Want regular and bankable dividends without having to analyze and invest in stocks? Consider ProShares S&P 500 Dividend Aristocrats ETF (NOBL 0.21%) and Schwab U.S. Dividend Equity ETF (SCHD 0.10%). Both these exchange-traded funds target dividend-focused U.S. stocks, offering investors an easy way to gain exposure to dividend stocks. However, the methodologies and holdings of these two ETFs create noticeable differences.

These two ETFs differ the most in terms of cost, yield, and sector approach, with SCHD offering lower fees and a higher dividend payout. NOBL tilts more toward industrials but offers exposure to top dividend growth stocks. Investors comparing these ETFs may want to weigh recent returns, risk profiles, and sector exposures, as well as headline metrics such as cost and yield before deciding which one to buy.

Snapshot (cost & size)

| Metric | NOBL | SCHD |

|---|---|---|

| Issuer | ProShares | Schwab |

| Expense ratio | 0.35% | 0.06% |

| 1-yr total return (as of Dec. 31, 2025) | 6.8% | 4.3% |

| Dividend yield | 2.2% | 3.8% |

| AUM | $11.3 billion | $72.5 billion |

Beta measures price volatility relative to the S&P 500; beta is calculated from five-year weekly returns. The 1-yr return represents total return over the trailing 12 months.

SCHD is more affordable with a 0.06% expense ratio compared to NOBL’s 0.35%, and it currently pays out a notably higher dividend yield, which may appeal to income-oriented investors.

Performance & risk comparison

| Metric | NOBL | SCHD |

|---|---|---|

| Max drawdown (5 y) | (17.91%) | (16.82%) |

| Growth of $1,000 over 5 years | $1,308 | $1,298 |

What's inside the ETF portfolios

The Schwab U.S. Dividend Equity ETF tracks a basket of 102 large U.S. dividend stocks, with a sector mix that skews toward energy (19.3%), consumer staples (18.5%), and healthcare (16.1%). Its top holdings include Bristol Myers Squibb (BMY 0.53%). Merck & Co (MRK 0.98%), and ConocoPhillips (COP +1.52%). The fund has a 14.2-year track record, providing some historical perspective on its approach and payout consistency.

The ProShares S&P 500 Dividend Aristocrats ETF, on the other hand, focuses on S&P 500 companies with at least 25 consecutive years of dividend growth, resulting in a lineup of 70 stocks. It leans most heavily on industrials (22.4%), consumer defensive (22%), and financial services (12.4%). The largest three positions include Albemarle (ALB +0.63%), Cardinal Health (CAH +0.70%), and C.H. Robinson Worldwide (CHRW 0.70%).

Both funds avoid leverage and other structural quirks, but the differences in sector weightings and selection rules may drive diverging performance over time.

For more guidance on ETF investing, check out the full guide at this link.

What this means for investors

If you compare the Schwab U.S. Dividend Equity ETF and the ProShares S&P 500 Dividend Aristocrats ETF in terms of yields, SCHD pays a considerably higher yield of 3.8%, easily beating the S&P 500 index's yield of 1.2%. That's also because SCHD tracks the Dow Jones U.S. Dividend 100 Index, which focuses on high-yield stocks. The good thing is that SCHD also places a strong emphasis on dividend track record and the financial strength of the underlying companies. SCHD is, therefore, a highly sought-after and reliable ETF to own to earn regular dividend income.

NOBL, however, stands out for dividend growth as it invests exclusively in Dividend Aristocrats®. The term Dividend Aristocrats® is a registered trademark of Standard & Poor’s Financial Services LLC, a subsidiary of the S&P 500 Global (SPGI 1.22%), reflecting S&P 500 stocks that have increased their dividends for at least 25 consecutive years. Yield is not important here. A company's ability to not just pay a regular dividend but raise it over time alongside cash flows is what matters, and that, by default, makes NOBL an incredibly safe dividend ETF to own to earn some extra income.

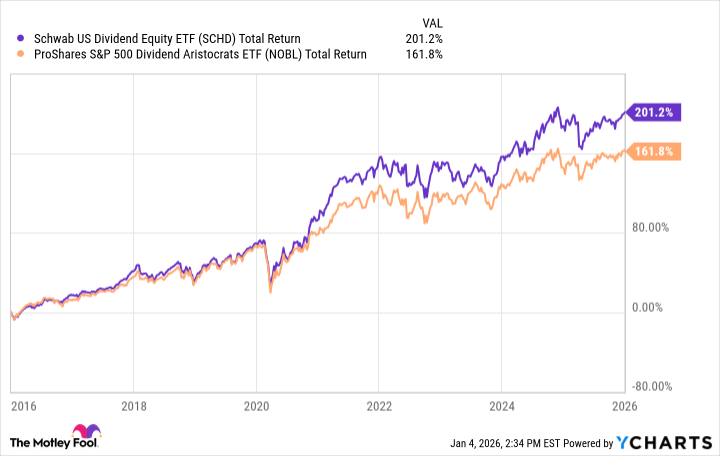

SCHD Total Return Level data by YCharts

Both ETFs give you exposure to fundamentally strong dividend stocks and are excellent additions to your portfolios if you're an income investor. One factor, however, that could make a considerable difference to returns over time is costs. On a $100 investment, you'll be paying 35 cents annually in costs to the fund manager of NOBL but only six cents on SCHD. Its low fees (expense ratio) and high yield are the primary reasons why SCHD has outperformed NOBL in the long term.

Glossary

ETF: Exchange-traded fund; a basket of securities traded on an exchange like a stock.

Expense ratio: Annual fee, expressed as a percentage of assets, that covers a fund’s operating costs.

Dividend yield: Annual dividends paid by a fund or stock, divided by its current price, shown as a percentage.

Dividend Aristocrats: S&P 500 companies that have increased dividends for at least 25 consecutive years.

Beta: A measure of an investment’s volatility compared to the overall market, typically the S&P 500.

AUM: Assets under management; the total market value of assets a fund manages.

Max drawdown: The largest observed percentage drop from a fund’s peak value to its lowest point over a period.

Sector weighting: The proportion of a fund’s assets allocated to specific industry sectors.

Consumer defensive: Companies producing essential goods like food, beverages, and household products, less sensitive to economic cycles.

Leverage: The use of borrowed money to increase potential investment returns, often increasing risk.

Total return: The investment’s price change plus all dividends and distributions, assuming those payouts are reinvested.