What happened

Shares of semiconductor giant Intel (INTC 5.58%) are having a terrible market day this fine Friday. The stock trades 8.8% lower here at 3:10 p.m. EDT, following the release of solid second-quarter results and boosted full-year guidance -- accompanied, however, by subtle signs of potentially big manufacturing problems ahead.

So what

In the second quarter, Intel's revenue rose 15% year over year to land at an even $17 billion. Adjusted earnings jumped 44% to $1.04 per share. Your average analyst would have settled for earnings near $0.96 per share on sales somewhere near $16.8 billion.

Looking ahead, Intel raised its full-year revenue guidance 7% to approximately $69.5 billion. The full-year earnings target was moved 8% higher at roughly $4.15 per share. Both of these new guidance goals sit well above the current Wall Street views.

But the company also said that its move to the next-generation 10-nanometer manufacturing node will result in commercial production volumes no earlier than the second half of 2019. That's slower than expected, and it could give rival Advanced Micro Devices (AMD 2.67%) some space to make inroads into Intel's dominant share of the data center market over the next year.

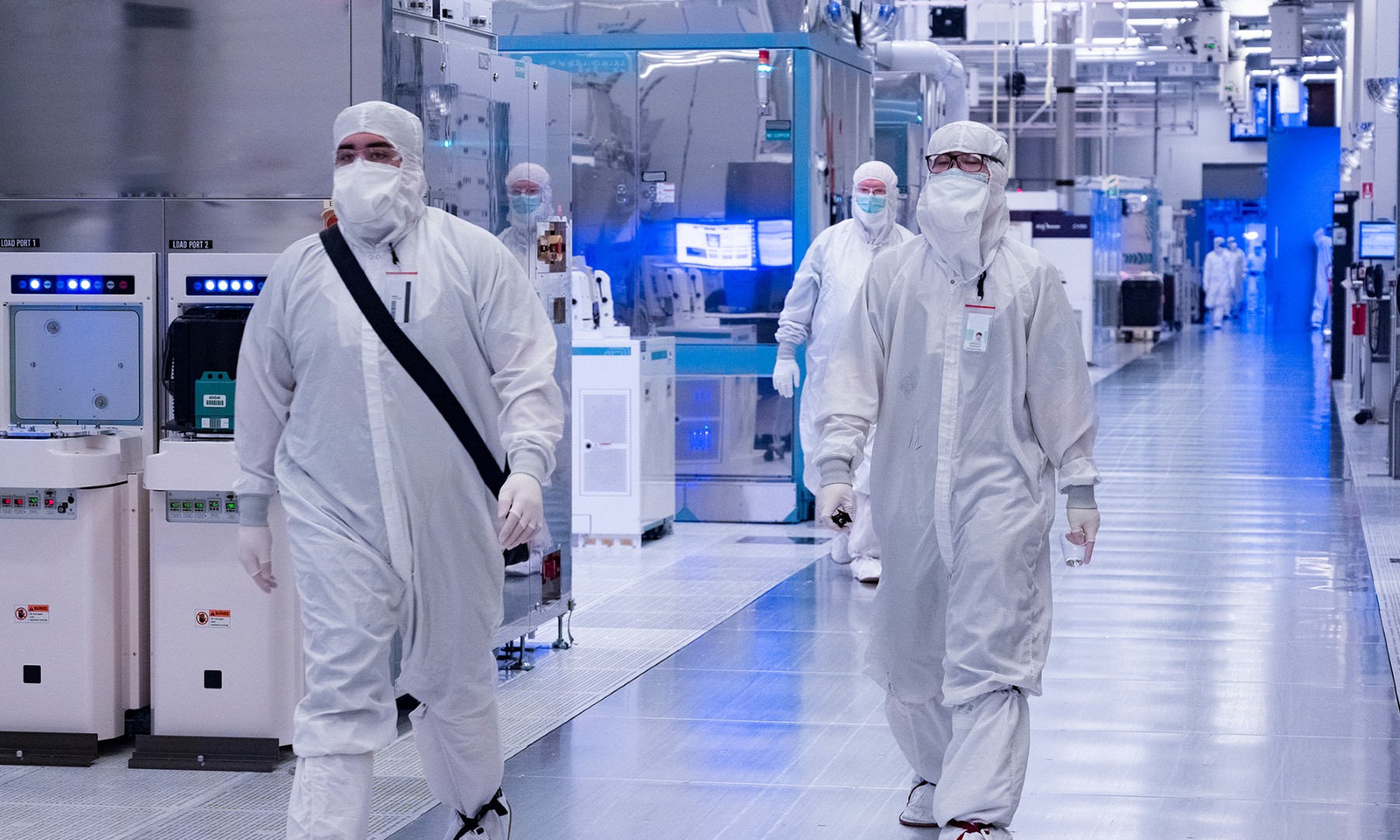

Image source: Getty Images.

Now what

Manufacturing yields are improving from the low levels Intel reported in April, but it's a slow process. On the earnings call, chief engineering officer Murthy Renduchintala tried to assure analysts and investors that everything is fine:

We're very pleased with the resiliency of our 14-nanometer road map. In the last few years, we've delivered an excess of 70% product performance improvement as we've moved through our 14-nanometer generation of products. As we look at 2019 across both the client and data center space, we feel very good about the product competitiveness of our 14-nanometer program.

In other words, investors shouldn't worry about slow 10-nanometer progress because the previous generation is doing just great. In fact, Renduchintala suggested that this strength is part of the reason the 10-nanometer upgrade isn't moving faster -- there's just no need for it.

Investors aren't buying that explanation today, and maybe that's the right reaction. Intel's shares have still gained a market-crushing 50% so far in 2018, including today's swift haircut. Now it's up to Intel to prove that it can deliver results from a slightly outdated technology node.

AMD investors took heart from this report, of course. That stock jumped as much as 8.3% higher before settling down to a 2.7% gain as of this writing.