Harley-Davidson (HOG -0.76%) is due to report fourth quarter and full-year earnings on Jan. 30 and investors would be smart to zero in on a few key numbers to get a sense of where the motorcycle manufacturer is headed.

Although several Wall Street analysts have upgraded Harley-Davidson's stock despite expecting some dour figures for the quarter, they say the outlook for the rest of the year is brighter. That seems to suggest they're wearing rose-colored glasses about the bike maker's prospects, so investors can make up their own mind if they focus on these four areas.

Data source: Harley-Davidson quarterly SEC filings. chart by author.

Shipments

Based on Harley's forecast for full-year bike shipments of between 241,000 to 246,000, that means it will be filling dealer lots with as many as 50,000 motorcycles in the fourth quarter. It hasn't shipped that many bikes in the fourth quarter since 2011 just as it was emerging from the crippling financial recession. Considering Harley-Davidson is still in a sales slide and the industry as a whole has weakened considerably since then, it seems a stretch to think it can duplicate that effort.

What it does have going for it is that it's allowed inventories to slide some 70% to 80% below where it typically is at this time of year, a maneuver that was meant to help dealers clean out all the old bikes that didn't sell. Whether that's helped remains to be seen, because buyers may still be waiting for the newest models to come in to make a purchase.

Data source: Harley-Davidson quarterly SEC filings. Chart by author.

Sales

Sales of all types of Harley bikes are down 6% this year, with U.S. sales off by 8% in the important U.S. market, which still accounts for 63% of the total. While international sales had been a bright spot for the bike maker before, they're down 3% year to date as well.

It will be important to see if Harley-Davidson can regain lost traction overseas at the same time halting the deceleration in U.S. sales. It is a struggle to do one or the other, let alone having to do both at the same time.

Harley-Davidson has begun introducing a string of new motorcycles under its 100 bikes in 10 year program, giving them new styling cues and outfitting them with its new Milwaukee Eight engine, but it also streamlined its platforms, killing off the Dyna line and incorporating it into the Softail. It also ended production of the V-Rod that never really fit in anywhere.

There were a lot of diehard Dyna fans upset by the move, and while the V-Rod was seemingly neither fish nor fowl here in the U.S., it did have something of a following overseas. It was a risky strategy that could pay off down the road, but it may cause problems near term.

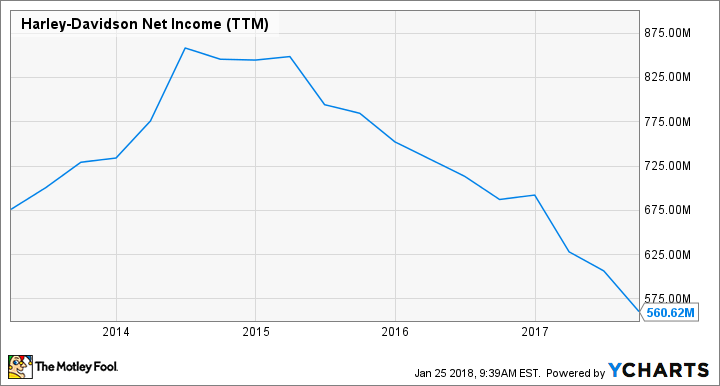

HOG Net Income (TTM) data by YCharts

Earnings

Analysts are forecasting a consensus of $0.46 per share, some 70% better than the $0.27 per share it earned a year ago. Harley-Davidson doesn't follow the crowd when it comes to discounting its motorcycles to move them, so it has done a good job of preserving both its profit margins and its premier branding.

Unfortunately, bike buyers really don't want to buy expensive motorcycles these days, which has been part of Harley's problem. It builds these big bikes that look pretty but cost a lot of money, and they've fallen out of favor with the new generation of riders. Although cruisers have been among its best sellers, the $15,000 to $20,000 bikes are not in line with the cheaper bikes riders are looking for these days.

Harley-Davidson may be preserving its prestige image, but hurting itself in the process.

Image source: Harley-Davidson.

Financing

Harley-Davidson Financial Services is essentially a one-stop shop for motorcycle buyers that finances not only the purchase of the bike, but any aftermarket parts, clothes, or accessories a buyer wants at the time of a bike purchase. It's a huge convenience that can work in Harley's favor when times are good, but can become a burden when things go sour.

Last year Harley was watching its loan portfolio deteriorate. It wasn't in the danger zone, but it wasn't moving in the right direction either. That hasn't changed for the better this year either, though the value of subprime loans in its portfolio has declined slightly. Still, they account for around one-fifth of total loans made and delinquencies have increased across the board. It's still not red flag material, but something to keep an eye on.

Not in hog heaven

Harley-Davidson remains a financially sound company and it's still selling a lot of motorcycles, albeit nowhere near the number it did at its peak. But that doesn't change the fact that its business is weak and getting weaker and there are few prospects for a u-turn on the horizon.

Its stock has bounced some 25% off the recent lows hit last November, and if next week's earnings report is worse than Wall Street anticipates, it could send it into a slide once again.