Why is the yield curve important?

Although the yield curve is an important indicator of future economic trends, individual investors can benefit from it as well. Brokers generally recommend investors start with a portfolio consisting of 60% equities and 40% fixed-income investments, such as bonds. U.S. governments and corporations reported almost $53 trillion in outstanding bonds at the end of 2021, about the same amount as the total value of U.S. stocks.

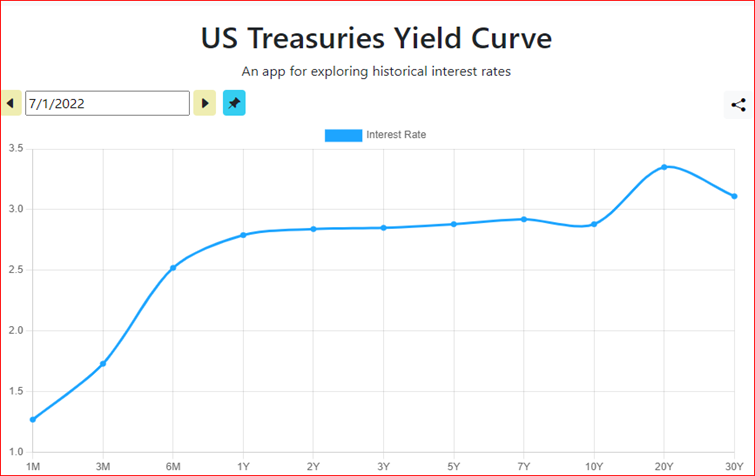

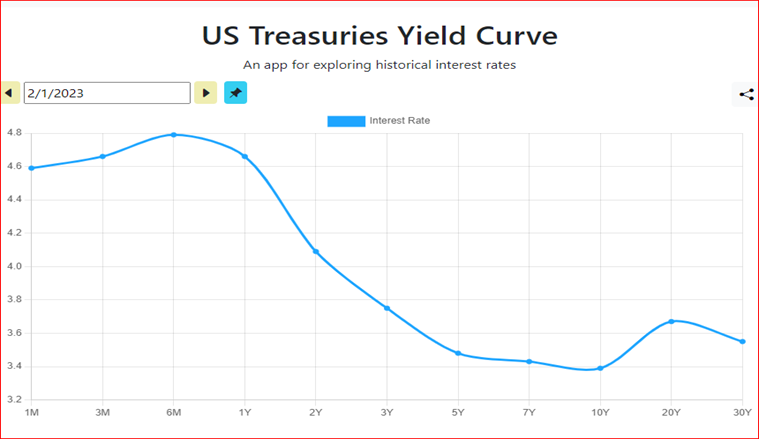

For most investors, however, the question isn’t whether to buy bonds; it’s whether to buy bonds that mature sooner or bonds that mature later. Short-term bonds are generally less risky but have lower yields. Longer-term bonds usually have higher yields, but their value can fluctuate.