What happened

Investors in Tahoe Resources (NYSE: TAHO) were in for an early Christmas gift last month as shares of the silver mining company shot through the roof to end November with a whopping 51.1% gains, according to data provided by S&P Global Market Intelligence. Meanwhile, rival Pan American Silver (PAAS 13.73%) stock lost double-digits last month for the same reason that Tahoe soared.

So what

Tahoe Resources has been stuck in a rut ever since it ran into legal troubles that landed at the Constitutional Court of Guatemala's feet after an anti-mining organization filed a claim against Guatemala's Ministry of Energy and Mines regarding a license grant for Tahoe's Escobal mine. In July 2017, the Supreme Court suspended Escobal's mining license, and there hasn't been much progress on the front since.

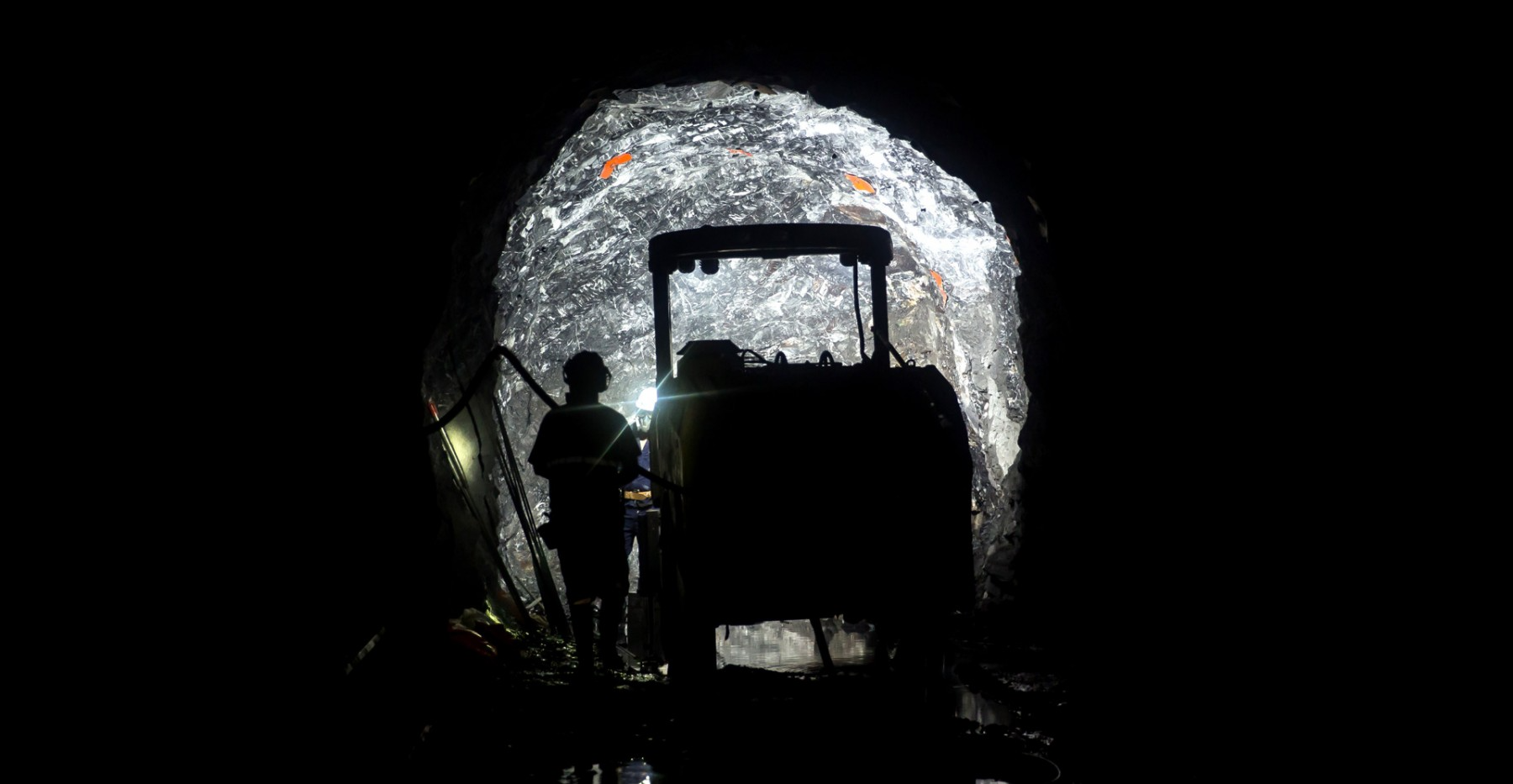

Image source: Getty Images.

Escobal is Tahoe's flagship mine, and it had been operating well since 2013, after the company acquired it from Goldcorp, until it was suspended last year. Not surprisingly, Tahoe shares kept hitting new lows before the big news hit headlines on November 14 last month: Pan American Silver, one of the strongest silver mining companies out there, announced its intention to acquire Tahoe Resources to create the "world's premier silver mining company."

Under the agreement, Tahoe shareholders can either opt for $3.40 in cash or 0.2403 shares of Pan American Silver for every share held in Tahoe, aside from a contingent value right attached to Escobal. Investors unsurprisingly lapped up this lifeline thrown at Tahoe Resources and sent the stock soaring.

Now what

With Tahoe trading at $3.52 apiece as of this writing, shareholders might as well want to offload their shares in the market. More aggressive investors can tender shares for Pan American and stay invested as the company has a solid footing in the silver industry. Just bear in mind that Escobal's future is still uncertain, and Guatemala infamous for its political and social unrest history. That, perhaps, is the biggest risk factor Pan American investors need to factor in right now before betting on the stock.