The Dow Jones Industrial Average closed above 24,000 for the first time Thursday, and the index has performed exceptionally well in 2017. It was up by about 23% at the end of November. However, it's important for investors to recognize what this means and what it doesn't, as well as why the Dow's performance this year could be particularly misleading as a gauge of the market more broadly.

The Dow is up by 23% in 2017

The Dow Jones Industrial Average, which is the most well-known measurement of stock market performance, is having it's best year since 2013, when the index rose by 26.5%.

Image Source: Getty Images.

In addition, when a big index smashes through a psychological numerical barrier, it always generates headlines. In 2017, the Dow hit five of those even-thousand barriers, from 20,000 to 24,000. That's never happened before in a single year.

However, it's important to keep a couple of things in mind. First, these "barriers" are just arbitrary numbers. The Dow reaching 24,000 for the first time is no more significant than the first time it passed through 23,500, 23,700, or any other number. And as the index rises, each thousand added become less significant in terms of performance. For example, a move from 24,000 to 25,000 would represent just a 4.2% gain, while the index's move from 19,000 to 20,000 was a larger percentage increase of 5.3%.

Second, and more significant to investors, is that the Dow represents a small collection of the largest stocks in the market, and for several reasons may overstating just how the market has performed.

The DJIA's distorted picture

The Dow Jones Industrial Average is not a perfect barometer of the market's performance. Far from it, actually.

First, the index is comprised of only 30 extremely large stocks, out of the thousands of publicly traded companies listed on the NASDAQ and NYSE. How those giants are faring can diverge markedly from how the average business is doing. Second, it is a price-weighted index: Components with higher share prices have more impact over the index's movements than those with lower price tags. For example, Dow component General Electric (NYSE: GE) is down by 43% year-to-date, and Apple (NASDAQ: AAPL) is up by 48%. You might expect that their performances would roughly cancel each other out. However, since Apple's share price is roughly 10 times that of GE's, its 2017 rise has had a disproportionately positive affect on the Dow.

Big growth stocks have fueled the market's performance

Not only is the Dow Jones Industrial Average a flawed measuring tool, but the bulk of the gains in the stock market's wider rally have come from large-cap stocks (like Apple), particularly those with growth components.

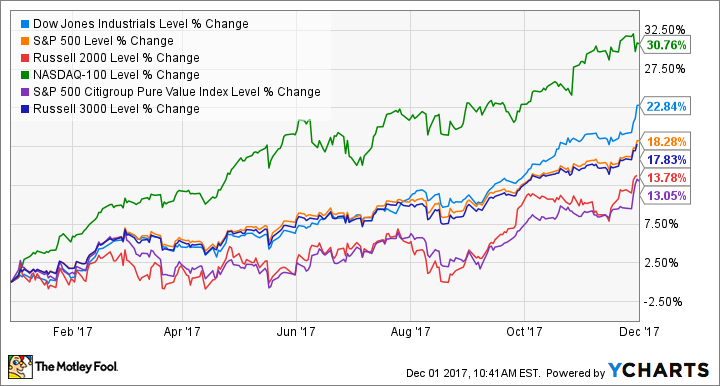

Looking at the performance the Dow in the context of a few other stock indices paints a much more useful picture about how the market is doing:

- The S&P 500, which also tracks large companies, is up a more modest 18%. But not only does this index track a broader basket of companies – 500 versus 30 – it's a market-cap weighted index: the larger the company, the more its price changes influence the result. That's a more useful way to measure than basing an index's weighting on share prices.

- The Russell 3000 index, which is perhaps the best indicator of the entire stock market, is also up about 18%. However, the Russell 2000, which is an index of small-cap stocks, is up by just 14%. This again reflects that Wall Street's high general performance is being fueled by larger companies, while smaller ones are lagging behind.

- Additionally, the growth- and large-cap-heavy NASDAQ 100 is up by a staggering 31% this year. On the other hand, the S&P 500 Citigroup Value Index is up by just 13%. That disparity shows that growth stocks have been fueling the market's performance, while value stocks haven't been doing quite as well.

Don't get me wrong. All of these indices are up by double-digit percentages, so it's been a solid year for stock investors. However, the point is that the performances of small-cap stocks and value stocks as a whole haven't been nearly as strong as the "headline" indices like the Dow Jones Industrial Average would lead one to believe.

Take the Dow with a grain of salt

The bottom line is that unless you're actually invested in a Dow Jones Industrial Average index fund (not common), you shouldn't pay too much heed to its behavior. Not only does the index only keep track of a small group of stocks, but a few large-cap growth stocks have been disproportionately boosting its performance this year.

Instead, keep your eyes on several broader indices, such as the S&P 500 and the Russell 2000. Those will give you a more accurate idea of how the stock market is really doing.