Philip Morris International (PM 3.83%) just threw a massive bucket of cold water on the notion that the electronic cigarette (e-cig) market was the vehicle that tobacco companies could effortlessly ride into a smoke-free future. The global cigarette giant hit a wall in Japan when its heated tobacco iQOS suffered from an unexpected slowdown in growth. While cigarette alternatives still have a lot of promise, and Philip Morris isn't about to collapse, the once-rosy expectations of the industry for seemingly unlimited expansion have been met with a big dose of reality.

Image source: Philip Morris International.

Japan has been Philip Morris' most successful market since introducing the next-generation electronic cigarette in 2014, with shipments of the iQOS device, which is marketed under Altria's (MO 0.95%) Marlboro brand as Heat Sticks, surpassing those of traditional cigarettes last quarter. Although it still remains the dominant reduced-risk product on the market there with an approximate 80% share, the e-cig has burned through the so-called innovator and early adopter ranks of people willing to switch, and it's run full tilt into the older, more conservative smoker who takes substantially more convincing before switching to some newfangled technology.

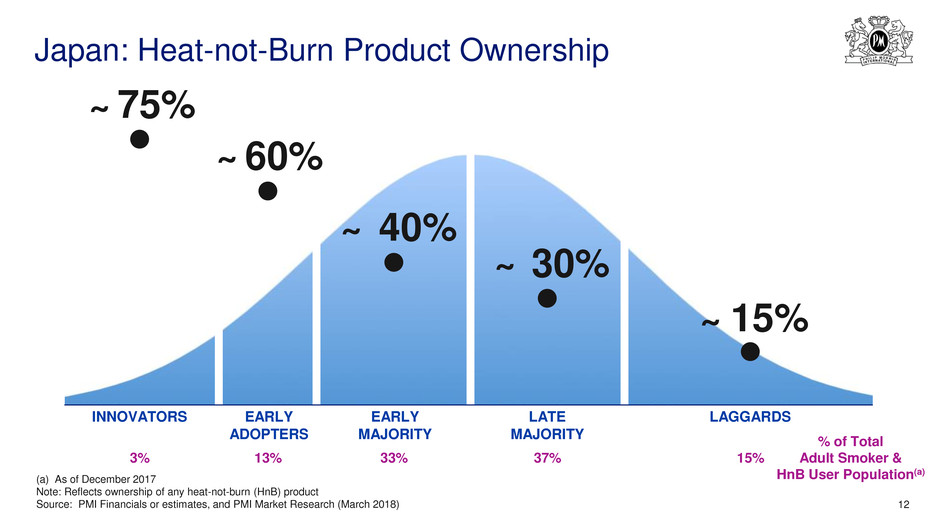

Chief Financial Officer Martin King said on the earnings conference call with analysts, "We're now reaching different socio-economic strata with more conservative adult smokers who may have slightly slower patterns of adoption." Philip Morris expected to eventually encounter them, but it apparently has met them sooner than originally forecast. As the graph below shows, while 60% to 75% of the roughly one-sixth of smokers in Japan whom Philip Morris characterizes as innovators and early adopters have already purchased heat-not-burn products, those rates fall to 40% for the one-third of smokers it calls "early majority" adopters, and just 15% to 30% for the remaining half of smokers who are late adopters.

The shrinking pie

This poses problems not only for Philip Morris, but also British American Tobacco, Japan Tobacco, and other tobacco companies pushing their own versions of traditional cigarette alternatives. It also calls into question the growth prospects of Altria, which has global marketing agreements with Philip Morris for the iQOS device.

First, it suggests that the overall pie has shrunk. While the universe includes hundreds of millions of cigarette smokers, there's only a certain subset of that group who will switch to electronic cigarettes. Philip Morris has already made its way through the easy-to-switch part of that cohort and is encountering the larger, more difficult-to-convert remainder -- which means there's going to be only a smaller number of people to win over in other markets.

Second, Japan has always been a best-case market because of social customs and norms that allow for broad adoption of cigarette alternatives, suggesting that other markets may not have nearly the uptake that Japan did. If it's hitting a wall already in Japan, it may reach that point much sooner elsewhere.

First-mover advantages

On the positive side, it also means that having first-mover advantage should give whichever tobacco company enters a market first a leg up on the competition as it will be able to capture most of those innovators and early adopters before anyone can respond. Philip Morris also noted it was "remarkable" that only 1% of iQOS users switched to a competing brand, considering the device was positioned as a premium product.

That bodes well for Philip Morris if it gains marketing approval for the iQOS in the U.S., with or without a reduced-risk label. While electronic cigarette use is far advanced here, the next-gen device could gain considerable share among users because of its many advantages over existing e-cigs. Since no competitor has applied to market their own heat-not-burn device yet, Philip Morris may have the field to itself for a significant amount of time.

Still, the industry now has had its wake-up call. Heated tobacco unit shipments hit 9.6 billion worldwide, more than double the 4.4 billion units shipped last year, but well below the 15.7 billion units shipped last quarter.

Philip Morris is picking up its efforts in Japan to communicate with these more stubborn smokers to convince them to make the switch, but now the process becomes a slog. With more companies introducing their own products, it may be an even more difficult one at that.

The future still could be smoke-free as Philip Morris International envisions it, but the path forward has suddenly become a lot more clouded.