Paying for things is inevitable, just like taxes, but there are often different ways those payments are named or categorized. A common phrase, "out of pocket," generally refers to anything that you pay for yourself, but it has a very specific meaning when it comes to healthcare costs.

Read on as we explore the wild world of out-of-pocket expenses.

What is out of pocket in healthcare?

The phrase "out of pocket" is a specific category of payment when it comes to healthcare expenses and a specific metric to check when evaluating a potential new health insurance policy. It refers to how much of your own money you will have to spend before the insurance company will carry the load.

Out-of-pocket expenses are front-loaded on health insurance policies, so you pay the largest percent of your medical costs at the beginning of your plan year, perhaps less toward the middle, and if you have a good prediction for your expenses and have a plan that matches your expenses, maybe nothing toward the end.

How do out-of-pocket expenses work?

Out-of-pocket expenses in healthcare are the costs that you have to pay. They're directly tied to other terms like deductibles, coinsurance, and copays. A health insurance policy generally has the following financial elements:

Premium. Your premium is your monthly fee for having an insurance plan. It should remain the same throughout the year.

Deductible. The deductible is how much you must pay out of pocket before the plan starts to pay at all. You receive the benefit of paying a negotiated fee to healthcare providers, but you still have to pay it all yourself.

Copay. A copay is the amount of money you pay to see a doctor. For example, your insurance card may say that you have a $35 copay to see your primary care physician. This is a base exam fee and generally doesn't go toward your out-of-pocket maximum, though once you meet the out-of-pocket maximum, you'll no longer have to pay the copay.

Coinsurance. Coinsurance is the percentage of medical procedures or tests that you pay, although it can apply to doctor visits and prescriptions, as well. If you have a $1,000 procedure coming up and your coinsurance is 80%, you will pay $200, or 20%, once you've met your deductible.

Out-of-pocket maximum. Out-of-pocket maximum is the most that your insurance can expect you to pay out of pocket. For 2024, plans obtained through the healthcare marketplace can have an out-of-pocket maximum of no more than $9,450 for an individual or $18,900 for a family.

An example of out-of-pocket expenses at work

Let's say you have a very expensive surgery coming up, and it's going to cost $20,000. That might seem like a lot, but for American healthcare, it often costs that to walk into the door of an operating theater.

Your healthcare plan has the following attributes:

- Deductible: $100.

- Copay: $25 for doctor visits, no copay for the hospital.

- Coinsurance: 80% is covered by insurance.

- Out-of-pocket maximum: $7,500.

So, how much will you spend on your surgery, assuming it's a new insurance year and you've not used your coverage yet?

If you know it will be $20,000, then you know the first $100 is on you. You don't have a copay for hospitalization, so there will be no additional costs there.

The next $19,000 is subject to the 80% coinsurance. So, you're liable for $3,800 of the surgical expense.

In total, you will pay $3,900 for surgery. This is the deductible, plus the copay ($0 in this case) and the coinsurance beyond your deductible.

The equation looks like this:

Deductible + ((total procedure cost - deductible) x (100% - coinsurance percent)) = total expense out of pocket.

If you happen to hit the out-of-pocket maximum, you will stop accruing bills, which is great, really. Let's say your procedure was $200,000 instead, and you'd be liable for $39,980. Luckily, because your out-of-pocket maximum is $7,500, that's all you'd pay.

How to use out-of-pocket expense to choose a health insurance plan

Out-of-pocket expenses are one of the most important elements of choosing a health insurance plan, so let's walk through some simple tricks to make this work for you.

If you have some basic idea of your annual healthcare costs, including doctor visits, vaccinations, medications, and routine testing like mammograms or colonoscopies for people who are high-risk, you can choose a healthcare plan that lines up as closely to those expenses as possible.

Entrepreneurs often have more options than people on employer plans, but those employer plans may also give you some options, so this is still worth considering.

With your out-of-pocket expenses tallied up, review your options. You may assume that you want the lowest out-of-pocket maximum that you can afford, within reason, but that's not always the best plan. Here's an example:

Let's say your yearly medical expenses are $3,000 before you consider which plan you'll choose for the year.

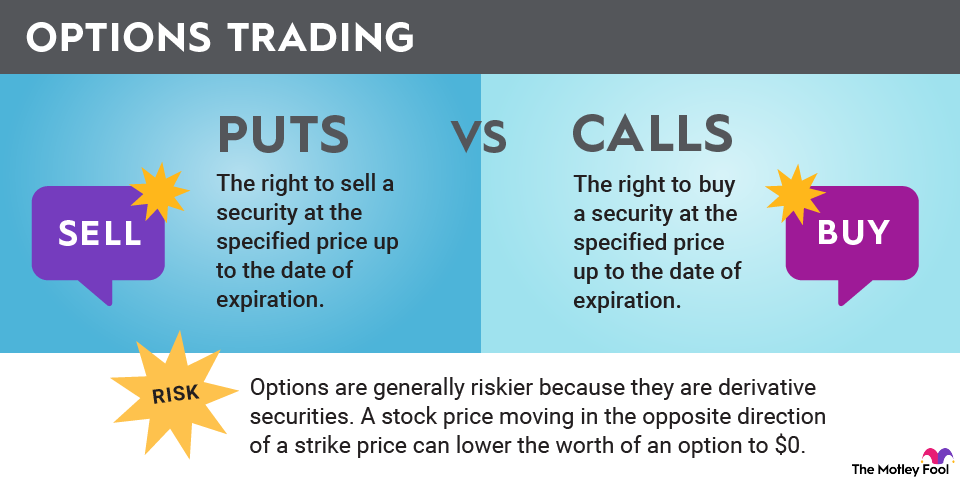

Related investing topics

If the out-of-pocket maximum is $1,000, but you have to pay $750 per month for it, and you know you'll only spend about $3,000 total on healthcare before your insurance comes into play, there may be a better option. After all, you're paying $9,000 just in premiums. Your total cost, not including any copays, would be $10,000 for that plan.

Another plan, with an out-of-pocket maximum of $4,000 but at $500 per month, might be a better choice considering your anticipated expenses. You'll pay $6,000 for that plan, plus the $3,000 out of pocket, making it only $9,000 total that year.

Of course, out-of-pocket maximums aren't the only thing to consider when choosing a healthcare plan, but they are a big part of the equation.