What is a going concern?

Going concern is a determination that a company has sufficient assets and revenue to continue operating for the foreseeable future. Businesses that are expected to remain afloat are referred to as going concerns. Once a business goes bankrupt or otherwise liquidates, it is no longer considered a going concern.

Revenue

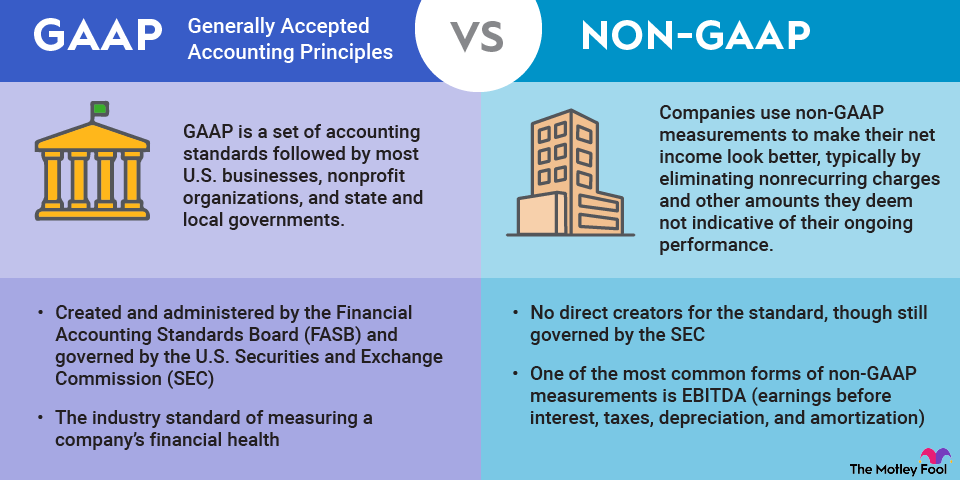

Auditors and management are required to make this determination using generally accepted accounting principles (GAAP) during an audit. If the auditor determines that the company is no longer a going concern, assets normally reported at cost on the balance sheet will instead be reported at a calculated liquidation value.

How to determine going concern

There are two steps in the process. In the first step, evaluate whether or not it is probable that the business will be able to meet all obligations during the next year. This means the business can pay all debt payments, fixed expenses, and operating expenses using its existing cash and a reasonable estimate of new cash flow during the year.

Factors that can negatively affect the business's ability include:

- Operating losses

- Negative working capital

- Default on existing loans

- Outstanding legal issues

- Internal issues such as work stoppages

If the auditor or management deems it unlikely that the business will be able to meet its obligations over the next year, the next step is evaluating the management's plan. In this step, the auditor must determine whether it is likely that the plan will be implemented on time and whether the plan is sufficient to save the company.

Management's plan could include borrowing more money to kick the can down the road, selling assets or subsidiaries to raise cash, raising money through new capital contributions, or reducing or delaying planned expenses.

Liquidity

If the plan isn't good enough, liquidation principles must be applied to the reporting of all assets. It is then assumed that the company will not be a going concern, and the assets will be liquidated to pay off the debts.

Going concern red flags

The going concern determination is a binary choice by the auditor. A company either is assumed to be one or it isn't. That means the auditor could determine that the business you're evaluating is likely to continue operating as a going concern even if there are substantial problems.

Let's go over some red flags you can look for to see if there could be a bankruptcy in the company's future.

- Past-due accounts payable: Accounts payable is the amount the company owes vendors for inventory and supplies. Payables are generally expected to be paid off quickly. In many industries, it should take fewer than 30 days. Use a ratio like days payable outstanding to compare the current year's accounts payable to prior years. If the number is going way up, it could mean the business isn't making enough money to pay its suppliers.

- Inability to get a loan: Banks are often the first to know if a company is heading down the road to bankruptcy. Banks are required to be conservative in lending and will deny loans to businesses that may not be able to repay. Of course, this could just mean the bank is being overly conservative or the business is stretching, but it's certainly a red flag.

