For an investor, it's anything but easy to single out one best stock among the thousands of stocks out there. But then, who wouldn't want to know about stocks that have the potential to stand the test of time and fetch you hefty returns in the long run? So we threw the challenge at three of our contributors, asking them which stock would make the cut if they had to pick only one to invest in today. Read along to know why they believe Markel Corporation (MKL 0.76%), Moody's Corporation (MCO -2.14%), and MasterCard Inc. (MA 0.26%) are among the best stocks to own today.

This mini-Berkshire is still my favorite stock

Steve Symington (Markel): As a longtime shareholder myself, I've argued that Markel is the best stock to own more than once -- most recently in a similar roundtable last December. With shares of the so-called "mini-Berkshire Hathaway" up a modest 5% since then, but still trading at a reasonable 1.54 times its book value, I think Markel is still a compelling buy for long-term investors looking to put their money to work today.

As a reminder, like Berkshire, Markel generates shareholder value through a combination of its high-quality insurance operations, investment portfolio, and its non-insurance, non-investing businesses acquired and managed under the Markel Ventures moniker.

Own winning stocks to take your portfolio to the next level. Image source: Getty Images

To be fair, Markel's results last quarter didn't look all that great on the surface. But in reality they were deceptively strong. Revenue increased just 2.6% year over year to $1.412 billion, book value per share increased 5.2% to $620.30, and Markel's net income per share declined 65% from the same year-ago period to $3.90. However, Markel's results were held back by a surprising reduction in the Ogden rate -- which is used to calculate lump sum awards in U.K. bodily injury cases -- from 2.5% to negative 0.75%, which increased Markel's expected claims payments and required the company increase its loss reserves. That meant an unusually high combined ratio last quarter in reinsurance operations (132%, which meant it "lost" $32 for every $100 in premiums it wrote), while U.S. and international insurance operations performed as expected with healthy combined ratios of 93% and 88%, respectively.

Meanwhile, Markel's investments delivered admirable results, with net investment income climbing 9.9% and net unrealized gains increasing to $1.9 billion (from $1.7 billion). And its Markel Ventures businesses saw revenue and EBITDA remain roughly flat as declines in cyclical businesses were propped up by steady progress and in-line performance from other diversified Markel Ventures companies.

In short, apart from the effects of the decrease in the Ogden rate, it was business as usual at Markel. As a patient shareholder who has benefited handsomely from Markel's market-beating ways over the years, that's just fine by me.

Owning a duopoly business

Jordan Wathen (Moody's): This may very well be a very consensus pick, as Moody's currently trades at about 22 times its 2017 guidance.

One could make the case that we're at the top of a cycle in credit expansion. Rising rates or the elimination of the tax deductibility of interest could certainly make issuing debt less attractive, but the market has mostly shaken off these concerns. I have, too. Eliminating the tax deductibility of interest seems unlikely, and rising rates could simply push companies to borrow money on shorter terms rather than avoid debt altogether.

As bond index funds grow, it will become more important for issuers to receive a rating so that their bonds can be readily purchased by index funds. Getting a rating is a little like buying a place in the Dow Jones Industrial Average -- if those spots were for sale, just imagine how much they might sell for.

In an illustrative example in a recent presentation, the company explains that its product essentially pays for itself. Corporate borrowers who issue rated debt pay lower effective interest rates than those who issue unrated bonds; thus, Moody's and S&P Global Inc. earn their fee, and then some. Issuers can pay a little to the ratings agencies in the form of fees or pay a lot in the form of interest when they go to borrow. The choice is obvious.

Moody's is far from a bargain, but I think it has room to grow earnings at a high-single-digit clip for many more years to come. It won't be a straight line up, but long-term shareholders should be rewarded handsomely.

Massive opportunities ahead for this stock

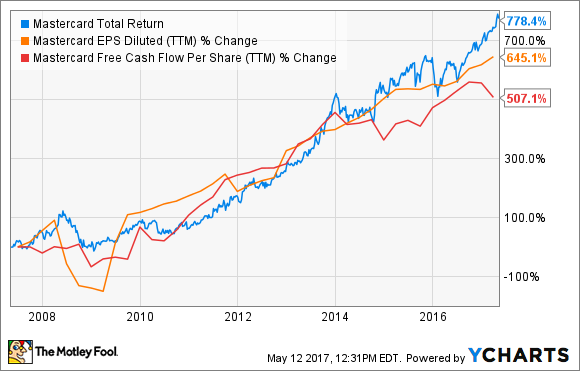

Neha Chamaria (MasterCard): Much like Moody's, MasterCard also operates in a duopoly. But before I tell you why MasterCard excites me, check out this chart to see how far the payments-processing behemoth has come.

MA Total Return Price data by YCharts

These numbers speak for themselves, as it isn't every day you see a company deliver triple-digit growth in its earnings as well as free cash flow. The credit for MasterCard's torrid growth goes largely to the network effects that its business enjoys -- the millions of connected merchants, banks, and financial institutions that facilitate customers to use their debit and credit cards each add some value to MasterCard every time its card is swiped. MasterCard earns a small fee on each transaction.

Mind you, the fees might be small in terms of a percentage of the transaction value, but overall, they brought in revenue worth $2.7 billion in MasterCard's first quarter alone. As of March 31, MasterCard had 2.4 billion cards in circulation worldwide. Setting up a business of this scale and reach isn't a cakewalk, which safeguards MasterCard from competition threats. Visa is the only other company MasterCard directly competes with.

MasterCard has a strong edge in high-potential markets like India. Image source: Getty Images

The biggest growth catalyst for MasterCard is the ongoing global push for digital payments and plastic money, further emboldened by the e-commerce boom. While Visa stands to benefit just as much, I believe MasterCard's hold in high-potential markets like India gives it an edge. Also, as fellow Fool Matthew Cochrane recently explained, MasterCard's recent acquisitions of NuData Security and VocaLink reflect management's vision of evolving into a full-service payments network – a move that should push MasterCard's revenue even higher in the coming years.

With MasterCard also boosting its dividend in recent years and management aiming to grow earnings per share by double digits through 2018, investors simply can't go wrong with this stock.