Oh, AMC Entertainment Holdings (AMC 2.69%), how unlikely am I to ever own your stock?

Let me count the ways.

Business trends

You may have heard that the movie industry as a whole is going through a shakeup these days. High-quality home theater systems plus the rise of ultra-convenient streaming video services such as Hulu and Netflix (NFLX 0.46%) are undermining the value of traditional movie theaters. That's exactly where AMC makes its living, so these macro trends are roughing the company up.

As the movie theater chain's revenue growth stalled a few years ago, AMC tried to work around that problem by picking up smaller rival Carmike Cinemas in a $1.1 billion buyout that closed at the very end of 2016.

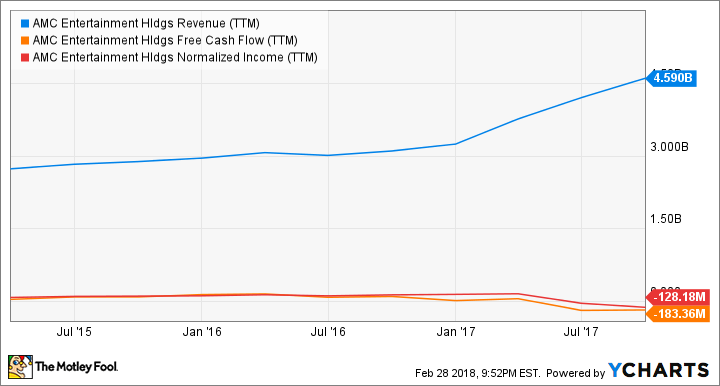

That deal immediately boosted AMC's top line, as expected. But the Carmike buyout has only weighed on AMC's already struggling bottom line, driving earnings and free cash flows into red-ink territory. It's not a pretty picture:

AMC Revenue (TTM) data by YCharts

Not the strongest competitor in a blighted sector

In fact, AMC is clearly the worst of the Big Three theater operators in many ways.

Both Regal Entertainment (NYSE: RGC) and Cinemark Holdings (CNK 1.94%) and churning out modest but significant profits even under today's difficult market conditions. AMC is losing money hand over fist.

The bears are stalking this company's campgrounds. Thirty-four percent of AMC's shares are currently sold short, compared to 14% for Regal and 11% of Cinemark's share count. To put these numbers into perspective, the high-flying and controversial Netflix stock has only attracted a 5.5% short-seller interest. In other words, negative market sentiment is gathering steam here.

If there's a right way of running a movie theater business in this market, AMC isn't doing it. At least Regal and Cinemark seem to have a clue.

Mind you, I'm unlikely to invest any of my money in the other two majors, either. But AMC is obviously the worst apple of a pretty bad bunch.

Bad ideas

Beyond the questionable attempt at growth by acquisition in the Carmike deal, AMC's solution for the problem of weak attendance figures is to raise ticket prices. This tactic is indeed raising AMC's total revenues but at the cost of keeping even more moviegoers seated in their own TV couches instead. Some of the price boosts are tied to higher-quality experiences such as large recliner seats, dine-in theaters, 3D viewings, and larger-than-life IMAX (IMAX 0.06%) screens, but prices are really rising across the board.

When Helios and Matheson (HMNY +0.00%) came along with the MoviePass subscription service as a way to usher more viewers back to the theater, AMC wasn't impressed. CEO Adam Aron has said that the MoviePass business model is unsustainable, and that his company has no intention to cut any sweetheart deals to share admission or concession sales with Helios and Matheson. In response, MoviePass currently doesn't work at all in a handful of hand-picked AMC locations around the country, presumably to show AMC what a difference MoviePass' involvement can make. Way to bite the hand that's trying to feed you, AMC.

Image source: Getty Images.

Flotsam and jetsam

We could do this all day, really. Let me just drop a few more nuggets of awfulness before we go home.

Credit ratings bureau Moody's downgraded AMC's corporate credit rating to a lower junk bond status in February, citing disappointing business results and a bumpy integration of Carmike's assets. Moody's is also uncomfortable with AMC's high debt leverage ratios. With $4.3 billion of long-term debt balanced against just $260 million in cash equivalents and negative cash flows, it's easy to see why Moody's is getting concerned about AMC's ability to keep the lights on.

Finally, AMC's shares are currently trading at 0.8 times the company's book value. In other words, AMC investors think they would be better off if the company just liquidated everything it owns and sent that cash back to shareholders rather than continuing to operate the business. That might not be entirely wrong.