The idea of investing in and improving America's aging infrastructure is all the rage these days. This will, naturally benefit a variety of companies, including Aqua America (WTR 1.24%). With increased infrastructure investment a very strong possibility, let's look at some things that help to provide a more complete view of the company.

Image source: Getty Images.

1. Getting water from the Keystone State

Aqua America's roots in Pennsylvania can be traced back to 1886, when a group of professors from Swathmore College were granted a charter to supply water to the residents of Springfield Township in Delaware County. Shortly, thereafter, they decided to incorporate the Springfield Water Company, which would eventually become Aqua America.

To this day, Pennsylvania remains a vital part of the company's operation. In fiscal 2016, the company's largest subsidiary, Aqua Pennsylvania, accounted for approximately 52% of Aqua America's operating revenue and 74% of its net income.

2. A rising tide

Since the company primarily operates in regulated markets -- the regulated segment accounted for 97.6% of revenue in fiscal 2016 -- it can't arbitrarily raise rates whenever it likes. As a result, the company relies heavily on growth through acquisition. For example, during the five-year period ended Dec. 31, 2016, Aqua America completed 84 acquisitions to expand its utility operations. For fiscal 2017, Aqua America has four pending acquisitions, which will add almost 9,000 customers.

3. Keeping it clean

In addition to providing clean water to approximately 3 million customers, the company provides wastewater services. According to Aqua America, every day its 175 wastewater plants return more than 26 million gallons of wastewater to streams and river "cleaner than it came out."

Moreover, the company powers several facilities in various states with clean energy, including solar power. For example, at its Pickering Water Treatment Plant in Pennsylvania, Aqua America installed a 6.5-acre solar field, which will effect an annual reduction of about 2.3 million kilowatt-hours and energy savings of $207,000 per year.

4. Diving in to the dividend

One of the things that most attracts investors to water utility stocks is the dividend. Paying a consecutive quarterly dividend for more than 70 years, Aqua America has shown a strong commitment to returning cash to shareholders.

Image source: Aqua America corporate presentation.

Raising its dividend at a compound annual growth rate of 7.6% from 2006 through 2016, Aqua America has not jeopardized the company's financial health. From fiscal 2012 through fiscal 2016, the company has averaged an annual payout ratio of 52.4%, according to Morningstar.

The stock's yield further illustrates the attractiveness of its dividend; currently, it has a dividend yield of 2.25% -- among the highest of its peers. By comparison, American Water Works (AWK 1.26%), the largest water utility by market cap, offers investors a yield of 1.87%.

5. Gas up

Looking to spread its water wings, Aqua America formed a joint venture in 2012 with Penn Virginia Resource Partners, L.P. to provide fresh water to natural gas producers drilling in the Marcellus Shale in north-central Pennsylvania. In fiscal 2016, the joint venture accounted for $976,000 in earnings.

In addition, Aqua Resources, a non-regulated subsidiary of Aqua America, operates five bulk water filling stations in northeastern and western Pennsylvania and one in Struthers, Ohio. From these stations, bulk water haulers fill up and transport the water to Marcellus Shale well drilling sites.

6. Riding a strong current

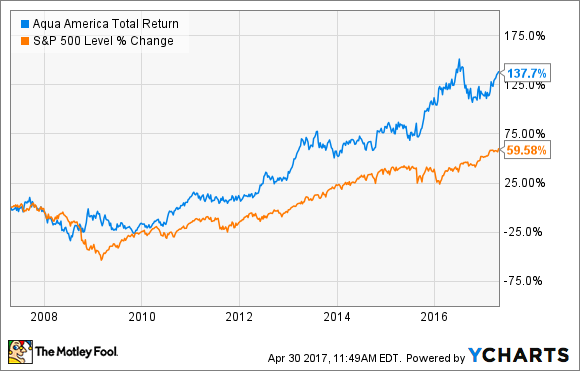

Aqua America's long-term investors have been rewarded handsomely. Over the past 10 years, the stock has generated a total return of approximately 138% -- handily beating the S&P 500, which has risen only about 60% during the same period.

WTR Total Return Price data by YCharts

7. More than just water

Aqua America's commitment to the environment transcends the return of treated wastewater to streams and rivers. Since 2005, the company has participated in TreeVitalize, a project that aims to restore tree cover to communities across Pennsylvania. According to the company, it has planted "more than 43,658 trees for 277 projects, equal to 302 acres of trees."