Medtronic (MDT +1.09%) and Intuitive Surgical (ISRG 0.46%) are two of the most successful medical device companies of all time.

Medtronic has been hawking medical devices since it was founded in 1949, and it has been a stellar long-term investment. The company has turned into such a steady-eddy business that it has raised its dividend for 41 years in a row.

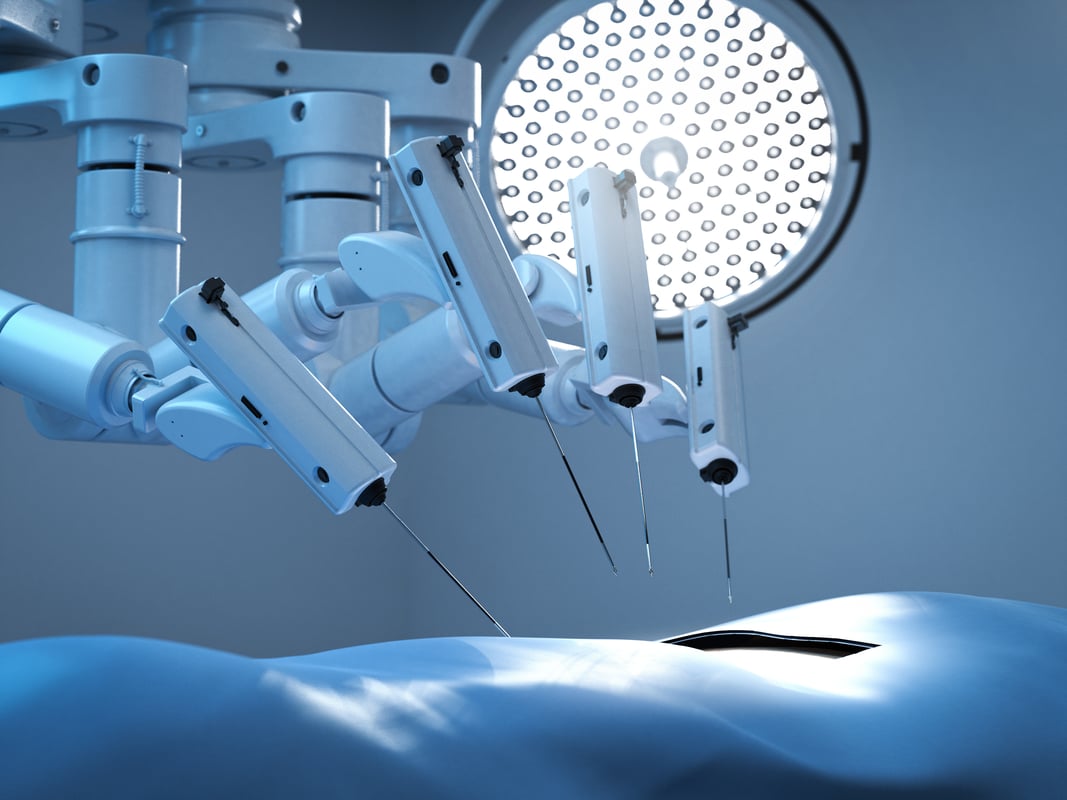

Intuitive burst onto the scene in 1995 and won FDA approval for the world's first robotic surgery system in 2000. The company benefited from a monopoly-like position in its industry for more than a decade and has produced multibagger returns for early investors.

So, which of these ultra-successful businesses is the better bet for new money today?

Image source: Getty Images.

The case for Intuitive Surgical

While it has inspired plenty of copy-cats, Intuitive Surgical still stands tall as the worldwide leader in surgical robotics. The company has methodically convinced thousands of healthcare providers around the world to warm up to the benefits of using a robot during surgery. All of that work has resulted in a worldwide install base of more than 4,600 of its da Vinci systems.

The beauty of Intuitive's business model is that the company makes the vast majority of its money when surgeries are performed on its system. Every time a da Vinci surgery takes place, a series of instruments and accessories are consumed. What's more, hospitals are also required to buy a service contract with each da Vinci sale to keep the machines performing at their best. When combined, these two business segments accounted for about 70% of total revenue and are very high margin.

This is why procedure growth is a key metric for investors to watch. With an ever-increasing install base and new surgeries getting regulatory clearance all the time, this figure has grown at a double-digit rate for many years. What's more, an aging global population should act as a favorable backdrop to keep this number heading in the right direction.

Intuitive also has a long history of keeping a squeaky-clean balance sheet that allows management to repurchase shares at the right time and maintain a healthy R&D budget that keeps it one step ahead of the competition. While its stock is usually expensive -- shares are currently trading hands for 46 times next year's earnings estimates -- history shows that buying this market leader has been a great bet.

The case for Medtronic

While Intuitive has a laser-like focus on robotic surgery, Medtronic takes a far more diversified approach to the healthcare business. The company has a long history of using its cash-generating abilities to fund acquisitions that help to spread its risk around. The company now sells hundreds of individual products that treat a diverse set of disease states such as pain, cardiovascular, diabetes, and more.

What's wonderful about Medtronic's business is that physicians and hospitals tend to stick with products they know well. After all, learning how to use something new is a hassle, and most providers are extremely busy. Medtronic uses that fact and a vast sales force to keep its products top of mind with its customers.

Most of Medtronic's businesses are mature, so the company's top-line growth rate isn't exactly spectacular -- total sales are only estimated to increase 4.6% next year -- but management can usually squeeze out a bit of extra growth on the bottom line through margin improvements. What's more, an aging global population and occasional acquisitions should ensure that both of these numbers continue to trend in the right direction for years to come.

Market watchers expect Medtronic's profits to grow about 7% annually over the next five years. That's a respectable growth rate for a large and diverse business. Adding in a well-covered dividend that currently yields over 2% should be enough to continue generating market-beating returns.

The better buy

Which of these two stocks is the winner? That depends more on the type of investor you are than anything else.

If you prefer income, safety, and steady growth, then Medtronic is the better bet. On the flip side, if you're a growth investor at heart, then Intuitive Surgical is the better choice.

Personally, I've been a shareholder of Intuitive Surgical for many years because I love the company's business model and firmly believe that robotic surgery will only grow in importance over time. Having said that, I'm also bullish on Medtronic, especially now that it is making a major move into the robotic surgical space, too.