This has been nothing short of a transformational year for the marijuana industry. In October, Canada became the first industrialized country in the world to legalize recreational weed, opening the door to what should be billions of dollars in added annual sales once the industry has had the time to ramp up production.

We also witnessed plenty of milestones hit in the United States. The number of legalized-medical-cannabis states increased to 32, with Vermont and Michigan becoming the respective 9th and 10th states to legalize adult-use weed. The U.S. Food and Drug Administration also approved its very first cannabis-derived drug in June.

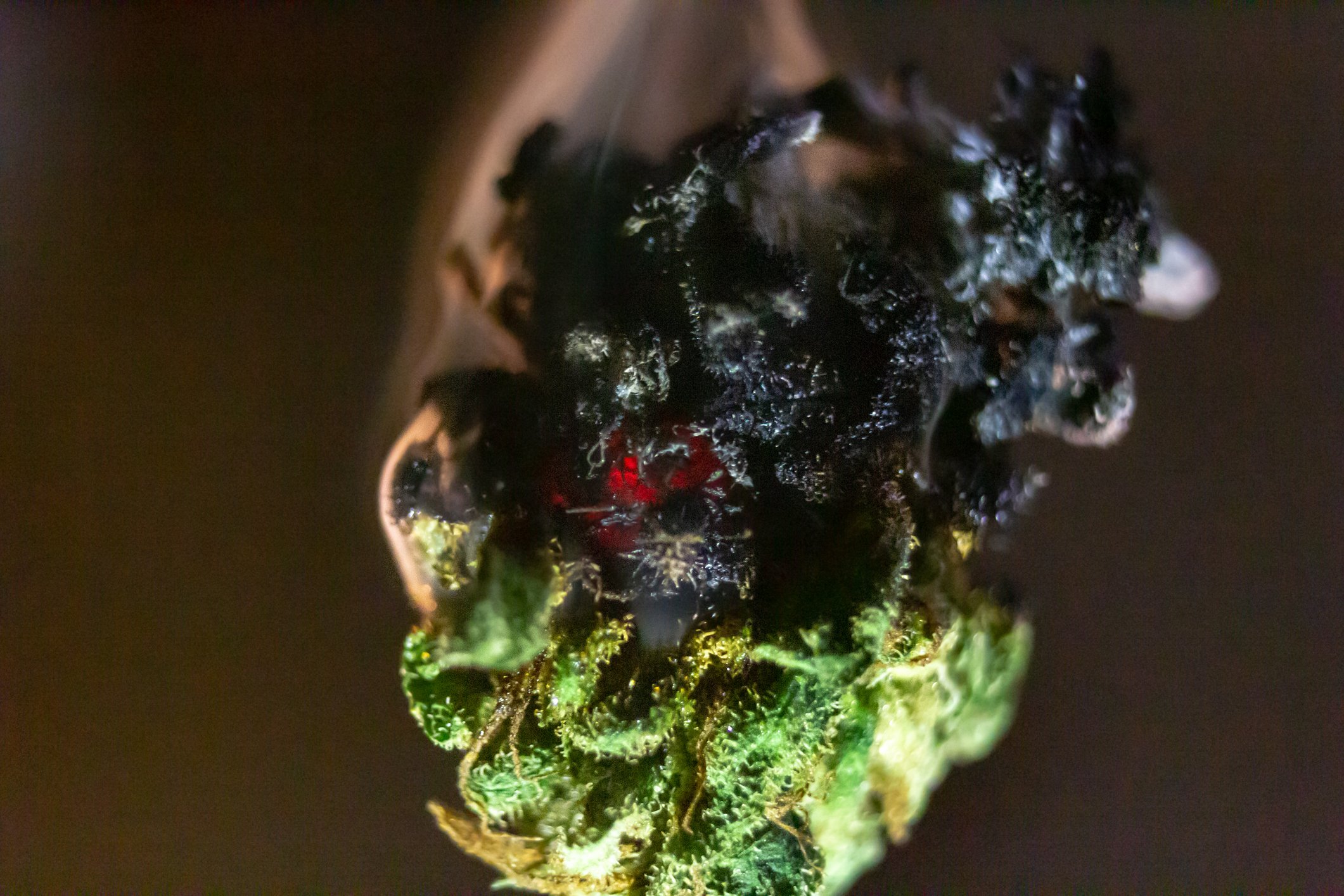

Image source: Getty Images.

