What happened

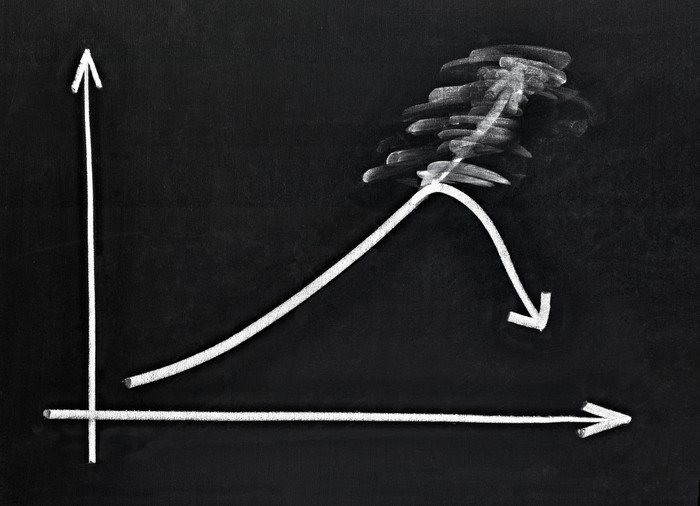

Shares of AK Steel (AKS +0.00%) closed down 11.6% on Thursday, one day after the company disappointed investors with its Q3 2019 earnings report.

Expected by analysts to report $0.04 per share in profit on sales of $1.65 billion, AK instead reported only $1.54 billion in sales, and a mere $0.01 per share in profit.

Image source: Getty Images.

So what

As management explained, mark-to-market losses of $15.3 million, or $0.05 per diluted share, from iron ore derivatives dragged down its results in the quarter -- the opposite of what happened in last year's Q3. Also, while AK Steel realized gains of $13.5 million for iron-ore derivatives contracts in the quarter, these gains had already been recognized as mark-to-market gains in its financial results in prior quarters.

As a result, sales declined 11% year over year, and profits fell 95%.

Now what

After so much bad news, you might think that at least things couldn't get worse -- but then they did. After reporting the poor results for Q3, AK proceeded to lower its guidance for the rest of this year.

It noted that instead of rising to $555 a ton, as it had hoped, the price of hot rolled coil steel is now looking more like $510 in October. Management warned that it now expects adjusted net income for the year to be just $0.32 to $0.37 per share, versus the $0.42 that Wall Street will be looking for. That sounds like there will be another disappointment coming in Q4.