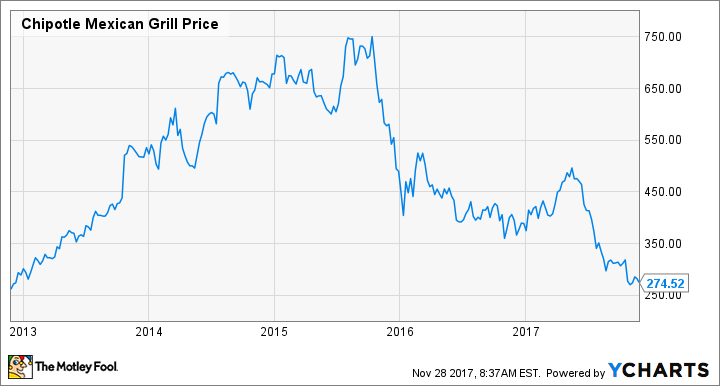

Chipotle (CMG 2.05%) continues to suffer from fallout from its 2015 E. coli scandal. While sales have somewhat rebounded -- or at least have been moving in the right direction -- the chain's stock price remains well below its pre-scandal heights.

Shares in the Mexican eatery closed at $274.52 on November 27, down from $754.03 on August 17, 2015, in the period where the first reports of E. coli had come out, but the impact had not yet been felt by the company. That's a stunning drop -- and the chain's share price continues to move in the wrong direction despite the company reversing its sales declines.

In the most recent quarter, for example, revenue increased 8.8% to $1.13 billion, and comparable restaurant sales increased by 1%. Chipotle also saw its earnings per share increase to $0.69, up from $0.27 in the same period a year ago. Despite that, investors remain unconvinced, and the chain's share price has continued to decline.

Data source: YCharts

What did management do?

In the days after the scandal, it's fair to say management took strong steps to address the problem. The company closed all of its stores for an afternoon to go over its new policies with employees. These included:

- High-resolution DNA-based testing of many ingredients to ensure the quality and safety of ingredients before they are shipped to restaurants

- Changes to food prep and food handling practices, including washing and cutting of some produce items and blanching of some produce items in its restaurants, as well as new protocols for marinating chicken and steak

- Enhanced internal training

- Paid sick leave to ensure that ill employees have no incentive to come to work sick

"Over the last few months, we have been implementing an enhanced food safety plan that will establish Chipotle as an industry leader in food safety," said CEO Steve Ells in January 2016, about a month after the last food-safety incident in the initial batch of outbreaks at the chain. "...Additionally, we have implemented unprecedented food safety standards with our suppliers, which make the food coming into our restaurants safer than ever before."

Chipotle has been suffering since its E. coli scandal. Image source: Getty Images.

What went wrong?

Chipotle is not the first chain to suffer from a food safety issue or to have people get sick eating its food. The company has suffered more than others in similar situations in part because of its arrogance. The chain has made offering what it calls "food with integrity" a core part of its marketing.

Essentially, Chipotle said its food was better, healthier, and more natural than its rivals. That's true in many cases, but it was a marketing tactic that led to consumer backlash after the outbreaks.

Is management to blame?

Management deserves credit for how it handled the scandal. The company moved fast, made real changes, and did everything that could be reasonably expected to ensure the safety of its customers.

Where management failed was before the E. coli outbreaks. That failure was not in safety procedures; it was in resting on its laurels and not advancing its business.

Pre-scandal Chipotle had not embraced digital technology. Its stores often had long lines, and what customers wanted did not seem to be factored into the company's thinking. It was an approach created by continued success that was only sustainable if the needle kept moving upward.

Where does Chipotle stand now?

Management has reversed its mistakes and changed its approach. The company now offers digital ordering and payment via its app. It has also added a second, behind-the-scenes production line to service those orders.

The company has also advertised, offered a short-term loyalty program, and finally added queso to its menu, something consumers had been asking for. These steps are late, but they will eventually pay off.

Chipotle may not be the unquestioned winner it once was, but it has learned its lesson. Management made mistakes, but it has largely corrected them, and eventually that should result in customers coming back in bigger numbers and the chain's stock price recovering.