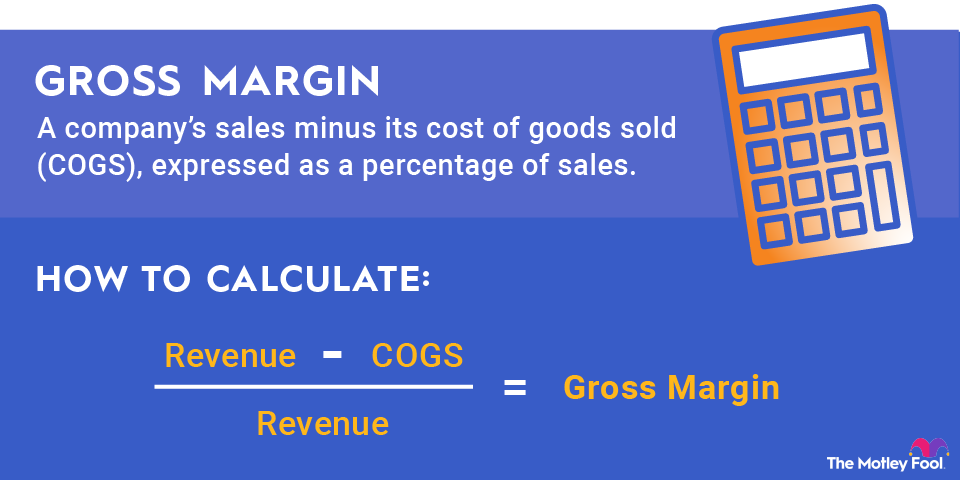

- Dependence on discounted sales: Discounts once in a while are a normal business practice, but discounting constantly means there are problems. Capital expenditures and budget plans are made using expected sales price. If the margin is suddenly half of what was planned, there won't be any money left over. Compare gross margin from year to year. If it's plummeting, there's an issue.

- Low current ratio: Current ratio is the ratio of assets that can be converted to cash in less than a year to liabilities that must be paid in less than a year. If the ratio is low or even negative, the company will have to use cash flow to keep up with payments. This is normal in some businesses, but it isn't sustainable in most. You want businesses that save enough cash to get through hard times.

Why is going concern important?

The main problem with a company not being a going concern is obvious: It is expected to be worthless in less than a year. But there are other factors to consider for companies not deemed a going concern or that have substantial red flags.

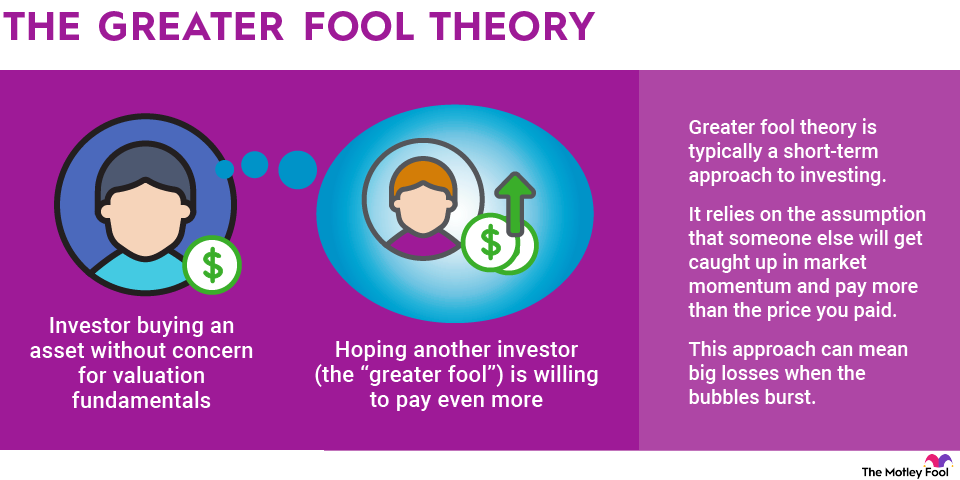

Publicly traded companies will likely see a sell-off in the market. This may not actually hurt the stock price that much since auditors usually will only make a negative going concern determination when there have been problems for a while.

For private companies, outside investors may look to unload their shares to wash their hands of the company at any price possible, especially if there are legal problems. This will include a business valuation to attempt to value the company as a going concern and to value the assets at liquidation value.

The company will be required to write down the value of its assets if liquidation value is lower than the current value on the balance sheet. The write-down process includes taking a loss on the income statement, so net income already doing badly will get even worse.

If management does have a plan to sell assets, seek additional financing, start selling a new gizmo, or raise money with new stock issuances, you'll need to evaluate it. Auditors are required to be conservative, so it is certainly possible, although unlikely, that the plan will work. That could mean there is value to be had.

Related investing topics

What going concern means for investors

As a beginning investor, you'll rarely see companies with going concern issues. As you gain experience, you'll start digging through riskier investments because sometimes that's where the value is. Understanding how and why auditors make going concern determinations can help you figure out which deals are worth it.