Pan American Silver (PAAS 0.05%) is one of the world's largest primary silver producers, and if you are looking for exposure to that precious metal it's worth a deep dive. But don't stop there, because you can invest in the production of silver and gold without owning a miner. And one of the best ways to do that is with Wheaton Precious Metals (NYSE: WPM), which doesn't operate a single silver or gold mine.

Here's why I think Wheaton is a better choice than Pan American Silver.

A perfectly fine miner

There's nothing inherently wrong with Pan American Silver. It has gold and silver mines located throughout the Americas, its production is diversified, with silver accounting for around 50% of revenues, gold 25%, and other metals the rest (including copper, lead, and zinc), it's expecting production to increase over the next few years, and it's been able to cut its costs in half over the last five years, taking all in sustaining costs from $22 an ounce in 2012 to a projected $11 an ounce this year.

Image source: Getty Images

On a fundamental basis, Pan American Silver sounds like it's doing pretty well. If what you are looking to own is a silver-focused miner, then, by all means, you should be looking at this company. But as a miner, Pan American has to deal with all of the inherent risks of mining.

For example, the ore at existing mines depletes over time. As a mine ages costs tend to go up because the ore usually gets harder and harder to dig up. Meanwhile, when commodity prices are high employees often seek higher wages, pushing costs up. And to keep growing, miners need to find new places to build mines or buy competitors with desirable assets. Both can be expensive and fraught with risk. To be fair, these are issues you'd face with any miner... but not with a streaming company like Wheaton Precious Metals.

A different breed

Wheaton's business is more financial. It provides miners cash up front for the right to buy silver and gold at reduced rates in the future, which is called streaming. Miners use the money for things like paying down debt, building new mines, and expanding existing assets. They often come to Wheaton because of other financing options, like banks, bonds, and stock sales, aren't financially desirable.

Wheaton, meanwhile, locks in low costs for the precious metals it buys (and then sells at market rates). To put a number on that, Wheaton pays around $4 an ounce for silver (about 55% of revenues) and $400 an ounce for gold (45%). That's well below the current spot price of each metal and leads to very wide margins. But because it doesn't have to deal with any of the troubles of running a mine, Wheaton's margins tend to be robust all of the time.

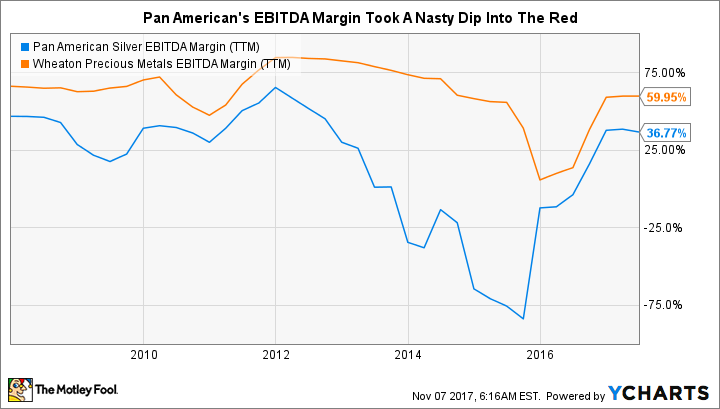

PAAS EBITDA Margin (TTM) data by YCharts

Take a look at the graph above for proof. Between 2012 and 2016 Pan American's EBITDA margin was falling steadily before hitting bottom deep in negative territory. Wheaton's margins sank some but remained solidly in the black throughout the span. That ugly spell for margins, for reference, was a commodity downturn.

But unlike miners, which were retrenching during that span (note that this is the period over which Pan American was working hard to trim its costs), Wheaton was actually expanding its business. That's because miners were desperate for cash in the downturn and Wheaton was more than happy to oblige by inking streaming deals with industry giants like Glencore and Vale.

A quick overview of the streaming model. Image source: Wheaton Precious Metals

Wheaton believes it could increase production by as much as 45% over the next few years if all of the projects its partners are working on pan out as hoped. And it won't have to lift a finger to get there because its streaming partners will do all of the work. Wheaton doesn't even care if mine costs start to rise because its costs are contractually locked in.

Erring on the side of wide margins

I don't want to give the impression that Pan American Silver is a bad company. It isn't. In fact, there are good things going on at this miner today. But if you are looking for precious metals exposure you might want to consider going about things a different way, like buying a streaming company. Wheaton Precious Metals, one of the premier names in the space, is a solid choice. In my opinion, Wheaton's low-cost structure, strong margins in good years and bad, and ability to expand in commodity downturns make it a better long-term choice than most miners, including Pan American Silver.