What happened

Shares of consumer-goods conglomerate Newell Brands Inc. (NWL +1.94%) were down 13.9% at 12:32 p.m. EDT, following the release of the company's second-quarter results before market open today. Today's big drop is a result of continued weak sales. The company reported $2.2 billion in sales from continuing operations, down 13% from last year. Earnings per share fell by 41% to $0.27, while non-GAAP diluted "normalized" earnings fell 5.7% to $0.82 per share.

Newell saw operating cash flows fall year over year to $11.2 million, down from $56.8 million last year. The company said last year's quarter benefited from "a significant one-time working capital benefit related to a business divested in 2017."

It's been a painful year-plus for Newell investors. Image source: Getty Images.

So what

Newell is in the beginning stages of what could prove to be a tough phase. After an initial boost to its results following the acquisition of Jarden in late 2015, the company has struggled with weak sales and high expenses that are weighing on its results, particularly cash flow:

NWL Revenue (TTM) data by YCharts.

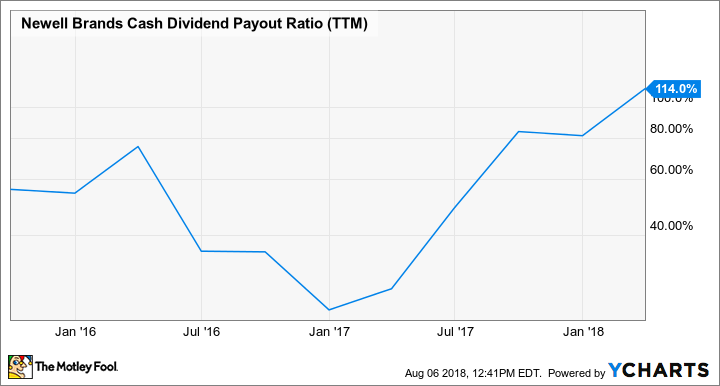

And that's put its dividend at risk. Over the past year, it has progressively paid out more of its cash flow to cover the dividend, and last quarter, the company actually paid out more cash than it generated:

NWL Cash Dividend Payout Ratio (TTM) data by YCharts.

Management says it has a plan in place to right the ship, having announced its intent to "generate ~$10 billion in after-tax proceeds" from a combination of asset sales and cost cuts, and to use that cash to repurchase "more than 40% of outstanding shares by 2020," as well as announcing some debt repayment.

In the first-quarter earnings release, Newell detailed its plans, which would result in selling off assets which generate about 35% of sales, but make up 45% of its brands. The company also said its plan would reduce its manufacturing facility count by 66%, its distribution centers by 55%, and its headcount by 39%.

Now what

Unfortunately, Newell's second-quarter release detailed a big 6% decline in what it calls "core sales," with the liquidation of Toys R Us having a big negative impact. The company also said seasonal weakness in segments related to the "late start to spring" in most of the U.S. played a role in weak sales. Newell also continues to take large impairment charges related to divestitures and other restructuring. It took a combined $77.3 million in restructuring and impairment expense in the quarter.

Management expects to see continued weakness in the third quarter, calling for sales to decline by "low single-digits" before returning to low-single-digit growth in the fourth quarter as the impact of seasonal weakness and the closure of Toys R Us retreat further in the rearview mirror.

Lastly, the company is giving a clearer picture of its expected results, having revised its guidance to exclude operations it plans to divest. The new outlook calls for $8.7 billion to $9.0 billion in sales, versus $14.4 billion to $14.8 billion from the first quarter, which did not exclude any segments which will be sold. Normalized earnings per share are expected to be $2.45 to $2.65, while guidance for operating cash flow is $900 million to $1.2 billion.

If the company can achieve its full-year adjusted earnings guidance, today's stock price is cheap, trading for between 8.7 and 9.4 times forward earnings.

But there are some big catches: Newell is not a value investment, and despite its attractive 4% dividend yield at recent prices, it isn't a very safe income investment. All of its restructuring efforts are due to a botched acquisition which destroyed billions of dollars of investor wealth. And barring a big boost in operating cash flow, the long-term sustainability of its dividend is no sure thing.

Before making a big investment in Newell on today's dip, consider the risks of management not being able to extract the value they say the assets they're selling are worth, and their need to further cut operating costs beyond those asset sales. If they pull it off, Newell is a bargain today. If not, there's a chance investors get burned even more.