Every day, Wall Street analysts upgrade some stocks, downgrade others, and "initiate coverage" on a few more. But do these analysts even know what they're talking about? Today, we're taking one high-profile Wall Street pick and putting it under the microscope...

Veon Ltd. (VEON 0.58%) has always been a strange kind of a stock.

Born as a holding company for the Russian mobile phone service Beeline, Veon was originally named VimpelCom -- presumably in order to make it sound more Western, and therefore more reliable, to Russian consumers enduring the hurly burly Yeltsin era of Russian business. Eventually, Veon moved its headquarters to Amsterdam and changed its name to one even less Russian. Still, the company retains its Russian roots -- and revenue stream. Nearly 50% of Veon's revenue still comes from Russia today, although that's much less than in years past.

At the same time, Veon now gets a bare majority of its revenue from outside of Russia, operating subsidiaries in locales as widely scattered as Ukraine, Uzbekistan, Algeria, Bangladesh, and Pakistan. It's trying hard to make its organization more streamlined and attractive to investors, however -- and it's succeeding.

Image source: Getty Images.

Upgrading Veon stock

Earlier this week, Veon announced plans to sell its stake in Italian mobile network Wind Tre for approximately $2.9 billion, then spend a fraction of that money to acquire the Pakistan and Bangladesh assets of international telecommunications company Global Telecom Holdings S.A.E (GTH). This news sent Veon stock up as much as 25% in a day. It also won the stock an upgrade from JPMorgan -- and today, a second upgrade from Goldman Sachs.

Both analysts like the company's decision to exit the Italian communications market. JPMorgan called the $2.9 billion that Veon got for its Wind Tre stake a "very attractive" price. Goldman Sachs said that in combination with Veon's doubling down on its investments in Pakistan and Bangladesh, the move "highlights management's willingness to create shareholder value through portfolio simplification," and predicted this simplification will "drive significant value creation."

In fact, even with Veon stock up 27% now from its pre-announcement price, Goldman Sachs thinks there are more gains in store for investors, as it explains in a note covered by StreetInsider.com (subscription required). Upgrading Veon stock to buy today, the analyst predicts Veon shares could rise by nearly one-third more, and hit $4 a share within a year. (JP's price target, too, is now $4 a share.)

Given the astounding gains Veon stock has enjoyed over the past few days, it appears many investors agree. But are they right?

Details, details

Let's look at the details of what Veon is up to and see if we can find out.

Announcing its Wind Tre sale on Tuesday, Veon noted that it intends to spend only $400 million of the money it makes from selling its Wind Tre stake to acquire its new GTH assets, leaving Veon perhaps as much as $2.5 billion with which to "reduce debt."

Reducing debt is certainly an admirable goal. Although Veon has a market capitalization of only $5.3 billion, the company carries $8.5 billion in net debt on its balance sheet (according to data from S&P Global Market Intelligence). Thus, its enterprise value is a whopping $13.8 billion -- 160% bigger than its market cap might lead an investor to expect. $2.5 billion in extra cash could make a sizable dent in that debt load, but here's the thing:

It won't.

Read even deeper into Veon's sale-and-purchase announcement, and what you'll find is that acquiring the GTH assets in question will actually cost Veon closer to $2.6 billion in total, because Veon will also be "discharging and taking on debt, including bonds, of the GTH group in an amount of approximately USD 1,600 million." It will also be obligated to pay "deferred consideration" in an amount that appears equal to approximately $550 million.

Sum it all up, and roughly 88% of the $2.9 billion that Veon expects to reap from selling its Wind Tre stake it will turn around and spend, in one form or another, on acquiring GTH assets. The debt-paydown aspects of this story, therefore, look to be minimal at best.

What it means for investors

So where does this leave Veon investors? Well, out of Italy and more deeply invested in Pakistan and Bangladesh to be sure. But when all's said and done, I honestly think it puts them pretty much right back where they started, valuation-wise.

After the sale and after the purchase, Veon should still end up with an enterprise value of $13.5 billion, give or take -- slightly less indebted than it is today, but not significantly so. It remains to be seen whether Veon will earn greater profits from a greater investment in the emerging markets of Pakistan and Bangladesh than it would have earned from its investments in the more developed Italian market.

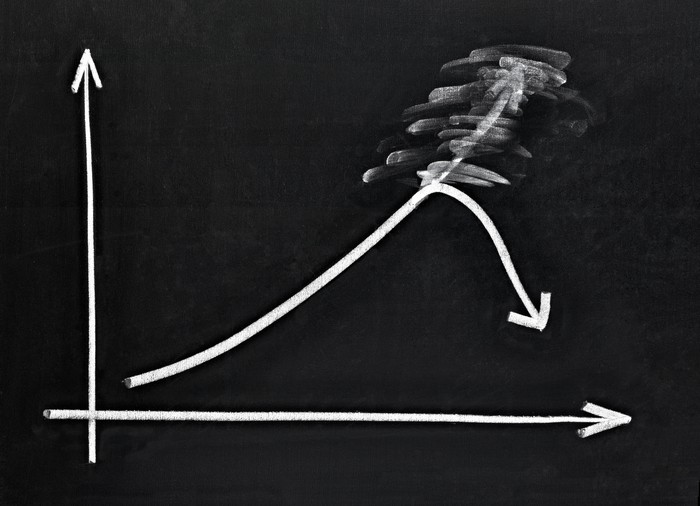

Hopefully, it at least won't do worse. Veon has lost money in four of the past five years. But still, unless and until we see Veon parlay its geographical repositioning into better profits on its income statement, I honestly don't see a whole lot to get excited about here.