Most investors don't think five decades into the future, because it's such a long time from now. But they should. The key to finding stocks that are likely to be around in 50 years is to look for strong businesses today. That list includes Google parent Alphabet Inc. (GOOG 0.06%), food giant General Mills, Inc. (GIS +3.05%), and retail Goliath Walmart Inc. (WMT 0.27%). Here's why making a long-term bet on these stocks could pay off.

The road to the internet

Jordan Wathen (Alphabet): If pressed to buy one stock to hold for 50 years, Alphabet would likely be at the top of my list solely because of its online search (Google) and video businesses (YouTube).

Google is an extraordinary business. With a near-monopoly on online search, it's instrumental in how we navigate the internet to find news and entertainment to consume, products to buy, and service providers to hire. It's the modern equivalent of the phone book, minus all the expenses of hiring sales staff to sell ads door to door and the high cost of printing paper copies.

Image source: Getty Images.

A business that generates operating margins nearing 28% (and quarterly operating profits of nearly $9 billion) would ordinarily attract real competition. But even Google's most capable competitors are also-rans, grabbing only 10% search share between them in most countries around the world. Google, of course, takes the other 90% for itself.

Likewise, YouTube is an asset that is almost impossible to replicate as viewers go to the video site with the most content, and content producers are attracted to the sites with the most viewers. Some analysts estimate that YouTube could be producing as much as $15 billion of revenue derived almost entirely from video ads.

And while Alphabet may have many more potential winners in its "Other Bets" on things like self-driving cars or ways to combat human aging, these are perhaps best viewed as free lottery tickets that you get for owning Alphabet. Even if none of its Other Bets pan out, I suspect that investors will realize a very attractive return by buying -- and holding -- Alphabet stock for years to come.

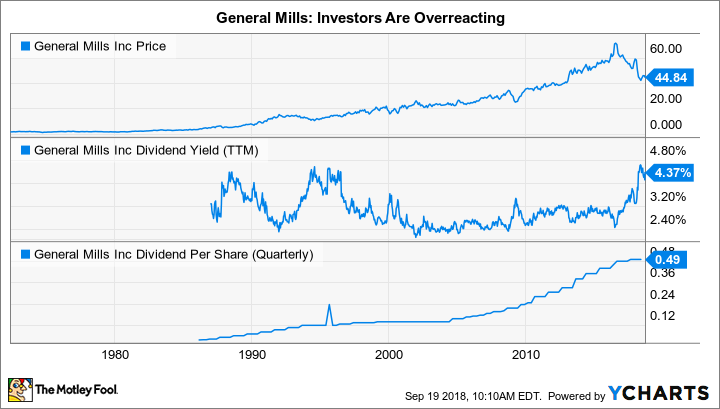

It isn't THAT bad

Reuben Gregg Brewer (General Mills): When General Mills reported fiscal first-quarter earnings its shares fell nearly 9%. The main cause was that the global packaged food giant missed analysts' revenue expectations, though it beat on earnings. And that's just one day -- the stock is down nearly 40% from 2016 highs. The dividend yield, meanwhile, is over 4%, and hasn't been this high since the 1990s.

To be fair, General Mills is facing headwinds. The most pressing has been a swift customer shift toward healthier and fresh products. For example, General Mills completely missed the Greek yogurt craze. It is working to adjust by acquiring new brands (like Annie's, Larabar, and its 2018 purchase of Blue Buffalo pet food) and via innovation (such as by introducing new yogurt and ice cream flavors and styles). More recently, meanwhile, input cost inflation has become an issue, leading to margin compression.

All of that said, the over 100-year-old company has lived through difficult times before and it's highly likely it will do so this time as well. There are already signs of progress, including gaining market share in eight of its nine core segments during the mot recent quarter. In fiscal year 2017, it only gained share in two of those segments. And while sluggish results in its North American Retail division (its largest segment) led revenue to fall short of expectations in the quarter, sales were higher throughout the rest of the company. Input costs, meanwhile, will eventually be worked through to customers -- it will just take some time.

All in, it looks like short-term investors are overreacting to issues that will eventually pass. Long-term investors, though, can collect a fat dividend for decades to come by acting now.

Winning through retailing's next phase

Demitri Kalogeropoulos (Walmart): I have no idea how people will be spending their time two, three, or five decades from today. But I'd be willing to bet that the consumers of the future will do plenty of shopping -- and that they'll be motivated by convenience and value. From that perspective, it makes sense to bet that industry giant Walmart will still be a major competitive force in 2068.

The retailing titan recently announced some of its fastest growth in years, with sales at existing locations spiking nearly 5% in the core U.S. segment. But the even better news for investors, I think, is Walmart's success at improving the shopping experience at both its physical locations and its e-commerce branch. After shedding market share to Kroger for years, for example, the company credited booming grocery sales for supporting its robust customer traffic last quarter. Digital revenue jumped as it blanketed more of the country with its quick home delivery offerings.

Walmart is still spending tons of cash on its transition into a multichannel retailer that sells to people everywhere they are (online and off) and that shift is likely to crimp profitability over the short term and perhaps into the long term, too. But if the latest earnings updates are any indication, consumers like taking care of their shopping through many sales channels, and Walmart has all the competitive assets it needs to satisfy those demands over its next half-century of existence.

Stick with the leaders for the long term

Fifty years is a very long time and you don't want to trust your hard-earned savings to just any company. That's why this trio of industry leaders should be high up on your wish list if you are looking for some buy-and-hold candidates today. Alphabet basically owns the search market and has a dominant position in streaming video. General Mills, while facing headwinds today, is a leading packaged foods maker that has adjusted to tough times before in its over 100-year history. And, after falling behind at first, Walmart is making up for lost ground in the online retail space while still holding a dominant position in the physical world. All three of these stocks are worth a deep dive today.