What happened

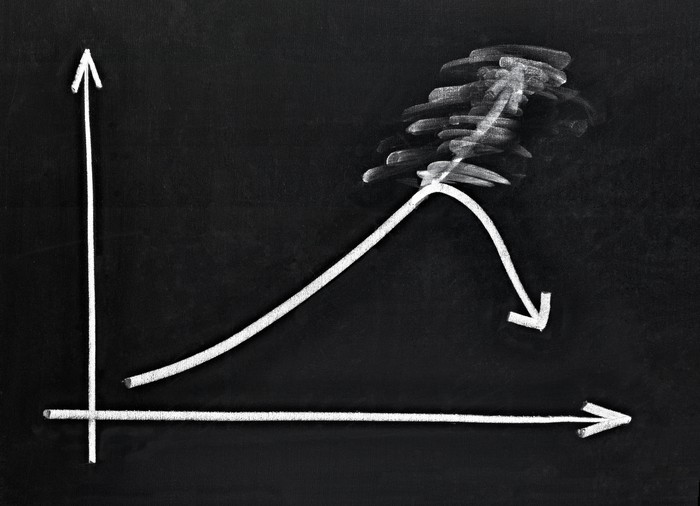

Shares of architectural glass specialist Apogee Enterprises (APOG +4.28%) are down 16.5% as of 12:15 p.m. EST Thursday after the company reported disappointing numbers for its fiscal third quarter 2018.

Analysts had predicted that Apogee would earn $0.92 per diluted share on sales of more than $373 million in Q3. Instead, Apogee reported only an $0.82-per-share profit on sales of $356.5 million -- thus missing on both profits and revenue alike.

Image source: Getty Images.

So what

Expectations aside, though, Apogee's third-quarter results really weren't all that bad. While revenue may have fallen short of expectations, Apogee nonetheless grew it 30% year over year. Net income as calculated according to GAAP grew 5%, and pro forma profits were up 15%.

As you can surmise from these numbers, though, profit margins took a big hit in the quarter. Apogee's operating profit margin was only 9.7% -- down 240 basis points over the past year.

Now what

With fiscal 2018 now mostly in the bag, Apogee updated investors on what to expect for the balance of the year. Unfortunately, this news was not all that great, either.

Apogee CEO Joseph Puishys warned investors that "lower than expected volume and pricing, primarily in architectural glass, and higher than expected healthcare costs" will cause full-year sales growth to slow to "approximately 20 percent" -- down from a previous expectation for 24% to 26% sales growth. Operating profit margin on that revenue will range between 8.6% and 8.9% -- down from a previous expectation of between 10% and 10.5%.

As a result, Apogee Enterprises is now expecting its full-year earnings to range between $2.58 and $2.68 per diluted share, a significant reduction from previous expectations of $3.05-$3.25 per share.

With analysts still predicting that Apogee will wrap up the year with a $3.07-per-share profit, Wall Street is bound to be disappointed when Q4 results come out in March. Investors unlucky enough to own Apogee shares today got their disappointment early.