean for you?

It's unlikely you'll be quizzed on this information anytime soon, but it's good to know what the federal funds rate is and how it can influence the other interest rates you may come across in everyday life.

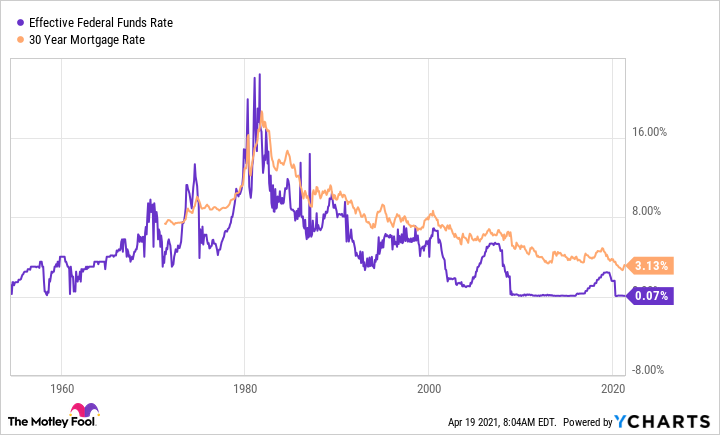

When the Federal Reserve chair talks about lowering or raising the federal funds rate, you'll know this very well might affect the cost of your new fixed-rate mortgage or help with the cost/benefit analysis for taking a loan against your vehicle. Simply knowing the federal funds rate is set by the FOMC, that it can affect many of the rates you see, and that it can affect your investment and borrowing decisions goes a long way.

As of mid-2023, the federal funds rate had risen to its highest level in more than 20 years to combat elevated inflation. That's making it a lot more expensive to borrow money, which will likely slow the economy. So now might not be the best time to be a borrower.