New Jersey aims to become the next adult-use marijuana state

As we barrel toward 2019, more legalizations in the U.S. could be on the docket, with the Garden State, New Jersey, looking to have a very good chance to legalize adult-use cannabis.

Back on Nov. 26, both the state's Senate and Assembly overwhelmingly voted in favor of three bills that would legalize recreational weed within the state, expand the medical pot program, and speed up criminal expungements of low-level cannabis offenses. Although this vote didn't legalize recreational marijuana, it does signal genuine support among state legislators for such a move.

Governor Phil Murphy, a Democrat, has also signaled support for legalization, although trying to hash out an exact tax rate on recreational pot sales has been perhaps the biggest stumbling block. Legislators have called for a low combined tax rate of 14%, whereas Murphy has opined that New Jersey should implement a tax rate that at least matches Nevada at 25%. The danger of placing a high tax rate on recreational sales is that it could drive on-the-fence buyers back to the black market. If legalized, New Jersey's marijuana market could hit $850 million in annual sales by 2022.

What is clear at this point is that New Jersey's residents, its governor, and apparently its legislators appear to favor the idea of legalizing adult-use pot. This suggests it's only a matter of time before the Garden State goes fully green and becomes yet another opportunity for the marijuana industry and investors.

What publicly traded pot stocks might benefit if New Jersey goes green? Let's take a closer look.

Image source: Getty Images.

These little-followed marijuana stocks have their eyes on the Garden State

The most obvious beneficiaries would be vertically integrated companies that are setting up shop (pun intended) in the Garden State.

Curaleaf Holdings (CURLF 2.21%) currently operates 35 dispensaries, a dozen cannabis grow farms, and 10 processing facilities across the United States. More than half of its dispensaries are located in Florida, but Curaleaf is developing a 2-acre greenhouse facility in New Jersey right now. Since the federal government disallows the interstate transport of any cannabis (it is a Schedule I substance), it's important for dispensaries like Curaleaf to have grow operations in the same states in which they also run dispensaries. This allows Curaleaf complete control of its supply chain and, in many cases, the quality of what it sells in its retail stores.

Another vertically integrated company that could benefit from legalization is Ontario-based TerrAscend (TRSSF 1.88%). Even though TerrAscend has its roots in Canada, one of its subsidiaries, NETA, was just awarded one of six vertically integrated licenses in New Jersey. Mind you, there were 146 applications received by the New Jersey Health Department for these six licenses, and no company scored higher than TerrAscend's subsidiary. Following receipt of this license, TerrAscend's subsidiary will be free to cultivate, process, and sell marijuana within the Garden State. Should recreational pot be legalized, the market for cannabis in the state's most populous region (which is where NETA was awarded its license) could be substantial.

The newly public cannabis investment firm Acreage Holdings (ACRGF +0.00%) would also likely benefit if New Jersey goes fully green. In March, Acreage Holdings partnered with the Compassionate Care Foundation (CCF), which is one of six licensed alternative treatment centers in New Jersey. Acreage is supplying the capital for CCF to help meet patient demand. As yet another pot stock with vertically integrated assets, Acreage can aid CCF and other Garden State providers throughout the cannabis supply chain if New Jersey were to legalize adult-use weed.

Image source: Getty Images.

Finally, and sticking with the theme of under-the-radar marijuana stocks, MariMed (MRMD +1.19%) could see a boost. In October, MariMed acquired BSC Group, a competitive licensing, consulting, and operations management company for the cannabis industry that's based in New Jersey. BSC's operations aren't limited to the pot industry, but legalization within New Jersey would certainly allow MariMed to take advantage of consulting and operational management opportunities. Not to mention, MariMed also announced an investment in Sprout in September, which is a marketing software company that can help dispensaries improve sales and customer loyalty.

Now we simply watch and wait to see if New Jersey legislators move to give adult-use pot the green light.