Federal vs. private student loans: An overview

Anyone looking to borrow to pay for college has a choice of federal vs. private student loans. But how do these student loans differ? Which one is the best option for which situation? Read on to get the answers to these questions and more.

Criteria | Federal Student Loans | Private Student Loans |

|---|---|---|

Interest rates | 5.5% to 8.05% | 4.55% to 16.45% |

Loan terms | Usually 10 to 25 years | Usually 10 to 25 years |

Loan amounts | $5,500 to $12,500 per year for undergraduate students,

up to $20,500 for graduate students | Varies by lender but can include the full cost of attending college |

Where to apply | Through your college after completing the Free Application for Federal Student Aid (FAFSA) form | Lender website |

Main benefits | Fixed interest rates, no credit check required, can be consolidated, no prepayment penalties, potential eligibility for loan forgiveness | Potential for lower interest rates, can borrow more, usually no up-front fees |

Main drawbacks | Up-front fees required, limits on the amount you can borrow | Interest rates could be higher in many cases, credit check often required, can't consolidate loans, prepayment penalties sometimes apply, loan forgiveness usually not available |

Better suited for | Individuals without a strong credit history and for whom federal student loan maximum borrowing isn't an issue | Individuals with excellent credit or those who need to borrow more than federal student loans permit |

Federal student loans

Federal student loans are made available by the U.S. Department of Education. There are four main types of federal student loans:

- Direct Subsidized Loans. These loans are available to undergraduate students who meet financial need criteria.

- Direct Unsubsidized Loans. These loans are available to undergraduate, graduate, and professional students, with no eligibility requirements based on financial need.

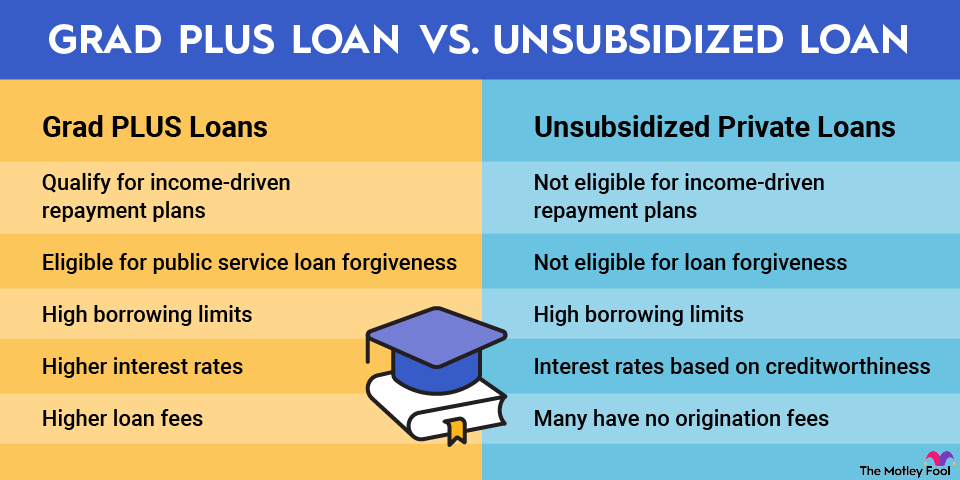

- Direct PLUS Loans. These loans are available to graduate or professional students and as parent loans for the parents of dependent undergraduate students. While eligibility isn't based on financial need, a credit check is required. (Note: Parents can also apply for another type of parent loan, called the Parent PLUS Loan, that isn't available to students.)

- Direct Consolidation Loans. These loans allow borrowers to consolidate all of their federal student loans into one loan.

Undergraduate students can borrow between $5,500 and $12,500 per year through Direct Subsidized Loans and Direct Unsubsidized Loans. Graduate or professional students can borrow as much as $20,500 per year with Direct Unsubsidized Loans.

The amount that can be borrowed depends on your progression in school and your dependency status. Direct Plus Loans can be used to fund any college costs not covered by other sources of financial aid.

There are several key potential advantages for federal student loans:

- Interest rates are fixed (meaning they can't go up) and are usually lower than you can obtain with private student loans.

- No credit check is required, which can be a big plus for younger students who haven't built a credit history or anyone with a poor credit record.

- You don't have to start repaying federal student loans until after you've left college (or are attending college less than half-time).

- With subsidized loans, the federal government pays your accrued interest while you're in school and sometimes after you complete your education.

- If you run into problems making payments, federal student loans offer flexible plans and options to delay payments.

- It's possible that you could qualify for an income-driven repayment plan that bases the amount you have to repay each month on how much money you make.

- Some individuals could be eligible for student loan forgiveness.

Interest Rate

However, there are also some possible disadvantages that stand out for federal student loans:

- Most federal student loans require up-front payment of loan fees. The fees are currently 1.057% of the total amount borrowed for Direct Subsidized Loans and Direct Unsubsidized Loans and 4.228% for Direct PLUS Loans.

- Federal student loans limit how much you can borrow. It's possible that the total cost of your college education could exceed these amounts.

The primary advantages of obtaining a private student loan:

- It's possible to obtain lower interest rates with a private student loan than a federal student loan if you have an excellent credit history.

- You can borrow the entire cost of your college education with many private student loans. Federal student loans have lower maximum amounts.

- Private student loans typically don't require the payment of up-front fees, which can be helpful for cash-strapped students.

Some disadvantages of private student loans:

- Although interest rates can sometimes be lower than those for federal student loans, they could also be higher in many cases. Private student loans with variable interest rates could especially be more costly during periods when the Federal Reserve raises interest rates to fight higher inflation.

- Private lenders often require credit checks. Students with poor credit histories could have problems securing approval for private student loans.

- Unlike federal student loans, multiple private student loans can't be consolidated into a single loan. However, private student loans can be refinanced to obtain lower interest rates.

- Some private student loans impose penalties if you pay off the loan early.

- Unlike federal student loans, loan forgiveness usually isn't available for private student loans.

Federal vs. private student loans: Which should I choose?

Most students should first try to obtain federal student loans. It doesn't take long to complete the FAFSA form. The effort could especially pay off if you qualify for federal subsidies or more flexible repayment options. However, if you can't fully cover the cost of college with federal student loans and/or other sources of financial aid, private student loans can be a good option.