A bond's rating can tell you a lot using only a few letters or symbols. Let's explore what bond ratings are, the three chief agencies responsible for coming up with bond ratings, and how a bond's rating is determined. We will also answer what the difference is between investment-grade and junk bond securities.

What is a bond rating?

A bond rating is a grade assigned to a bond issuer or an individual security that indicates creditworthiness. There are three major bond rating agencies:

- Standard & Poor's

- Moody's (MCO -0.45%)

- Fitch Ratings

Although their rating systems differ slightly in terms of the numbers and symbols used, a triple-A rating is widely considered the gold standard when it comes to bond quality. All three agencies strive to deliver independent, unbiased reviews of a company's health and solvency.

The major rating agencies are responsible for evaluating a bond issuer's credit quality. In other words, the agencies provide ratings to assure investors that money invested in a particular security will be repaid. Investors can then use the information to decide whether to invest in bonds.

What does a bond's rating show?

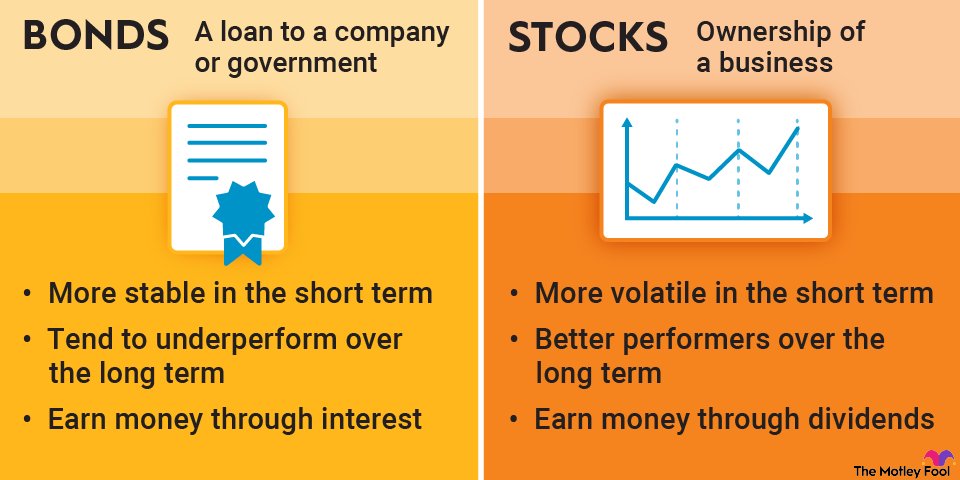

In the simplest terms, a bond's rating reflects the likelihood that an issuing company will be able to repay its debt. When you invest in a company's bonds, you want to be confident that the company can actually pay you back when the bond matures. If a particular bond receives a low rating, you might think twice before investing.

All three ratings agencies use letters to provide insight into bond quality, but the way they are used is slightly different. Bond ratings earlier in the alphabet are considered better than those later, and having more letters is generally better than having fewer.

Bond ratings chart

Review and compare ratings across the three agencies.

Moody's | Standard & Poor's | Fitch Ratings | |

|---|---|---|---|

Investment Grade (Lowest Risk) | Aaa | AAA | AAA |

Investment Grade | Aa1 | AA+ | AA+ |

Investment Grade | Aa2 | AA | AA |

Investment Grade | Aa3 | AA- | AA- |

Investment Grade | A1 | A+ | A+ |

Investment Grade | A2 | A | A |

Investment Grade | A3 | A- | A- |

Investment Grade | Baa1 | BBB+ | BBB+ |

Investment Grade | Baa2 | BBB | BBB |

Investment Grade | Baa3 | BBB- | BBB- |

Speculative Grade | Ba1 | BB+ | BB+ |

Speculative Grade | Ba2 | BB | BB |

Speculative Grade | Ba3 | BB- | BB- |

Speculative Grade | B1 | B+ | B+ |

Speculative Grade | B2 | B | B |

Speculative Grade | B3 | B- | B- |

Speculative Grade | Caa1 | CCC+ | CCC+ |

Speculative Grade | Caa2 | CCC | CCC |

Speculative Grade | Caa3 | CCC- | CCC- |

Speculative Grade | Ca | CC | CC |

Speculative Grade | Ca | C | C |

Speculative Grade (Highest Risk) | C | D | D |

Bonds with triple-A ratings are considered the safest investments available, and C and D ratings are considered the worst and are generally in default. As you scan down the chart, credit quality decreases and risk increases. Debt rated below BBB- will pay a higher rate of interest to the bondholder, but will also come with a much greater risk of default.

How are bond ratings determined?

Rating agencies undertake extensive due diligence on an issuer (a company issuing bonds) before determining a rating. They review, analyze, and compile data from the issuer's financial statements and then issue a rating based on financial ratios and other nonfinancial information.

When calculating a score, rating agencies might also consider relationships with local government agencies or a parent corporation, as well as broader economic conditions at the time of bond issuance. A bond's rating can be a quick and useful way to gauge a company's general ability to repay its bondholders.

Changes to a company's underlying fundamentals -- or a swift change in macroeconomic conditions -- can cause unusual financial outcomes. Still, overall, rating agencies try to keep the investing public informed about the financial health of any issuing company.

Investment-grade versus speculative-grade bonds

Bonds rated above BBB- (or Baa3 in the Moody's rating scale) are considered investment grade. This means that most institutional investors are permitted to own them. Bonds rated lower than BBB- are considered speculative, which is another way of saying, "Invest at your own risk."

Bonds with speculative ratings typically have issuers with questionable liquidity and solvency measures. Investment-grade bonds typically pay a lower interest rate due to their higher credit quality. In other words, the probability of receiving your principal back is considered high with these securities, so issuers can pay lower interest rates because the risk is low for investors.

Speculative-grade bonds, on the other hand, pay a higher interest rate to compensate the investor for the higher probability of issuer default. Speculative bonds are also sometimes referred to as junk bonds.

Related investing topics

The bottom line on bond ratings

Rating agencies attempt to consolidate a company's financial health into a letter rating, which is quite useful for investors. The investing public is unquestionably better off having independent organizations perform deep analyses for potential bond buyers.

To some investors, bond ratings may feel oversimplified. However, even though bond ratings aren't ironclad guarantees of investment success, they're a great place to start when researching a company's debt. Before purchasing bonds of any quality, be sure that you understand what you're buying and how they fit into your overall financial picture.