After two years of trouble stemming from numerous recalls of its off-road vehicles, Polaris Industries Inc. (PII +2.66%) appears to have put the worst of its problems behind it. As fellow Fool Rich Duprey recently pointed out, fire risks for the company's off-road vehicles and ATVs haven't been completely put to rest, and it's possible there could be more recalls in the future. But a recent warning of "thermal hazards" didn't come with the don't ride/don't sell statements that had come with previous announcements. By the look of it, recall costs should be slowing down and consumers and dealers are apparently looking past any residual fire risk. Polaris was solidly profitable in 2017, and its 2018 is expected to be even better.

If you're considering investing in the motorsports industry, Polaris stock could be a good option. The company may be on a path to long-term growth, as long as recalls don't get in the way.

Image source: Getty Images.

Expectations are rising

The strength at Polaris is pretty widespread right now: Each of its business segments is expected to grow in 2018. Off-road vehicles and snowmobiles is by far its largest segment, and its sales are expected to grow in the low to mid-single digits percentages, continuing a recovery from recall-driven lows in 2016. Motorcycles and aftermarket products are expected to see stronger growth, in the high single-digit range.

Image source: Polaris.

Overall, revenue is expected to grow by 3% to 5% to between $5.6 billion and $5.7 billion. Earnings per share is expected to increase 24% to 28% to between $6.00 and $6.20.

Charting a new path in motorcycles

The biggest shift at Polaris is its new motorcycle strategy. In 2017, Polaris decided to shut down its Victory Motorcycle marque to focus instead on the Indian Motorcycle brand it bought in 2011. Indian Motorcycle has been taking market share from Harley Davidson and is expected to increase its revenue in the high single-digit percentages again this year.

Indian has managed to attract consumers in the cruiser market as well as those looking for raw, sportier bikes like the Scout and Scout Bobber. These models are geared toward a younger demographic that doesn't have the brand loyalty to Harley Davidson that many older riders do, and catering to them has been a successful strategy for Indian Motorcycle.

Polaris' newest businesses

The performance of the aftermarket parts segment may be the most impressive, given how new it is. Polaris' acquisition of Transamerican Auto Parts diversified the business, and gave it exposure to adjacent customers who might be looking for aftermarket parts for their trucks as well as their ATVs.

In 2017, the aftermarket segment generated $885 million in revenue and gross profit of $238 million. If Polaris can expand its margins even a little in 2018, it'll make this $665 million acquisition look like a steal, in the long term.

A balance sheet that's getting better

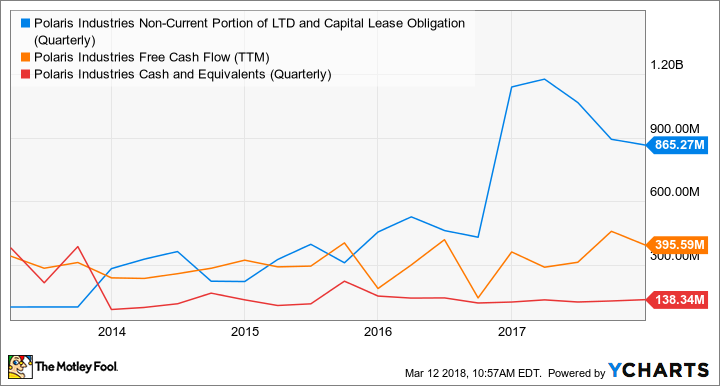

In late 2016, Polaris paid cash to acquire Transamerican Auto Parts, which pushed the leverage on the balance sheet up significantly. But the company has generated solid free cash flow and lowered its debt load in the year since.

PII Non-Current Portion of LTD and Capital Lease Obligation (Quarterly) data by YCharts.

If these trends continue in 2018, Polaris could keep slicing away at its debts and deleveraging itself. On the Q4 2017 conference call, CFO Mike Speetzen said, "We aggressively deleveraged in 2017 and anticipate continued progress in this area into 2018."

Is Polaris a buy?

I think Polaris' purchase of Transamerican Auto Parts and its shift in motorcycle strategy put the company in a good position. And with shares trading at 20 times the top end of 2018 earnings guidance, the stock isn't too expensive given the company's expected growth.

The one fear I have is that an economic downturn will squeeze discretionary purchases like ATVs and motorcycles, so that's what investors should keep an eye on. But if the economy keeps humming along, Polaris looks like a good buy for investors in 2018.