Across America and around the world, stock markets are crashing in response to Britain's Brexit. Over here in America, however, one stock -- American Water Works (AWK 1.41%) -- is still soaring.

You can thank Argus Research for that.

Earlier this morning, Argus Research announced that it has initiated coverage of American Water Works stock with a buy rating and a $88 price target. If Argus is right about the stock, then new buyers today can look forward to about a 10% profit on the stock itself, and collect a 1.8% dividend yield while they wait for the profit to materialize.

So roughly a 12% profit in total. What's not to like about that? Here are three things to start with...

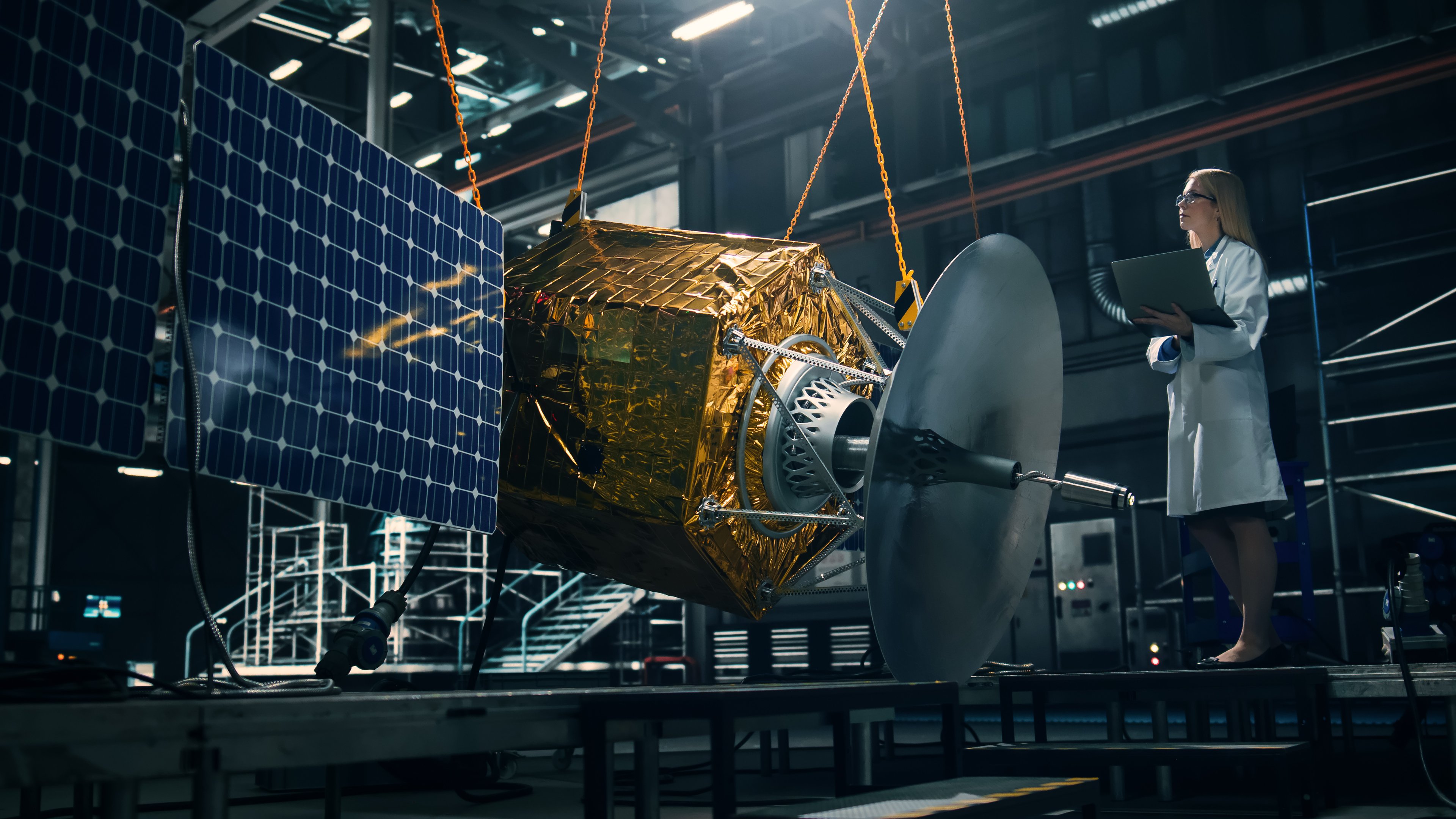

Everyone loves water. Not everyone should love American Water Works stock. Image source: Getty Images.

Thing No. 1: Bigger, yes...

There's not a whole lot of detail available on Argus's buy call on American Water Works stock, but here's what we do know, courtesy of our friends at StreetInsider.com: "Favorable water industry fundamentals," says the analyst, will result in "above-average rate base, earnings and dividend growth" at American Water Works.

That's not an uncommon view. In fact, just last month, my Foolish colleague Beth McKenna argued that American Water Works "supplies the world's most essential product, which insulates it as much as possible from factors such as economic downturns to consumers' changing tastes." What's more, the company boasts "industry-leading size and geographic diversity" that "provide it with a significant competitive advantage over" rivals such as Aqua America (WTR 1.03%) and American States Water (AWR 1.97%).

Viewed side by side, American States Water is more than twice the size of Aqua America, and nearly 10 times as big as American States Water.

Thing No. 2: ...but better?

But that doesn't necessarily make American Water Works a better investment than these alternatives. According to data from S&P Global Market Intelligence, American Water Works' operating profit margin of 34% surpasses the 25% margin at American States Water, but lags the 40% margin of Aqua America. Data from finviz.com actually show American Water Works scoring lowest of the three companies on return on invested capital, at 6.6% for American Water Works, versus 8.8% for Aqua America, and 9.9% for American States Water.

Thing No. 3: And definitely most expensive

And that's before we even come to the question of valuation. After running up 64% in price over the past year, American Water Works stock currently sells for a whopping 30 times trailing earnings, versus 29 times earnings for Aqua America, and 27 times earnings for American States Water.

The most important thing: Valuation

Granted, American Water Works also sports the highest projected growth rate of the three companies. But even so, most analysts who follow the stock see little prospect for more than 7.3% annualized earnings growth at American Water Works over the next five years.

Even combined with a 1.8% dividend yield (stingier than the yields at both American States Water and Aqua America, by the way), that works out to at best about a 9.1% total return on the stock, and a total return ratio of worse than 3.0. That's more than 3 times the price we'd like to see before declaring American Water Works stock is cheap.

Long story short, American Water Works is a fine company, but American Water Works stock sells for an indefensible price. Argus Research is wrong to recommend it.