What happened

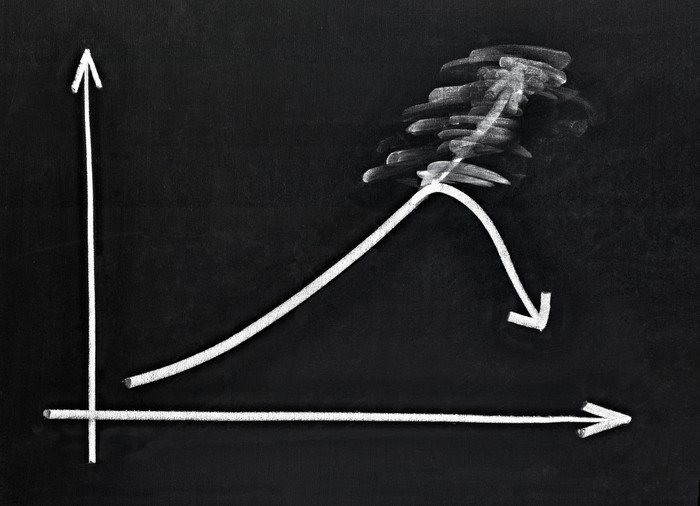

Shares of Ohioan steel producer AK Steel (AKS +0.00%) got crushed on Tuesday, closing the day down 10.1%.

So what

This is not how things were supposed to work out. Last week, AK Steel rivals Nucor (NUE +0.65%) and Steel Dynamics (STLD +0.09%) both delivered earnings reports that were generally well received, encouraging some analysts (Macquarie Capital, I'm talking to you) to clamber out on a limb and predict good things for every steelmaker in sight.

As it turned out, Macquarie Capital wasn't all wrong, and AK Steel's news wasn't all bad. To the contrary, the $0.19-per-share profit that AK reported beat expectations on Wall Street and was AK's "best first quarter net income since 2008." The company's $1.5 billion in Q1 revenues likewise edged out expectations .

Image source: Getty Images.

Now what

But if all that is true, then why is AK Steel stock down 10%? Honestly, after poring over the report, I can see only one explanation: AK Steel was "profitable" last quarter, but it was only barely cash profitable.

I refer to free cash flow, an alternative method of determining a company's profitability, calculated by taking a company's cash generated by operations and deducting from it the company's capital spending. In AK Steel's case, the company reported earning $79 million in profit under GAAP accounting standards last quarter, but it generated only $36.3 million -- and then spent $32.5 million of that on capital investment. The result: Free cash flow at AK Steel was a meager $3.8 million last quarter, a 96.5% decline from the nearly $108 million in cash profit that AK Steel produced in the year-ago quarter.

If any investor was looking for an excuse to sell AK Steel stock today, I think that would qualify as a good reason.