If you want to get visceral reactions from investors, ask them about their stance on gold. Some will swear by its ability to hedge against stock price volatility, while others see it as just another mined metal that is subject to the same rules as any other commodity.

Whatever side of the spectrum you fall on the role of gold in your portfolio, there are a few stocks investors should watch in the gold industry. Here's why three of our Motley Fool contributors think you should pay attention to Barrick Gold (B 1.13%), iShares Gold Trust (IAU -0.70%), and Wheaton Precious Metals (NYSE: WPM).

Image source: Getty Images.

Gold's great, but free cash flow is even better

Rich Smith (Barrick Gold): Two months ago, I gritted my teeth and -- despite my well-publicized aversion to investing in gold stocks -- admitted that if I absolutely, positively had to pick a gold stock, well, the story at Barrick Gold at least appeared less atrocious than it once did.

Wonder of wonders, Barrick Gold stock is up 30% since.

Actually, that's not too big of a wonder. Stock charts had a miserable run in the month of October, whereas the chart for gold prices looked quite a bit better as investors fled stock markets for the perceived safety of shiny rocks. Gold prices are up 4% off their lows of early October.

Not coincidentally, I think, the story at Barrick Gold keeps on improving as well. A couple weeks ago, Barrick reported fiscal Q3 earnings . The company reported a GAAP net loss of $0.35 per share, but generated $319 million in positive free cash flow, with the end result being that FCF for the past 12 months is now $568 million -- up from one quarter ago.

Granted, at a price-to-free cash flow ratio of 27 times, I still cannot call Barrick Gold "cheap." But with gold prices on the rise, and Barrick promising to produce as many as 5,000 troy ounces of gold by year end (more than four times last quarter's production), chances are good that free cash flow will grow again through November and well into Q4.

The longer that keeps happening, the more Barrick Gold stock will glitter for gold investors.

Still a decent asset to hedge against stock market volatility

Jason Hall (iShares Gold Trust): While my colleague Rich can crow about Barrick Gold's solid run since he wrote about it in September, I can make no such bold claim of gains for the iShares Gold Trust after I wrote about it last month.

But I can show you how it served as what I suggested it could do: help hedge your portfolio against short-term stock market volatility.

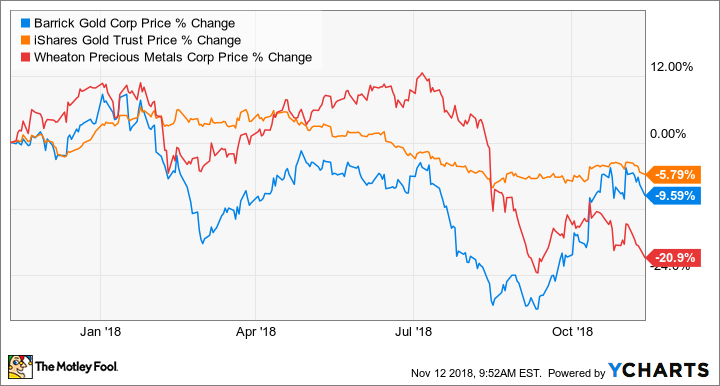

As you can see, the iShares Gold Trust, which tracks U.S. gold prices pretty closely, has done exactly what one would expect it to do during a stock market sell-off, holding value, and even gaining a little bit during the worst days.

But as you can also see, it has lost some of its luster in more recent days, as investors have come back to stocks.

So how should investors view the Gold Trust today, and why should you watch it? In short, if you're concerned about protecting some of your portfolio from short-term declines in the stock market, there's still a good case for this investment as a good proxy for owning gold. Furthermore, there's also potential upside if stocks tumble in a protracted way, since that would probably drive even more interest in gold during high market uncertainty.

The downside is that if stocks do what they do most of the time and go up, your gold investment could lose value. But if you're only using it to hedge a small part of your portfolio, then you have a "high-class problem" since your stocks went up.

Precious metals streaming is rarely this cheap

Tyler Crowe (Wheaton Precious Metals): For individual investors looking for exposure to precious metals, streaming companies are almost always a much more attractive option than regular miners or owning physical gold. As specialty financiers that operate in the precious metal world, it provides essential capital to miners looking to develop a new mine. Instead of conventional loans, though, streaming companies negotiate contracts that entitle it to buy a certain amount of precious metal from the particular mine at a deep discount to the spot price of the metal. This leads to more consistent results through the ups and downs of the commodity cycle and higher rates of returns.

Of course, higher returns and more consistent performance typically comes at a price as investors tend to pay a premium valuation for these stocks. That isn't the case right now with Wheaton Precious Metals, though, as its stock trades at a price to tangible book value of 1.37 times. Ever since the company went public in 2005, it has only traded at a lower valuation than that during the Great Recession and the recent dip for gold and silver prices in 2016.

Wheaton's stock has largely moved along with the ups and downs of silver prices, which helps to explain the most recent dip as the price for the metal was down to $14.60 per troy ounce lately. That doesn't really do the company justice, however, as Wheaton has deliberately moved away from being a pure silver streamer with large investments in gold streams as well as other high-value metals such as cobalt and palladium. In fact, after several recent streaming deals, gold makes up 49% of Wheaton's revenue stream while silver is down to 46%.

It appears that the market hasn't exactly caught on to the changes at Wheaton lately, and that could be to investors' advantage if they are looking for an attractive precious metals investment selling at a reasonable price.