If you're in the market for cheap stocks at a time when the stock market is still near all-time highs, then you need to think outside the box. Although dating company Match Group (MTCH +0.00%), biotech Celgene (CELG +0.00%), and energy giant ExxonMobil (XOM +2.35%) may not all show up on your typical value screens, they appear to have a desirable combination of stock price and opportunity ahead of them (and Exxon adds a fat dividend yield, too). Take a close look and at least one may entice you to do a deeper dive.

Match is more of a value than you think

Brian Stoffel (Match Group): It might seem absurd to claim that a stock trading for 35 times trailing earnings is a value. But in Match Group -- the parent company to Match.com, Tinder, OkCupid, and a host of other dating services -- I believe we have an anomaly.

Image source: Getty Images.

Match has made almost $500 million in free cash flow over the past year. That puts the company's price-to-free cash flow ratio at a much more reasonable 24. Over the next year, the company is expected to grow non-GAAP earnings per share by 31% to $1.62. Today's price tag is only 25 times that value.

If that doesn't convince you that Match might be a value stock, consider its blueprint for success, which has already been put to good use:

- Develop a killer app (like Tinder) that enjoys wild success and offer it up for free to get the full benefit of the network effect.

- Once it nears saturation, start adding tiered levels of subscription for added functionality. Each additional user costs nothing to service, and a huge portion of revenue goes right to free cash flow.

- If a rival starts to corner a new market, buy it out. If that doesn't work, offer a competing service for free.

Pulling this off isn't as easy as I'm making it sound, and I'm not a huge fan of Match's recently announced special dividend, but the dynamics are there to make today's prices seem like a real value. Admittedly, I don't own shares in my portfolio, but I have given the stock an outperform rating in my All-Star CAPS portfolio.

A big biotech bargain

Keith Speights (Celgene): When you think of value stocks, biotechs typically don't come to mind. However, there's one big biotech stock that is dirt cheap right now -- Celgene. This stock trades at a little over seven times expected earnings. And its price-to-earnings-to-growth (PEG) ratio is a ridiculously low 0.42.

What's the catch with Celgene? The company is heavily dependent on blood cancer drug Revlimid, which generates around 63% of Celgene's total revenue. Revlimid faces limited-volume generic competition by March 2022. Celgene's patents for the drug are also being challenged in court. A loss would open the door to generic competition much sooner.

This reliance on Revlimid means that Celgene really needs pipeline successes to offset future revenue loss. Celgene has experienced a couple of big pipeline setbacks over the last 14 months that rattled investors, with disappointing late-stage clinical results for once-promising Crohn's disease drug GED-0301 and the FDA refusing to consider an approval application for multiple sclerosis drug ozanimod.

However, Celgene should soon resubmit for approval of ozanimod. The biotech's pipeline also includes four other drugs with blockbuster sales potential that could reach the market by 2020. Celgene has even more potential winners on the way in the following years.

There's still a risk that Celgene could lose its Revlimid litigation or see more pipeline setbacks. But I think the odds are in its favor, making this biotech a value stock worth buying at current prices.

Turning a giant ship takes time

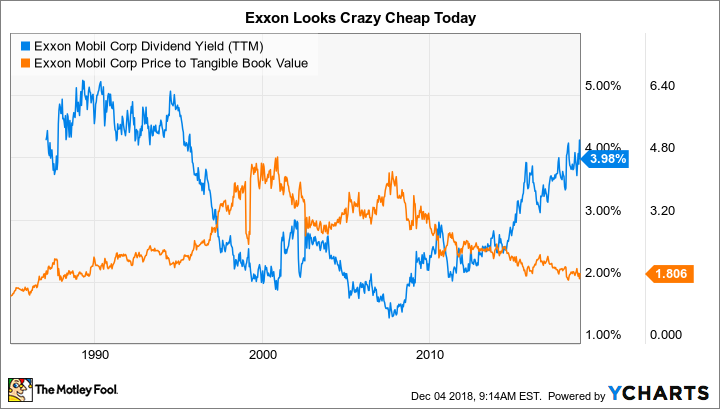

Reuben Gregg Brewer (ExxonMobil): Giant, integrated energy company Exxon is offering income investors a 4.1% yield today. That's the highest level since roughly the late 1990s. The company's price to tangible book value, meanwhile, is lower than it has been since about that same time period. Exxon looks very cheap today.

The knocks against the energy producer are starting to look less material. For example, Exxon's production has been falling for a couple of years, but grew sequentially between the second and third quarters of 2018. The reason for the improvement is that drilling in the onshore U.S. market is starting to produce results. And that's just one of the company's major investments that's expected to come on line between now and 2025.

XOM Dividend Yield (TTM) data by YCharts.

That said, recently falling oil prices have been another headwind. But here's the interesting thing: Exxon's spending plans are fairly robust, with the company projecting that it can increase earnings by 35% in 2025 even if oil prices fall to $40 per barrel. (At $80 per barrel, earnings grow by 225%.) And with long-term debt at less than 10% of the capital structure, there's little worry that Exxon can afford its investment program, which is large relative to peers even if oil prices are weak.

It looks like short-term investors are punishing Exxon for issues that will resolve over time. There are also early signs that the giant ship is starting to turn toward better days. Income investors should jump aboard before more people realize just how cheap Exxon looks right now.