What happened

Shares of precious metals miner Pan American Silver (PAAS +2.50%) are surging today, up 12% as of 10:30 a.m. EDT, after the company reported better-than-expected earnings results and announced that one of its mines is getting closer to restarting.

So what

Let's start with earnings. Net income adjusted for one-time gains came in at $0.20 per share, which beat Wall Street expectations of $0.18 per share for the quarter. Much of that performance is due to lower operating costs. According to management, Pan American's all-in sustaining costs were $6.98 per silver ounce sold. Similarly, its cash costs for the quarter were just $1.18 per silver ounce sold, which were the lowest operating costs in a decade.

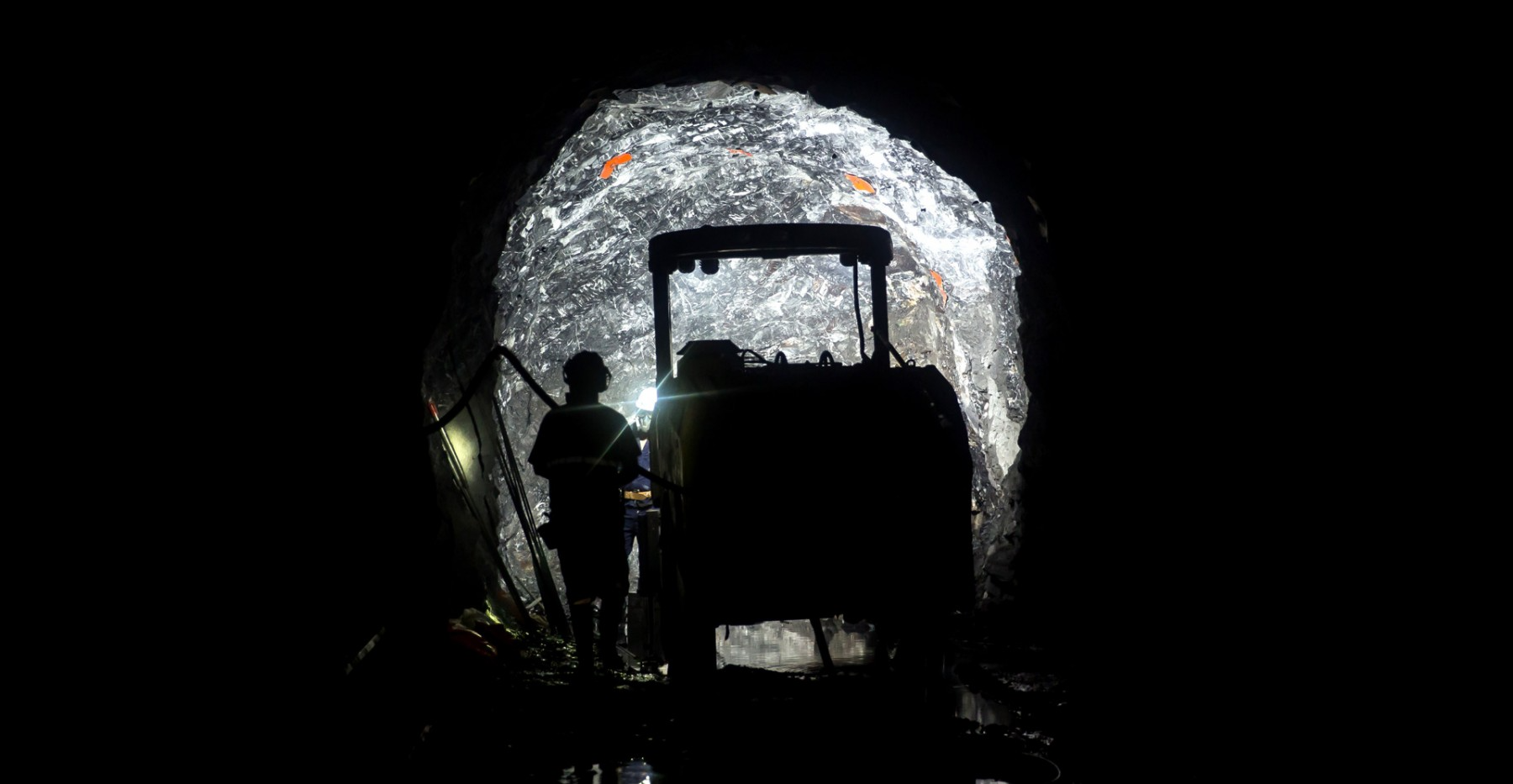

Image source: Getty Images.

The other news that has Pan American Silver's stock up today was the announcement that protests that involved roadblocks to its Huaron mine in Peru have ended. The local community had set them up on April 24, which forced Pan American to suspend operations. While investors can expect an impact on the company's income statement this coming quarter, it won't be as bad as it could have been.

Now what

It's encouraging to see Pan American lower its cash costs and resolve the issues with the local community to allow its Huaron mine to restart operations soon. With a balance sheet free of debt and a couple new mines on track, Pan American Silver looks like one of the more attractive precious metals miners out there. That said, it is still a precious metal miner, and any downturn in gold or silver prices could really take this stock down a notch.