Chinese electric-vehicle maker NIO (NIO +0.66%) said that it delivered 3,318 vehicles to customers in December. That was an increase of 7.4% from its November delivery total, and more than enough to beat its own guidance for the month and the full year.

NIO beat its 2018 deliveries target, but it gets harder from here

December's total put NIO at 11,348 deliveries of its ES8 in 2018. The ES8, an upscale battery-electric three-row SUV positioned as a domestic Chinese alternative to Tesla's (TSLA +0.04%) Model X, went into production in late June. Deliveries have ramped up more-or-less steadily since.

Data source: NIO. Chart shows deliveries of the NIO ES8 SUV in every month since deliveries began on June 28, 2018.

CEO William Li said that 2018 was a "milestone year" for NIO, in which it exceeded its deliveries goal in its first months as a public company. He said the company will continue to focus on market penetration in 2019, emphasizing service as a differentiator.

While CFO Louis Hsieh said he was "pleased" with NIO's production ramp and delivery totals in 2018, he noted that the company's strong year-end total was due in part to a reduction in government subsidies for electric vehicles that took effect at the beginning of 2019. He also hinted that an "overall challenging automotive market" in China could put a damper on NIO's growth for a while.

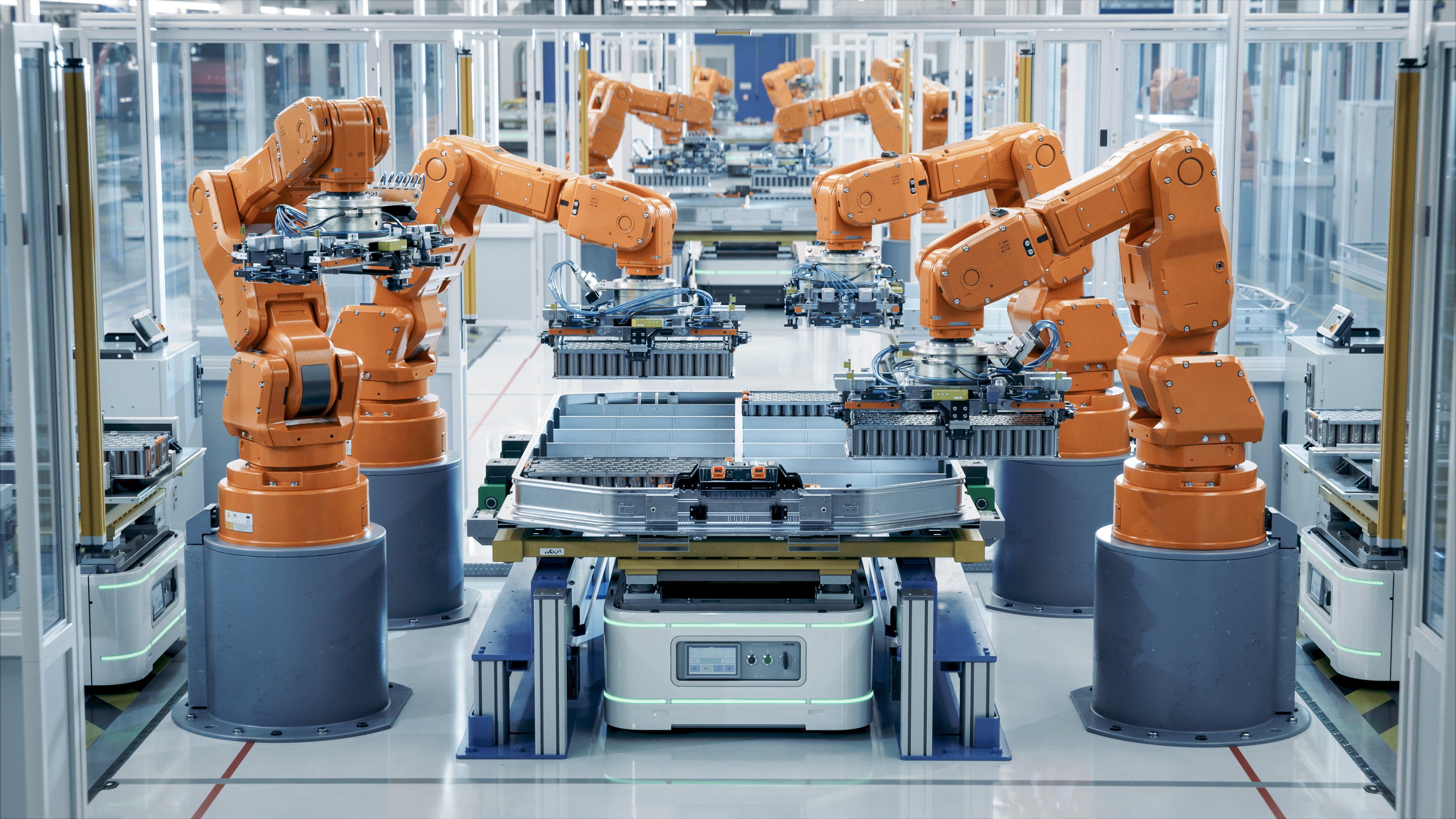

NIO delivered 11,348 ES8 units in 2018. Image source: NIO.

Why NIO might struggle to find growth in 2019

"Challenging" is the right word for China's new-car market right now. Sales of passenger vehicles in China fell 19% in December versus the year-ago month. A stock market slump and ongoing trade-war concerns have dented Chinese consumers' confidence, driving passenger-vehicle sales sharply lower in recent months. For the full year, passenger-vehicle sales in China fell 6% from 2017 levels, to 22.7 million units.

NIO may also face a second set of pressures in 2019: Its much larger Silicon Valley rival appears to have secured a foothold in China. The Chinese government said in December that it will temporarily lower import tariffs on U.S.-made light vehicles to 15% from 40%, a move that will make imported Teslas somewhat more affordable to Chinese customers right away.

Chinese buyers may find Teslas even more affordable in another year or so: The company broke ground on a new factory in Shanghai last week that will produce inexpensive versions of the Model 3 and Tesla's upcoming Model 3-based Model Y SUV. Because they'll be built in China, they won't be subject to tariffs.

The Model Y in particular could throw a wrench into NIO's plans. NIO is looking ahead to the introduction of its second mass-market model, a five-passenger SUV called the ES6, in June. NIO is counting on the ES6 to take its sales up a notch, and on paper at least, the ES6 seems likely to give the company a boost. It's one size smaller than the ES8, with longer range and a lower price.

But if Tesla can deliver the Model Y to Chinese customers at a competitive price, NIO may find itself watching its big American rival run away with its hoped-for sales.

NIO's next model is the ES6, a five-passenger electric SUV due in June. It could end up doing battle with Tesla's upcoming Model Y. Image source: NIO, Inc.

The upshot: NIO has a tough year ahead

Hsieh said that NIO will stay focused on fundamentals, expanding its sales network and boosting the brand's visibility to support future growth. That's the right answer, but there may not be much more NIO can do in a year in which events beyond its control seem likely to put a damper on its growth -- at least for a while.

Check out all our earnings call transcripts.