Hasbro's (HAS 4.01%) last quarterly report was a memorable one for investors -- but not in a good way. Sales and profit both plummeted as the toy giant dealt with challenges brought on by the liquidation of one of its biggest retailing customers.

Those difficult trends aren't likely to improve much in Hasbro's second-quarter earnings report, which is set to be published before the market opens on Wednesday, July 25.

Let's take a closer look.

An unusually weak result

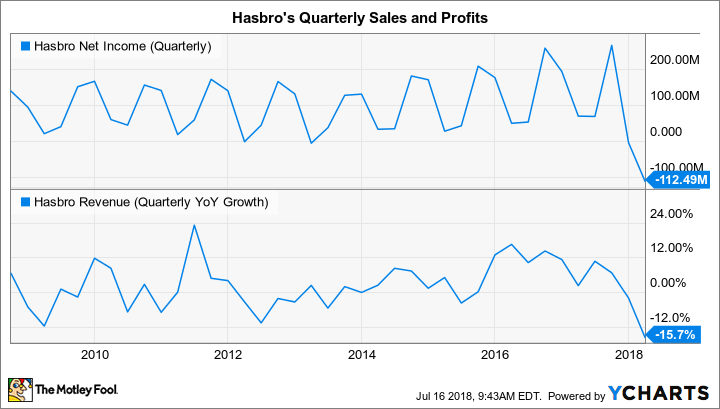

Hasbro's last quarterly report contained mostly bad news. Revenue plunged 16% and the company reported a net loss of $113 million, or $0.90 per share, compared to a net profit of $69 million, or $0.54 per share a year ago.

Hasbro Quarterly Net Income and Revenue Growth, data by YCharts.

As investors had feared, the liquidation of toy retailer Toys R Us, which accounted for 9% of Hasbro's sales last year, had a major impact on Hasbro's first-quarter results. Mainly, the bankruptcy lowered revenue and increased costs around debt write-offs, as management explained in late April.

The good news is that these issues shouldn't hurt the business beyond the current fiscal year. The "lower revenues and higher expenses associated with [the liquidation]," Chief Financial Officer Deborah Thomas told investors, "do not reflect the health of our underlying business."

Still, the top and bottom lines are likely to stay pressured by the Toys R Us liquidation for now. While investors shouldn't place much emphasis on Wall Street's short-term targets, consensus estimates predict a 14% sales drop to $840 million this quarter. Analysts expect earnings to fall to $0.31 per share from $0.53 per share in the prior-year period.

Bright spots

Hasbro notched a few operating and financial wins last quarter that point to strength in its core business. Gross margin improved, thanks to growth in the higher-margin entertainment and licensing divisions, for example.

Image source: Getty Images.

Owned brands like Monopoly and Magic: The Gathering, were lifted by innovative product launches. Standout licensed brands included growth in the Marvel and Beyblade franchises. "Our marketing efforts and product innovations are driving high demand across retailers," CEO Brian Goldner said in a conference call with investors. After removing the Toys R Us impact, "consumer takeaway is significantly up across our franchise, partner, and gaming categories," management noted.

A temporary blip?

Goldner and his team predict that the Toys R Us liquidation will hurt the second-quarter results, but at a reduced rate compared to the first quarter. From there, the impact should lessen again in the second half of the year, although Hasbro also has a challenging inventory overhang to work through in a few European markets.

Executives expressed confidence back in April that the painful sales and profit declines investors will see this year do not represent a long-term challenge. On the contrary, they affirmed an outlook that calls for revenue to grow at a robust pace in both developed and developing markets over the next few years as the company continues winning market share.

At the same time, innovative product launches and a growing entertainment division should make Hasbro more profitable. "We believe operating margins are not only sustainable," Goldner said, "but will improve over the next two to three years."

Those market share and profitability gains will be easily offset by the industry disruption caused by the Toys R Us bankruptcy this year. However, unless management changes its optimistic long-term outlook over the next few quarterly reports, investors can expect the bad news to stay confined to Hasbro's 2018 fiscal year.