What happened

Shares of Tahoe Resources (NYSE: TAHO) rocketed nearly 50% today after the company announced it was being acquired by Pan American Silver (PAAS 13.73%). Shares of the acquirer fell nearly 14% on the news. Both stock moves are unsurprising -- and for the same reason.

The 30,000-foot view is simple: Tahoe Resources has been embroiled in a messy situation in Guatemala in recent years that has gone all the way to the country's Supreme Court and Constitutional Court. The company lost the operating license for its Escobal mine, which was only the most prolific silver asset in the portfolio and a key cash generator. The fiasco proved difficult to recover from, and it will still cause headaches going forward. Investors are pricing that into Pan American Silver shares.

As of 12:19 p.m. EST, shares of Tahoe Resources had settled to a 46.1% gain, while Pan American Silver stock dropped to a 13.5% loss.

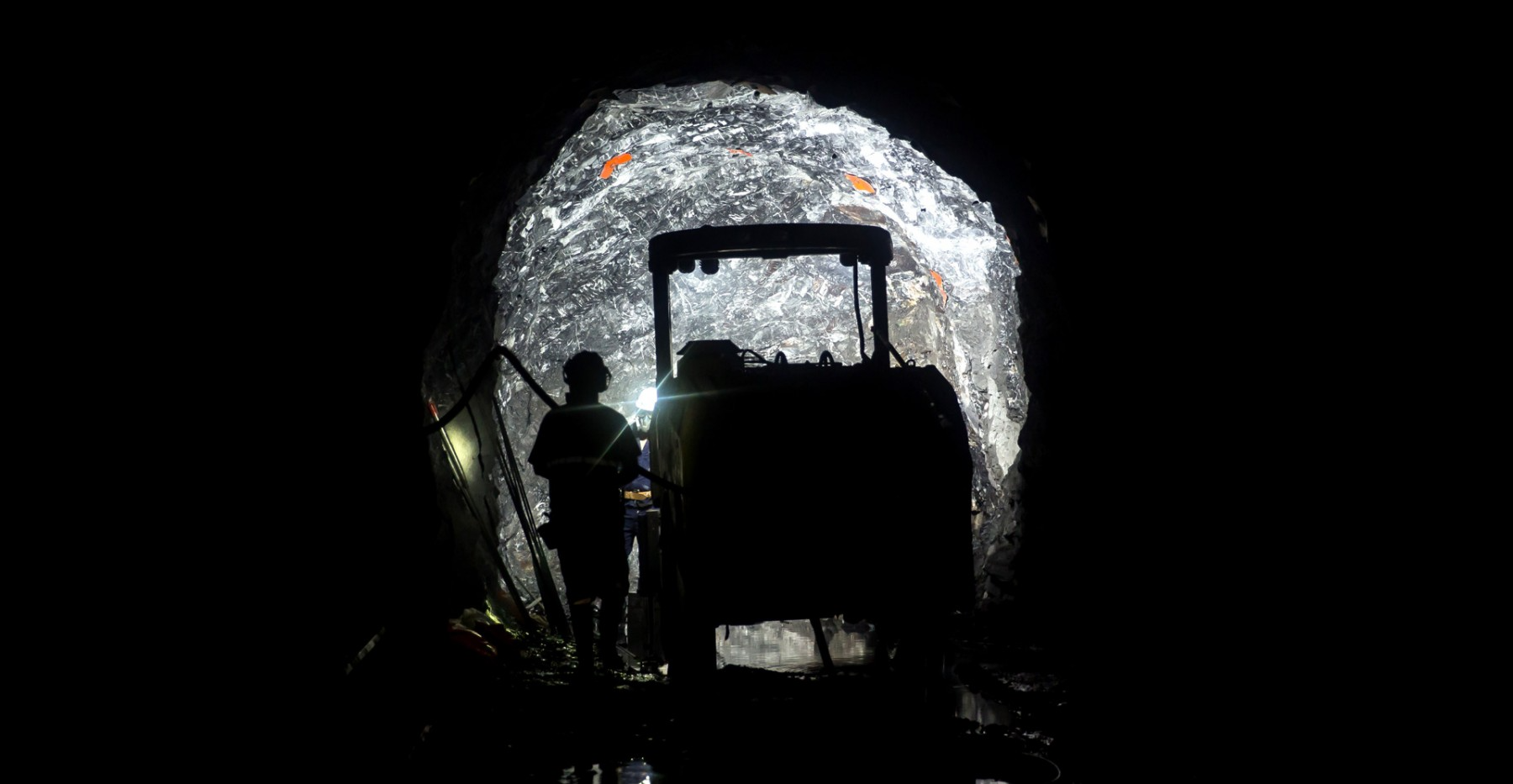

Image source: Getty Images.

So what

Tahoe Resources recently began the process of moving on from Escobal by taking an impairment charge of $170 million during the third quarter of 2018. Well, moving on financially, anyway. The company is still working with stakeholders in Guatemala on a long process that could eventually earn an operating license again, but likely not until 2020.

Recording that massive impairment charge opened the door for Pan American Silver to swoop in and make a bold $1 billion bet that it can pick up the remaining precious-metal assets of the struggling miner at a rock-bottom price. Investors may be right to think that's a risky bet.

While Tahoe Resources stated that expansion projects at other mines are on track to deliver growth in 2019, gold production (not impacted by Escobal, which is a silver mine) was down 16% in the first nine months of 2018 compared to the same period last year. The business still managed to generate $58 million in operating cash flow in the first three quarters of this year without Escobal, but it's going to take years to recover assuming the mine doesn't come back online.

Now what

In mid-2016, Pan American Silver and Tahoe Resources were valued at a combined $8 billion. Today their combined market cap weighs in at just under $3 billion. While the management teams are hopeful that joining forces can return the combined portfolio's gold and silver assets to their former glory, there's much to prove on that front. Earning a higher valuation requires greatly improved profitability, successful execution of growth plans in 2019, and (most likely) the eventual restart of Escobal in 2020. Given all of the moving parts and uncertainty, investors are better off waiting for the dust to settle and results to trickle in before buying these stocks.