General Mills (GIS 0.99%) stock is down an unsightly 25% for the year. Much of the pessimism has come thanks to lackluster earnings reports from several branded food companies, as well as the February announcement that General Mills plans to acquire the Blue Buffalo (NASDAQ: BUFF) pet products company, which many thought was an expensive move to diversify the business.

The latest leg down, however, is due to a different problem, and one that can't be so easily fixed.

Inflation takes a toll

General Mills reported its fiscal third-quarter earnings on March 21. While the company beat analyst expectations on both the top and bottom lines, the bad news was in the guidance, specifically, the company's FY 2018 outlook for cost of goods sold. Management now expects these input costs to be up 4% for the fiscal year ending in May, one percentage point higher than it had previously guided, and will contribute to operating profit declines of 5%-6%.

Increasing costs for commodities such as grains, fruits, and nuts are having an impact, but the real hurt has been in skyrocketing freight costs -- the costs to ship products to retail outlets. Higher oil prices, surging demand, and a shortage of drivers have caused trucking costs to rapidly increase. "We're now having to go out to the spot market for close to 20% of our shipments versus the historic average of about 5%, and those spot market prices can be 30% to 60% higher than our contracted rates," said CEO Jeffrey Harmening during the conference call with analysts.

General Mills' margins are displeasing investors. Image source: Getty Images.

Can General Mills cope?

The problem of inflation is the reason Warren Buffett has long touted the merits of buying franchises with pricing power -- the ability to raise prices without sacrificing sales.

However, it looks increasingly unlikely that General Mills -- or any of the other consumer packaged-goods companies, for that matter -- will be able to meaningfully raise prices without sacrificing volume. That's because its core brands, which are mostly in the nonprotein processed food category, have much less clout than in the past. General Mills brands include Chex, Pillsbury, Wheaties, Green Giant, and many more.

Consumers have a much wider array of choices now, including healthier and organic offerings on the high end, and increasingly popular private-label brands from big retailers. Private-label brands typically don't have to recover advertising dollars, so they can provide high margins to retailers while being priced below branded goods.

In addition, the rise of technology and e-commerce has made price-comparing easier than before. Scott Galloway, founder of research firm L2 (a Gartner subsidiary), in a blog post called the rise of voice-enabled speakers another step in the "death of brands," with more and more consumers unable to pick out a single favorite brand across many retail categories. It may be an exaggeration that brands will be going extinct, but it's clear that consumer packaged-goods brands are challenged, especially those perceived as belonging to a prior era of more processed food.

Still, General Mills, along with its peers, has been trying to rapidly adapt to the changing times. It bought Annie's Natural Foods for $820 million in 2014; Epic Provisions, a maker of protein-based snack bars, in 2016 for an undisclosed sum (though acquisitions totaled $84 million that year); and announced the planned acquisition of Blue Buffalo, a maker of organic pet food, for a huge $8 billion enterprise value just in February.

While General Mills should be commended for adapting to the times, the growth from these smaller segments has, so far, only been successful in stopping the declines of the past few years. Check out this revenue chart.

GIS Revenue (TTM) data by YCharts.

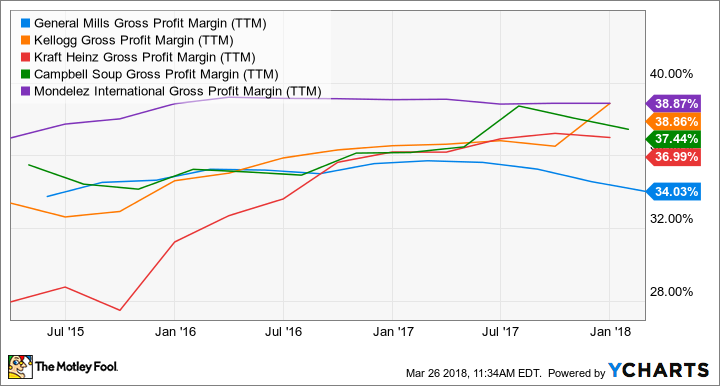

In addition, General Mills has among the lowest gross margins of its branded peers, which means it may be difficult to raise prices without losing ground to competitors.

GIS Gross Profit Margin (TTM) data by YCharts.

More challenges ahead

2018 will be a challenging year for General Mills. With inflation that will be difficult to pass on via higher prices, a nearly $14.5 billion debt load (4.2 times EBITDA, which is quite high) plumped up by the pending Blue Buffalo acquisition, and competition from big brands and retail private labels, I wouldn't expect a turnaround for General Mills in the near term.