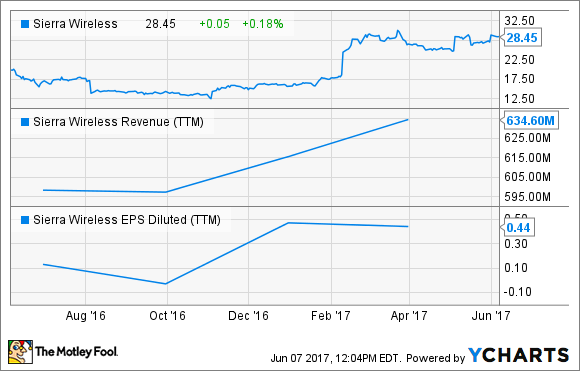

Investors in Sierra Wireless (SWIR +0.00%) have enjoyed a 90% gain so far this year. The semiconductor specialist seems to be on track to take advantage of a booming Internet of Things (IoT) market, as its latest quarterly report and accompanying guidance beat expectations, substantially boosting investor sentiment as the stock climbed 15% in one day.

The company is hoping to take advantage of a multitrillion-dollar opportunity in machine-to-machine communication, but investors looking to tap the IoT opportunity shouldn't overlook Micron Technology (MU +7.68%), either. The memory specialist has made a big splash in this space and has a number of other catalysts to boot and its stock is up 40% so far this year.

Let's look at how these two companies are approaching the IoT market to help investors determine which might be the better buy for them.

Image source: Getty Images.

The case for Sierra Wireless

Sierra Wireless is a pure-play IoT company that has enjoyed strong financial gains by betting big on this space.

More importantly, Sierra's momentum isn't going to stop anytime soon, if its latest guidance is any indication. The company's adjusted earnings-per-share guidance of $0.24 to $0.32 for the current quarter sits significantly above the $0.16 Wall Street estimate, thanks mainly to an improving product mix in the original equipment manufacturer (OEM) solutions business that accounts for 82% of overall revenue.

The company saw stronger customer activity in OEM solutions last quarter, scoring a higher number of design wins than usual. What's more, its low-power, wide-area (LPWA) solutions are gaining traction at international telecom companies, which could be a big deal in the long run, since some estimates put the LPWA technology market at $7.5 billion in 2022.

But this isn't the only multibillion-dollar opportunity Sierra is pursuing in the IoT space. Its recent acquisition of the global navigation satellite systems business of GlobalTop Technology has opened access to a market that Research and Markets says could hit $5 billion in 2022.

More specifically, GlobalTop's products should play nicely with Sierra's embedded chips aimed at the telematics market. So the company can provide location-based services to big automakers such as Volkswagen, which will soon start using Sierra's high-speed AR series cellular modems in its cars. Sierra's pursuit of big opportunities in the IoT space and its good track record so far make it a good pure-play bet for investors.

The case for Micron Technology

Micron Technology is not a pure-play IoT company like Sierra Wireless. It manufactures primarily DRAM and NAND memory. But Micron has started making moves in this area, not wanting to miss out on the IoT trend. To that end, back in April, Micron announced that it's partnering with Microsoft to launch a product aimed at improving the security of IoT devices.

The security technology integrates Micron's flash memory into IoT devices at the hardware stage, enabling system developers to improve security features by using just the existing flash memory sockets, thus reducing additional costs. The chipmaker believes that integrating security measures into the devices at the hardware level will help end users save costs when they scale up their IoT deployment, setting Micron on the way toward tapping into a market that could hit $17 billion in 2020.

So Micron is approaching the IoT opportunity by focusing on the security aspect, while Sierra focuses primarily on chips that enable connectivity between devices. This approach narrows Micron's potential end-market opportunity, but investors shouldn't forget that the company also has massive catalysts in the form of favorable DRAM and NAND markets.

DRAM demand, for instance, is expected to accelerate thanks to a jump in smartphone memory content, along with an increase in demand for server DRAM chips that are used in data centers. Micron, for its part, is fast transitioning to an advanced manufacturing node ahead of its rivals to make the most of the growing end-market opportunity that could be worth as much as $110 billion in 2021.

The verdict

Both companies are taking their own paths to attack the Internet of Things opportunity. Sierra is focusing on the entire spectrum to make the most of this market, while Micron has decided to focus on a particular area to make a dent in the space. Micron's advantage is that it has other areas to fall back on, providing investors a cushion in case things go south.

Sierra Wireless, on the other hand, could be a more volatile play but has the potential to deliver stronger gains, given the estimated size of the end market. Not surprisingly, Sierra stock is expensively valued, at almost 60 times last year's earnings, while Micron sports a cheaper price-to-earnings ratio of 46. Investors need to assess their risk profile before deciding which one suits their portfolio better.