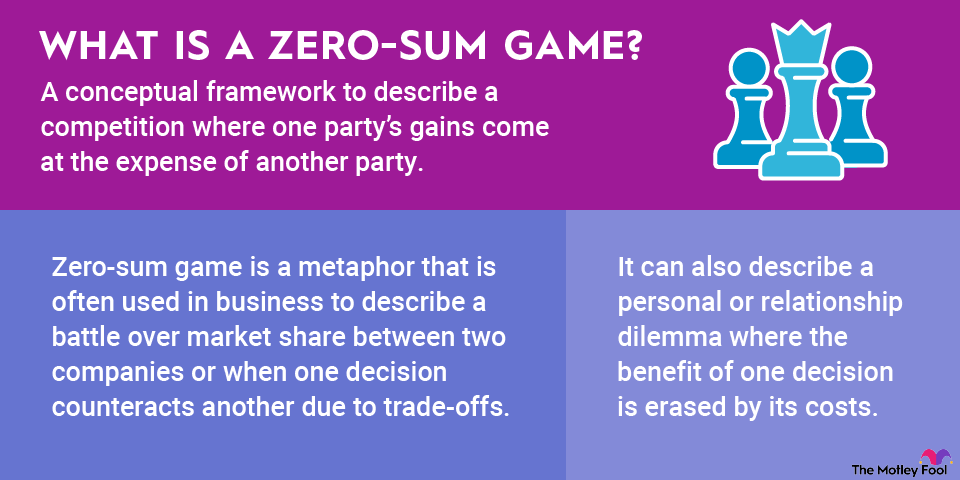

Why zero-sum games matter

Whether you’re an investor or seeking to understand the zero-sum game concept for personal reasons, it helps to know when you’re dealing with a zero-sum game. In business, for example, two companies may be fighting over a fixed amount of market share. That would be a zero-sum game since one company’s market share gains would come at the expense of the other.

Alternatively, in a growth market, both parties might be going after a growing pie rather than pieces of a fixed pie, which is going to make their strategies different. Instead of focusing on profitability and market share, companies in a growing market are likely to spend more on growth drivers like marketing or research and development, potentially accepting a short-term loss because they believe it will lead to a long-term gain.

Elsewhere, a non-zero-sum game leaves room for collaboration since both parties have room to win. For that reason, playing a non-zero-sum game is preferable to a zero-sum game. Trade is one example of a non-zero-sum game since, according to the theory of comparative advantage, trade creates economic benefits for all parties that participate.

Related investing topics